Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jaime is the financial advisor for his company and is considering the purchase of excavation equipment which will cost $91,000. The purchase of this equipment

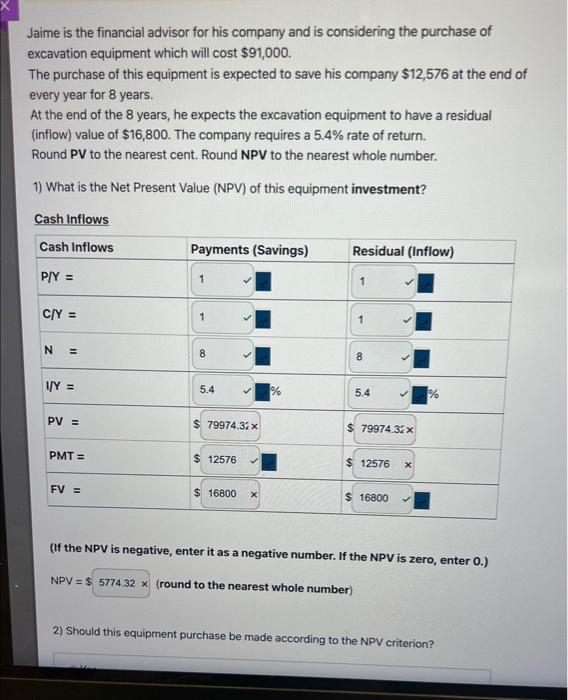

Jaime is the financial advisor for his company and is considering the purchase of excavation equipment which will cost $91,000.

The purchase of this equipment is expected to save his company $12,576 at the end of every year for 8 years.

At the end of the 8 years, he expects the excavation equipment to have a residual (inflow) value of $16,800. The company requires a 5.4% rate of return.

Round PV to the nearest cent. Round NPV to the nearest whole number.

1) What is the Net Present Value (NPV) of this equipment investment?

Cash Inflows

Cash Inflows Payments (Savings) Residual (Inflow)

P/Y =

1

Correct

1

Correct

C/Y =

1

Correct

1

Correct

N =

8

Correct

8

Correct

I/Y =

5.4

Correct%

5.4

Correct%

PV = $

79974.32

Incorrect $

79974.32

Incorrect

PMT = $

12576

Correct $

12576

Incorrect

FV = $

16800

Incorrect $

16800

Correct

(If the NPV is negative, enter it as a negative number. If the NPV is zero, enter 0.)

NPV = $

5774.32

Incorrect (round to the nearest whole number)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started