Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jake launched Gopher Technologies on January 1 with an initial investment of $15,000 of his personal cash and a one-year loan of $10,000 from

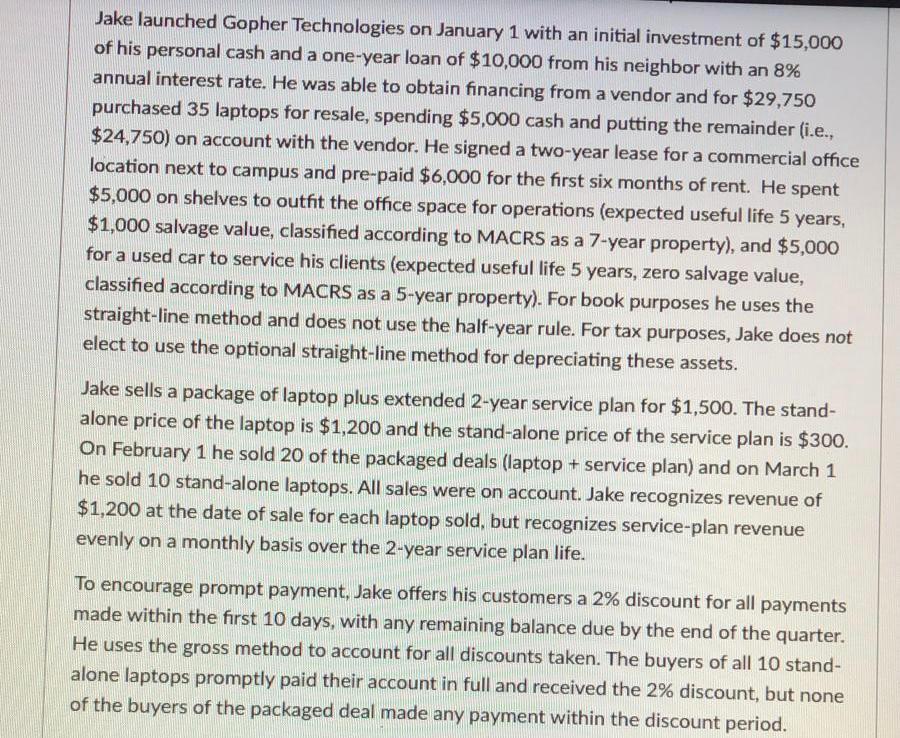

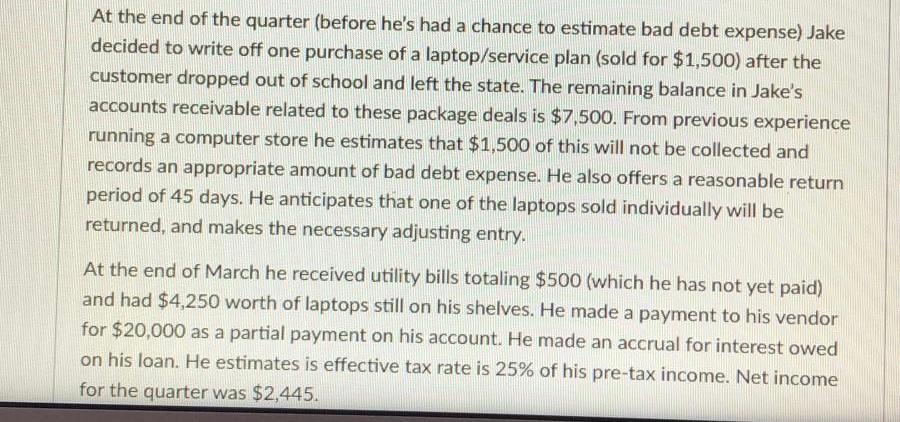

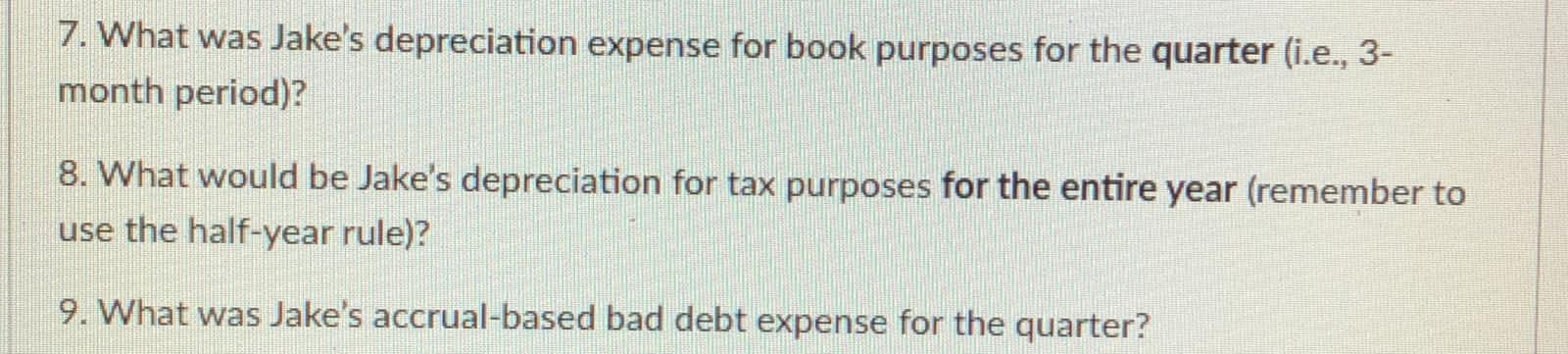

Jake launched Gopher Technologies on January 1 with an initial investment of $15,000 of his personal cash and a one-year loan of $10,000 from his neighbor with an 8% annual interest rate. He was able to obtain financing from a vendor and for $29,750 purchased 35 laptops for resale, spending $5,000 cash and putting the remainder (i.e., $24,750) on account with the vendor. He signed a two-year lease for a commercial office location next to campus and pre-paid $6,000 for the first six months of rent. He spent $5,000 on shelves to outfit the office space for operations (expected useful life 5 years, $1,000 salvage value, classified according to MACRS as a 7-year property), and $5,000 for a used car to service his clients (expected useful life 5 years, zero salvage value, classified according to MACRS as a 5-year property). For book purposes he uses the straight-line method and does not use the half-year rule. For tax purposes, Jake does not elect to use the optional straight-line method for depreciating these assets. Jake sells a package of laptop plus extended 2-year service plan for $1,500. The stand- alone price of the laptop is $1,200 and the stand-alone price of the service plan is $300. On February 1 he sold 20 of the packaged deals (laptop + service plan) and on March 1 he sold 10 stand-alone laptops. All sales were on account. Jake recognizes revenue of $1,200 at the date of sale for each laptop sold, but recognizes service-plan revenue evenly on a monthly basis over the 2-year service plan life. To encourage prompt payment, Jake offers his customers a 2% discount for all payments made within the first 10 days, with any remaining balance due by the end of the quarter. He uses the gross method to account for all discounts taken. The buyers of all 10 stand- alone laptops promptly paid their account in full and received the 2% discount, but none of the buyers of the packaged deal made any payment within the discount period. At the end of the quarter (before he's had a chance to estimate bad debt expense) Jake decided to write off one purchase of a laptop/service plan (sold for $1,500) after the customer dropped out of school and left the state. The remaining balance in Jake's accounts receivable related to these package deals is $7,500. From previous experience running a computer store he estimates that $1,500 of this will not be collected and records an appropriate amount of bad debt expense. He also offers a reasonable return period of 45 days. He anticipates that one of the laptops sold individually will be returned, and makes the necessary adjusting entry. At the end of March he received utility bills totaling $500 (which he has not yet paid) and had $4,250 worth of laptops still on his shelves. He made a payment to his vendor for $20,000 as a partial payment on his account. He made an accrual for interest owed on his loan. He estimates is effective tax rate is 25% of his pre-tax income. Net income for the quarter was $2,445. 7. What was Jake's depreciation expense for book purposes for the quarter (i.e., 3- month period)? 8. What would be Jake's depreciation for tax purposes for the entire year (remember to use the half-year rule)? 9. What was Jake's accrual-based bad debt expense for the quarter?

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Trial Balance 12312014 Debit Credit Journal Entries Particulars Debit Credit Cash 37562 A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started