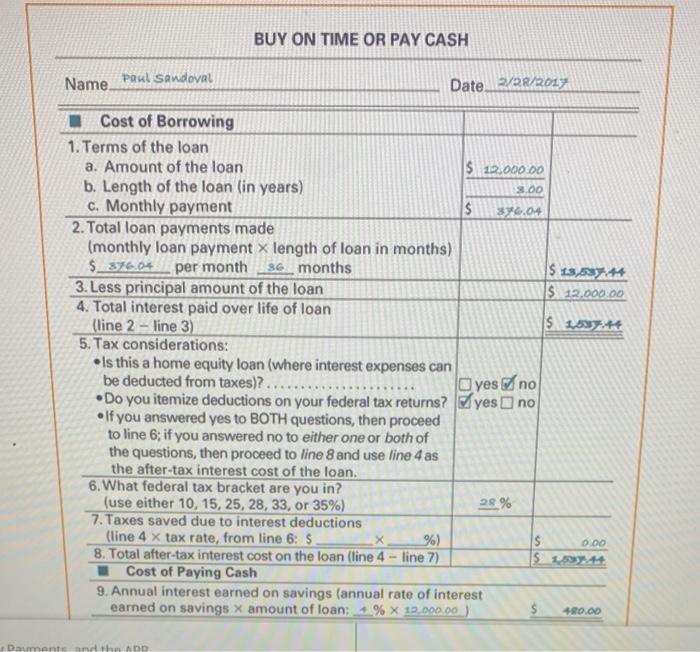

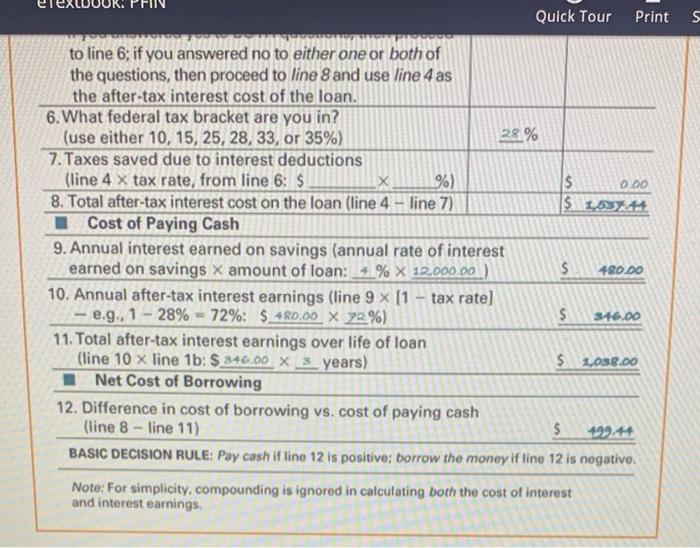

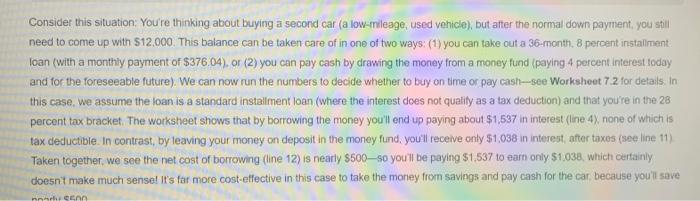

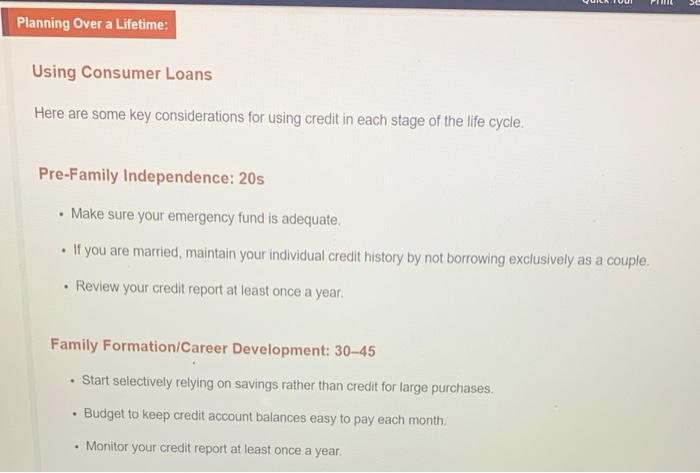

Jake and Agnes Barnett budget and spend their money carefully. Your Honda CRV has more than 150,000 miles and needs to be replaced. Because they have been driving their cars for so long, Jake and Agnes have decided to buy a new car and have saved a $5,000 down payment. They're willing to make a monthly car payment of about $ 350, while 48-month loans are at 3 percent. Before choosing a new car, they want to determine how much they can afford to spend on it given their budget constraints. Jake and Agnes run their auto loan calculations backwards to calculate the size of the implied auto loan at a maturity of 48 months and an interest rate of 3 percent. Using a calculator and the approach explained in this chapter, the loan amount is approximately $ 15,813. So, given their $5,000 down payment, Jake and Agnes can afford a car that sells for around $ 20,813 net of tax, title, and license fees. In fact, it is the careful car buyers, if not "the other way around," who explore the angles. 7-4c. Buy on Time or Pay Cash? When buying a big-ticket item, you often have itle choice but to take out a loanthe item being purchased is just so expensive that you can't afford to pay cash. And even if you do have the money, you may still be better off using an instaltrent loan if the cash purchase would end up severely depleting your liquid reserves. But don't just automatically take out a loan Rather, take the time to find out it, in fact that is the best thing to do Such a decision can be made by using Worksheet 72, which considers the cost of the loan relative to the after-tax earnings generated from having your money in some type of short-term investment. Hero, It's assumed that the consumer has an adequate level of liquid reserves and that these reserves are being held in some type of savings account (Obviously, if this is not the case, then there's little reason to go through the exercise because you have no choice but to borrow the money ) Essentially, it all boils down to this: at costs more to borrow the money than you can earn in interest, then withdraw the money from your savings to pay cash for the purchase. If not, you should probably take out a loan BUY ON TIME OR PAY CASH Name Paul Sandoval Date 2/2/2017 3.00 Cost of Borrowing 1. Terms of the loan a. Amount of the loan $ 12,000.00 b. Length of the loan (in years) C. Monthly payment $ 30.04 2. Total loan payments made (monthly loan payment x length of loan in months) $_396.04 per month 36 months $ 13,53 3. Less principal amount of the loan $ 12.000.00 4. Total interest paid over life of loan (line 2 - line 3) $ 15374 5. Tax considerations: Is this a home equity loan (where interest expenses can be deducted from taxes)? yes no Do you itemize deductions on your federal tax returns? yes no If you answered yes to BOTH questions, then proceed to line 6; if you answered no to either one or both of the questions, then proceed to line 8 and use line 4 as the after-tax interest cost of the loan. 6. What federal tax bracket are you in? (use either 10, 15, 25, 28, 33, or 35%) 7. Taxes saved due to interest deductions (line 4 x tax rate, from line 6: S X %) $ 8. Total after-tax interest cost on the loan (line 4 - line 7) $ 18+ Cost of Paying Cash 9. Annual interest earned on savings (annual rate of interest earned on savings x amount of loan: % X 12.000.00) $ 28 % 0.00 RO.CO ADD Quick Tour Print 5 to line 6; if you answered no to either one or both of the questions, then proceed to line 8 and use line 4 as the after-tax interest cost of the loan. 6. What federal tax bracket are you in? (use either 10, 15, 25, 28, 33, or 35%) 28 % 7. Taxes saved due to interest deductions (line 4 x tax rate, from line 6: $ X %) $ 0.00 8. Total after-tax interest cost on the loan (line 4 - line 7) $ 1,59 Cost of Paying Cash 9. Annual interest earned on savings (annual rate of interest earned on savings X amount of loan: $ % X 12,000.00 ) $ 4R0.00 10. Annual after-tax interest earnings (line 9 x 11 tax rate) e.g., 1 -28% - 72%: $ 4R0.00 X 72%) $ 316.00 11. Total after-tax interest earnings over life of loan (line 10 x line 1b: $ 346,00 X 3 years) $ L038.00 Net Cost of Borrowing 12. Difference in cost of borrowing vs. cost of paying cash (line 8 - line 11) $ BASIC DECISION RULE: Pay cash if line 12 is positive; borrow the money if line 12 is negative. Note: For simplicity, compounding is ignored in calculating both the cost of interest and interest earnings. Consider this situation: You're thinking about buying a second car (a low-mileage, used vehicle), but after the normal down payment, you still need to come up with 512.000. This balance can be taken care of in one of two ways: (1) you can take out a 36-month. 8 percent installment loan (with a monthly payment of $376,04), or (2) you can pay cash by drawing the money from a money fund (paying 4 percent interest today and for the foreseeable future). We can now run the numbers to decide whether to buy on time or pay cash--see Workshoot 7.2 for details. In this case, we assume the loan is a standard installment loan (where the interest does not quality as a tax deduction) and that you're in the 28 percent tax bracket. The worksheet shows that by borrowing the money you'll end up paying about $1,537 in interest (line 4X, none of which is tax deductible. In contrast, by leaving your money on deposit in the money fund, you'll receive only $1.038 in interest, after taxes (soe line 11) Taken together we see the net cost of borrowing (line 12) is nearly $500-so you'll be paying $1.537 to earn only $1.038, which certainly doesn't make much sense! It's for more cost-effective in this case to take the money from savings and pay cash for the car because you'll save nonhan se Planning Over a Lifetime: Using Consumer Loans Here are some key considerations for using credit in each stage of the life cycle. Pre-Family Independence: 20s . Make sure your emergency fund is adequate, If you are married, maintain your individual credit history by not borrowing exclusively as a couple. Review your credit report at least once a year. Family Formation/Career Development: 30-45 Start selectively relying on savings rather than credit for large purchases Budget to keep credit account balances easy to pay each month. . Monitor your credit report at least once a year Pre-Retirement: 45-65 . If you must make credit payments late, inform the lender. . Monitor your credit card and bank statements for unauthorized transactions Monitor your credit report at least once a year. Retirement: 65 and beyond Consider a second mortgage or home equity line of credit to reduce borrowing costs. Budget to limit dependence on consumer credit Monitor your credit report at least once a year, Although $500 is a convincing reason for avoiding a loan sometimes the actual dollar spread between the cont of borrowing and interest eamed is smat, perhaps only $100 or less Being able to deduct the interest on a loan can lead to a relatively small sprond, but it can also occur, for example, if the amount being finanood is relatively smal say you want $1,500 or $2.000 for a ski trip to ColoradoIn this con--and as long as the spread stays small enough you may decide it's still worthwhile to borrow the money in order to maintain a higher level of liquidity. Although this decision is perfectly legitimate when very small spreads exist, it makes less sense as the gap starts to widen Jake and Agnes Barnett budget and spend their money carefully. Your Honda CRV has more than 150,000 miles and needs to be replaced. Because they have been driving their cars for so long, Jake and Agnes have decided to buy a new car and have saved a $5,000 down payment. They're willing to make a monthly car payment of about $ 350, while 48-month loans are at 3 percent. Before choosing a new car, they want to determine how much they can afford to spend on it given their budget constraints. Jake and Agnes run their auto loan calculations backwards to calculate the size of the implied auto loan at a maturity of 48 months and an interest rate of 3 percent. Using a calculator and the approach explained in this chapter, the loan amount is approximately $ 15,813. So, given their $5,000 down payment, Jake and Agnes can afford a car that sells for around $ 20,813 net of tax, title, and license fees. In fact, it is the careful car buyers, if not "the other way around," who explore the angles. 7-4c. Buy on Time or Pay Cash? When buying a big-ticket item, you often have itle choice but to take out a loanthe item being purchased is just so expensive that you can't afford to pay cash. And even if you do have the money, you may still be better off using an instaltrent loan if the cash purchase would end up severely depleting your liquid reserves. But don't just automatically take out a loan Rather, take the time to find out it, in fact that is the best thing to do Such a decision can be made by using Worksheet 72, which considers the cost of the loan relative to the after-tax earnings generated from having your money in some type of short-term investment. Hero, It's assumed that the consumer has an adequate level of liquid reserves and that these reserves are being held in some type of savings account (Obviously, if this is not the case, then there's little reason to go through the exercise because you have no choice but to borrow the money ) Essentially, it all boils down to this: at costs more to borrow the money than you can earn in interest, then withdraw the money from your savings to pay cash for the purchase. If not, you should probably take out a loan BUY ON TIME OR PAY CASH Name Paul Sandoval Date 2/2/2017 3.00 Cost of Borrowing 1. Terms of the loan a. Amount of the loan $ 12,000.00 b. Length of the loan (in years) C. Monthly payment $ 30.04 2. Total loan payments made (monthly loan payment x length of loan in months) $_396.04 per month 36 months $ 13,53 3. Less principal amount of the loan $ 12.000.00 4. Total interest paid over life of loan (line 2 - line 3) $ 15374 5. Tax considerations: Is this a home equity loan (where interest expenses can be deducted from taxes)? yes no Do you itemize deductions on your federal tax returns? yes no If you answered yes to BOTH questions, then proceed to line 6; if you answered no to either one or both of the questions, then proceed to line 8 and use line 4 as the after-tax interest cost of the loan. 6. What federal tax bracket are you in? (use either 10, 15, 25, 28, 33, or 35%) 7. Taxes saved due to interest deductions (line 4 x tax rate, from line 6: S X %) $ 8. Total after-tax interest cost on the loan (line 4 - line 7) $ 18+ Cost of Paying Cash 9. Annual interest earned on savings (annual rate of interest earned on savings x amount of loan: % X 12.000.00) $ 28 % 0.00 RO.CO ADD Quick Tour Print 5 to line 6; if you answered no to either one or both of the questions, then proceed to line 8 and use line 4 as the after-tax interest cost of the loan. 6. What federal tax bracket are you in? (use either 10, 15, 25, 28, 33, or 35%) 28 % 7. Taxes saved due to interest deductions (line 4 x tax rate, from line 6: $ X %) $ 0.00 8. Total after-tax interest cost on the loan (line 4 - line 7) $ 1,59 Cost of Paying Cash 9. Annual interest earned on savings (annual rate of interest earned on savings X amount of loan: $ % X 12,000.00 ) $ 4R0.00 10. Annual after-tax interest earnings (line 9 x 11 tax rate) e.g., 1 -28% - 72%: $ 4R0.00 X 72%) $ 316.00 11. Total after-tax interest earnings over life of loan (line 10 x line 1b: $ 346,00 X 3 years) $ L038.00 Net Cost of Borrowing 12. Difference in cost of borrowing vs. cost of paying cash (line 8 - line 11) $ BASIC DECISION RULE: Pay cash if line 12 is positive; borrow the money if line 12 is negative. Note: For simplicity, compounding is ignored in calculating both the cost of interest and interest earnings. Consider this situation: You're thinking about buying a second car (a low-mileage, used vehicle), but after the normal down payment, you still need to come up with 512.000. This balance can be taken care of in one of two ways: (1) you can take out a 36-month. 8 percent installment loan (with a monthly payment of $376,04), or (2) you can pay cash by drawing the money from a money fund (paying 4 percent interest today and for the foreseeable future). We can now run the numbers to decide whether to buy on time or pay cash--see Workshoot 7.2 for details. In this case, we assume the loan is a standard installment loan (where the interest does not quality as a tax deduction) and that you're in the 28 percent tax bracket. The worksheet shows that by borrowing the money you'll end up paying about $1,537 in interest (line 4X, none of which is tax deductible. In contrast, by leaving your money on deposit in the money fund, you'll receive only $1.038 in interest, after taxes (soe line 11) Taken together we see the net cost of borrowing (line 12) is nearly $500-so you'll be paying $1.537 to earn only $1.038, which certainly doesn't make much sense! It's for more cost-effective in this case to take the money from savings and pay cash for the car because you'll save nonhan se Planning Over a Lifetime: Using Consumer Loans Here are some key considerations for using credit in each stage of the life cycle. Pre-Family Independence: 20s . Make sure your emergency fund is adequate, If you are married, maintain your individual credit history by not borrowing exclusively as a couple. Review your credit report at least once a year. Family Formation/Career Development: 30-45 Start selectively relying on savings rather than credit for large purchases Budget to keep credit account balances easy to pay each month. . Monitor your credit report at least once a year Pre-Retirement: 45-65 . If you must make credit payments late, inform the lender. . Monitor your credit card and bank statements for unauthorized transactions Monitor your credit report at least once a year. Retirement: 65 and beyond Consider a second mortgage or home equity line of credit to reduce borrowing costs. Budget to limit dependence on consumer credit Monitor your credit report at least once a year, Although $500 is a convincing reason for avoiding a loan sometimes the actual dollar spread between the cont of borrowing and interest eamed is smat, perhaps only $100 or less Being able to deduct the interest on a loan can lead to a relatively small sprond, but it can also occur, for example, if the amount being finanood is relatively smal say you want $1,500 or $2.000 for a ski trip to ColoradoIn this con--and as long as the spread stays small enough you may decide it's still worthwhile to borrow the money in order to maintain a higher level of liquidity. Although this decision is perfectly legitimate when very small spreads exist, it makes less sense as the gap starts to widen