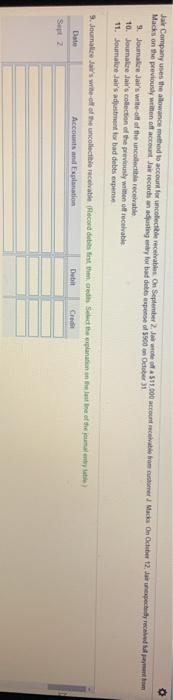

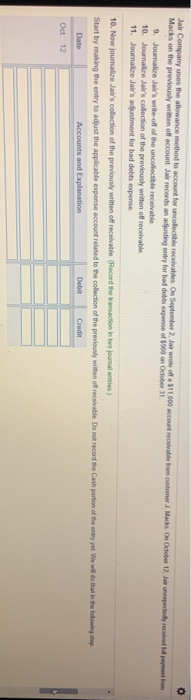

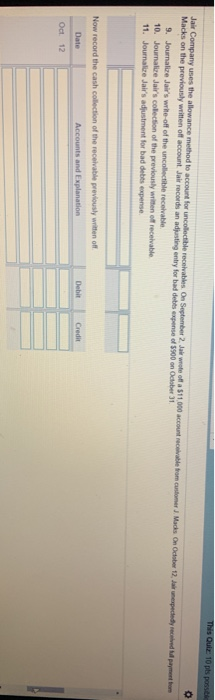

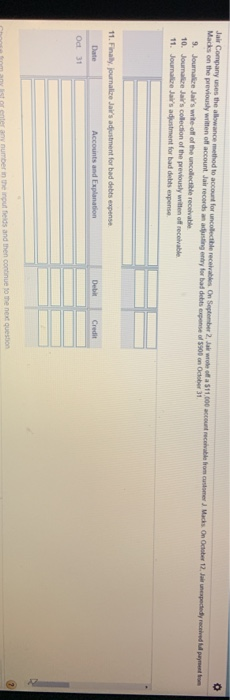

Jair Company uses the allowance method to account for uncollectible receivables On September 2, Jar wroe off a $11.000 account recelvable from customer J Macks On October 12, Jair unexpectedly recelved full payment from Macks on the previously written off account Jair records an adjusting entry for bad debts expense of 5900 on October 31 9. Journalize Jair's write-off of the uncollectible receivable 10. Jounalize Jair's collection of the previously written off receivables 11. Journalize Jair's adjustment for bad debts expense 9. Journalize Jair's write-off of the uncollectible receivable (Record debits frst then, credits Select the explanation on the last line of the joumal entry table) Date Accounts and Explanations Debit Credit Sept 2 Jair Company uses the allowance method to account for uncollectible receivables On September 2. Jair wroe off a $11.000 account receiable from cuntomer J. Macks On October 12 Jair unexpectedy received l payment bom Macks on the previously writen off account Jair records an adjusting entry for bad debts expense of $900 on October 31 9. Journalize Jair's write-off of the uncollectible receivable 10. Journalize Jair's collection of the previously written off receivable 11. Journalize Jair's adjustment for bad debts expense 10. Now journalize Jair's collection of the previously written off recelvable. (Record the transaction in two jounal enries) Start by making the entry to adjust the applicable expense account related to the collection of the previously writen off receivable Do not record the Cash partion of the ontry yet We will do that in the folowing step Accounts and Explanation Debit Credit Date Oct 12 This Quiz 10 pts possible Jair Company uses the allowance method to account for uncollectble receivables On September 2, Jar woe off a $11.000 account recaable rom cunomer J Macks On October 12, Jar unespectedy recelved ll payment rom Macks on the previously weitten off account Jair records an adjunting entry for bad debts expense of $900 on October 31 9. Journalize Jair's write-off of the uncollectible recelvable. 10. Journalire Jair's colection of the previously writen off receivable 11. Journalire Jair's adiustment for bad debts expense. Now record the cash collection of the receivable previously written off Debit Credit Date Accounts and Explanation Oct 12 Jar Company unes the alowance method to accout for uncollectle receivables On September 2, Jak wrote off a $11 000 ecount receivable from customer J Macks On October 12, Jar unexpectedy received M pryment from Macks on the previously written off account Jair records an aduning ontry for bad debts expense of $900 an October 31 9. Journalize Jai's write off of the uncollectible receivable 10. Joumalire Jair's collection of the previously witten off recelvable. 11. Jounalize Jair's adjustment for bad debts expense 11. Finally, journalize Jair's adjustment for bad debts expense Date Accounts and Explanation Debit Credit Oct 31 enter any number in the input fields and then continue to the next questions