Question

Jake Johnson is a young single professional living in Charlotte, North Carolina. At age 24, he has been working for six months at his new

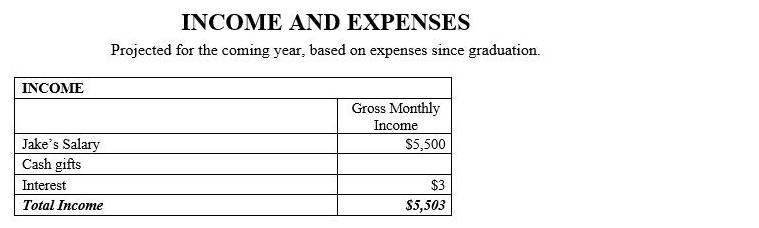

Jake Johnson is a young single professional living in Charlotte, North Carolina. At age 24, he has been working for six months at his new job as a junior electrical engineer at a local utilities company. Jake loves living in the Carolinas and plans to remain in or near Charlotte until retirement. Jake has also been dating Amanda for the past three years, and they are beginning to talk about marriage, but want to wait a couple more years until Amanda is out of school. Jake’s parents, now in their mid-sixties, want to retire but are financially unable to. At his parent’s urging, Jake has decided to prepare a financial plan to prevent himself from facing the same financial difficulties.

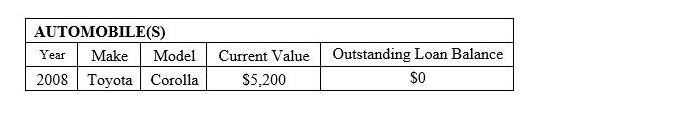

Jake and Amanda have not really discussed their finances, but Jake is sometimes irritated by the way Amanda “pinches pennies.” Amanda will not buy anything unless it is marked down, and she always shops for the best prices. Jake likes to spend money and is currently thinking about upgrading his vehicle to a new Toyota Tacoma. He also gets pleasure from buying gifts for those he loves. Jake was a triathlete in college and would like to continue to compete. In order to remain competitive, he must continue to train at a high level and travel to compete it at least three triathlons each year.

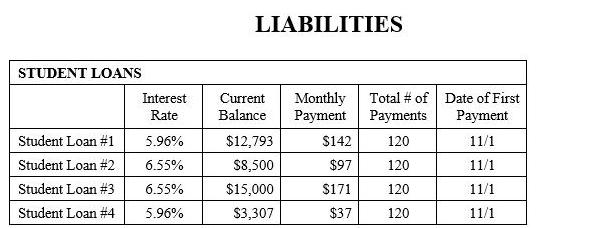

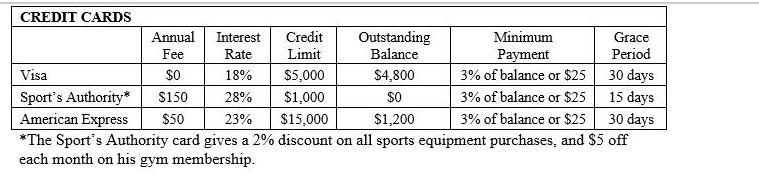

Jake was responsible for paying for his own education, and despite having a small scholarship, has significant student loan debt. He must start repaying these loans now that he has graduated, and he is surprised by the size of his payments. In addition to his student loan debt, he also has some credit card debt that he would like to pay off.

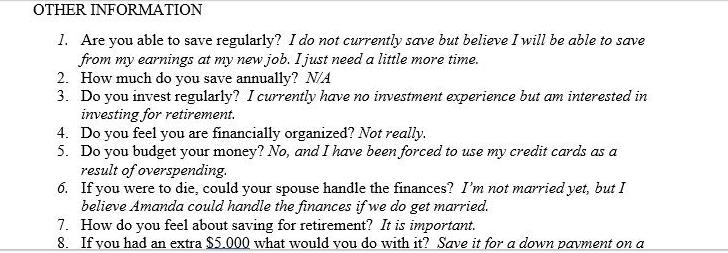

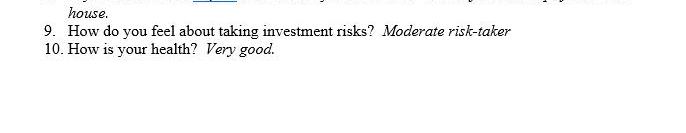

Jake has several goals. He would like to reduce his debt and establish an adequate emergency fund to be better financially prepared. Jake feels that the rent for his two-bedroom apartment is too expensive. He is considering buying a house instead. Jake does not currently save for retirement, and he does not know much about investments. With his new job, he will have the opportunity to participate in a 401(k) retirement plan. He is uncertain, given his other goals, about how much he should currently be saving into the plan. He also needs to select health insurance benefits from the package offered by his new employer.

Motivated by the desire to be financially successful, Jake has decided to consult you to help him develop a financial plan. He has filled out the data gathering forms you provided to him and returned them for your use. These forms are presented on the following pages. Read the information Jake has provided so that you can “get acquainted” with his financial situation.

AUTO INSURANCE

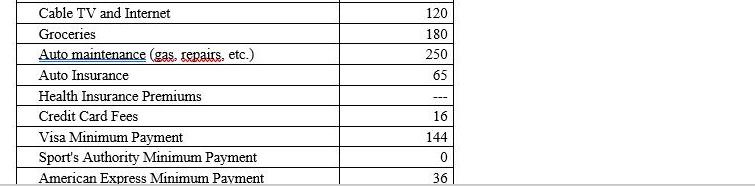

Jake’s parents covered the cost of his auto-insurance while he was in college. Now that he has graduated, he is responsible for paying the $65 per month policy premium. However, if he decides to purchase a new truck, he will have to get higher coverage that will cost $135 per month.

RENTER’S INSURANCE

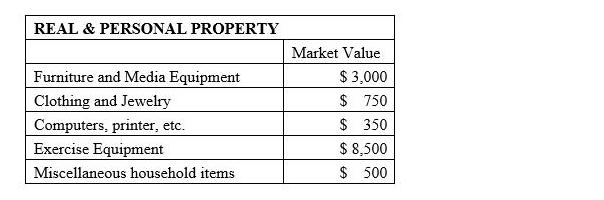

Jake does not currently have renter’s insurance. If it is decided that this is something he needs, it will cost him $15 per month.

LIFE INSURANCE

Jake currently has no life insurance. If he buys some, he will have to pay $10 per month for every $100,000 of coverage he purchases.

DISABILITY INSURANCE

Jake’s new employer provides short-term disability insurance as a benefit of employment.

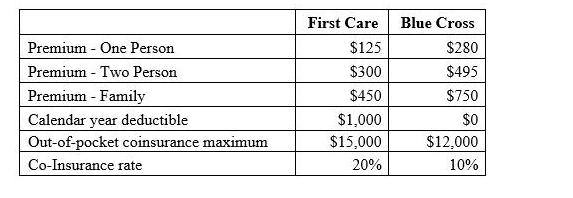

MEDICAL INSURANCE

Jake was previously covered by his parent’s health insurance policy. He can remain on his parent’s policy until he is 25, but he would like to get his own policy as soon as possible so his parents don’t have to keep paying for him. His employer has provided the following insurance policy options:

ESTATE PLANNING INFORMATION

Jake currently has no estate planning documents in place.

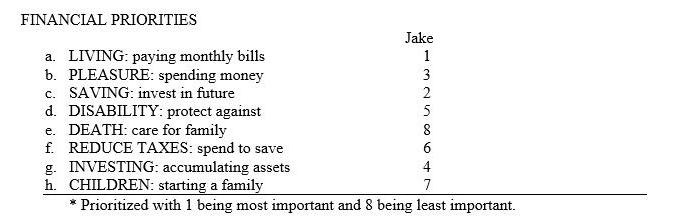

FINANCIAL GOALS

Establish a cash management plan

Incorporate a comparison of debt payoff vs savings decisions.

Debt payoff includes student loans and credit cards.

Savings includes emergency (min. $5,000 preferred), honeymoon, gifts, and retirement.

Obtain adequate insurance.

Consider life, medical, disability, and property coverage.

Make a decision about major life purchases.

When and how to buy a house and new truck

Make sure necessary estate planning documents are in place.

Consider medical directives, powers of attorney, and a will.

What is your single most important financial objective at this time?

To make sure I am saving in a way that will allow me to meet my short and intermediate term goals.

Questions

To begin identifying Jake’s options in reference to his goals answer the following questions:

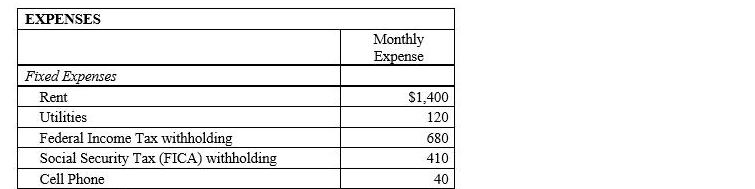

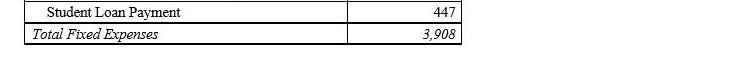

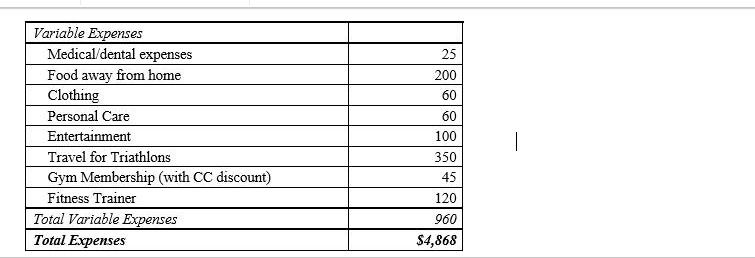

1. Analyze Jake’s cash flow statement.

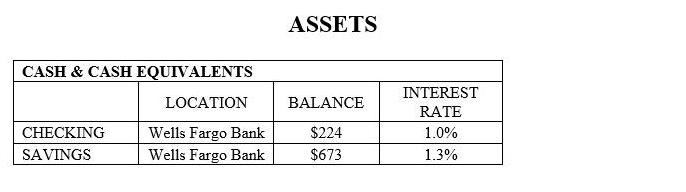

a. Calculate his net worth, asset-to-debt ratio, investment assets to total assets ratio, liquidity ratio, and debt service-to-income ratio.

b. Are these ratios in an acceptable range for him? If not, suggest strategies to start improving them.

c. Create a new budget for Jake by adjusting some of his expenses that you feel are either too high or too low. Be specific about how much he should spend in each category and be sure to justify why you feel this change is worth making.

2. Help Jake save up for a down payment for a house. He figures he will need to have $7,350 for a down payment before he can buy a house.

a. Calculate how much Jake must save each month to reach his goal in 12 months, assuming he uses his savings account.

3. Help Jake buy a new Toyota Tacoma for $27,000.

a. Calculate his monthly truck payment if he can get a loan with an interest rate of 2.5% over 72 months.

b. Calculate his other costs of buying the truck. If he buys the truck his auto insurance will increase to $135 per month, but his auto maintenance expenses will fall to approximately $220 per month. Can Jake afford to buy the truck with his current budget? Explain what he might have to sacrifice in order to afford the truck.

4. Help Jake build his emergency fund.

a. Determine how much Jack should have in liquid assets in order to have a comfortable liquidity ratio.

b. Calculate how much he must save each month to fill his emergency fund within three years.

5. Jake is considering changing to the “extended repayment” plan on his student loans. If he does this, the loans will take 20 years to pay off instead of 10.

a. Calculate his new monthly payments for all of his student loans if the term changes to 20 years.

b. How much lower will his total student loan payment be if he changes to the 20-year repayment plan?

c. Is this something Jake should consider doing to help him achieve his other cash management goals?

6. Using the figures you calculated in #1-5, give Jake a final and comprehensive set of recommendations for what he should do to balance his budget and reach his goals. Jake may not be able to accomplish all of his goals, so you will need to either adjust his goals (like buying a cheaper car/house), get creative with how he spends his money, or prioritize which goals he should focus on first. Be specific, creative, and as realistic as possible.

Premium - One Person Premium - Two Person Premium - Family Calendar year deductible Out-of-pocket coinsurance maximum Co-Insurance rate First Care $125 $300 $450 $1,000 $15,000 20% Blue Cross $280 $495 $750 $0 $12,000 10%

Step by Step Solution

3.52 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

To analyze Jakes cash flow statement and provide recommendations follow these steps Calculate key ratios a Net worth Assets 224 673 5200 3000 750 350 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started