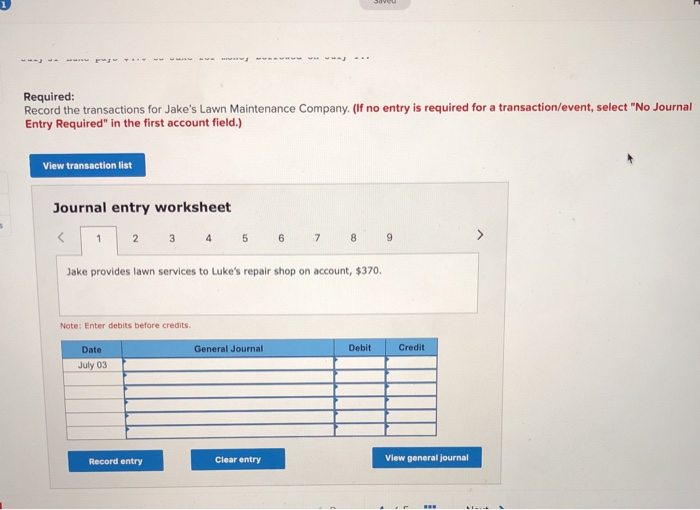

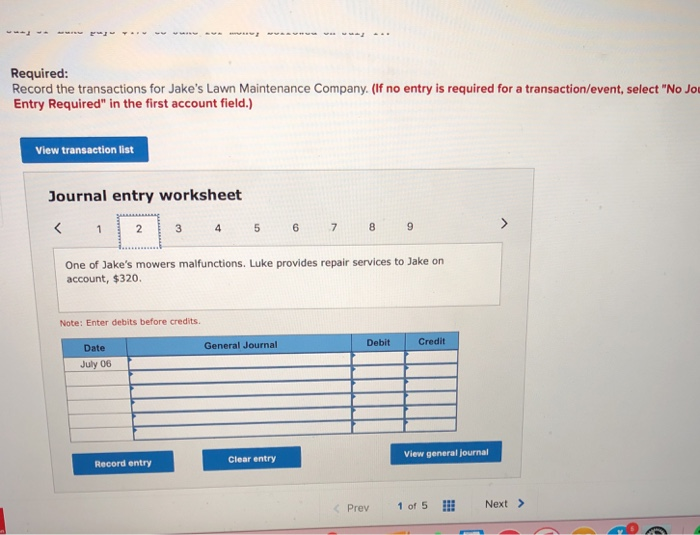

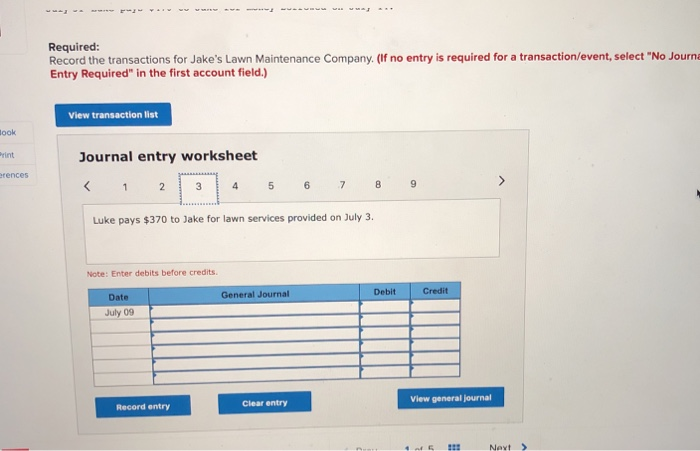

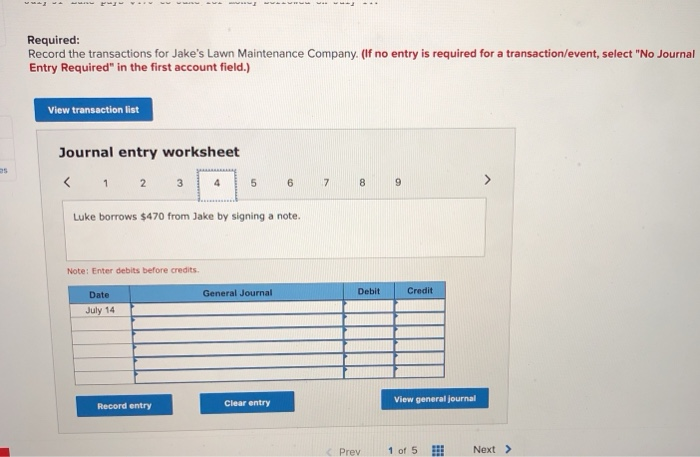

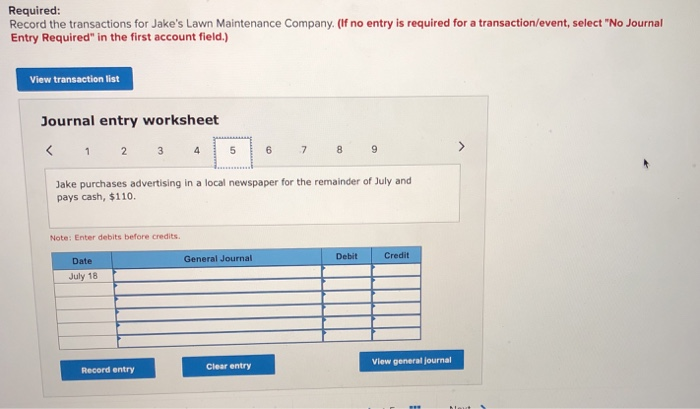

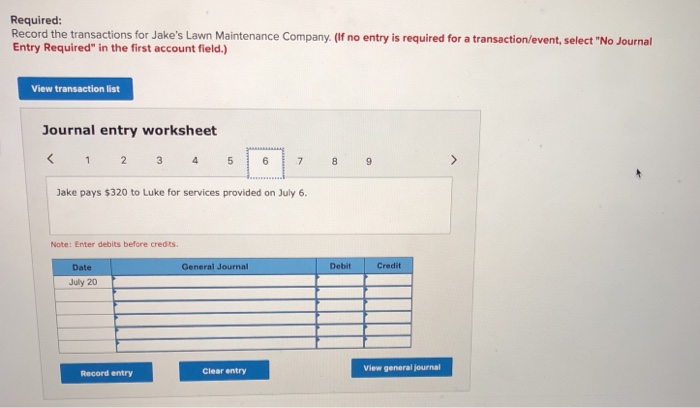

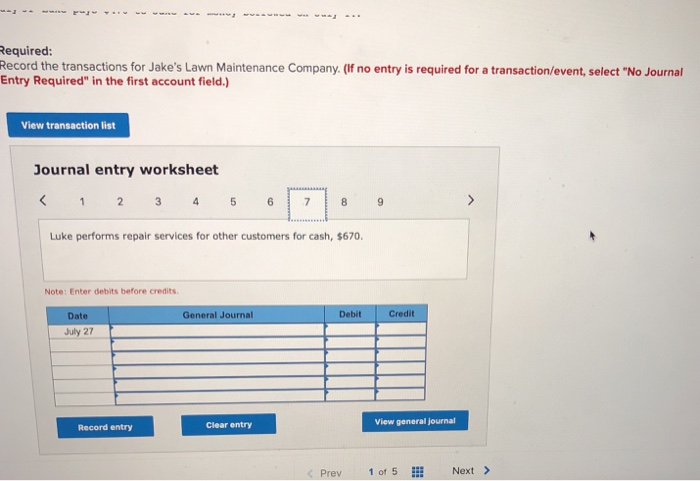

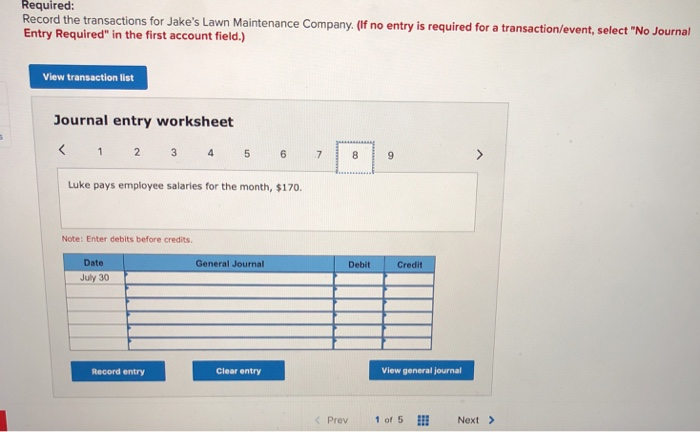

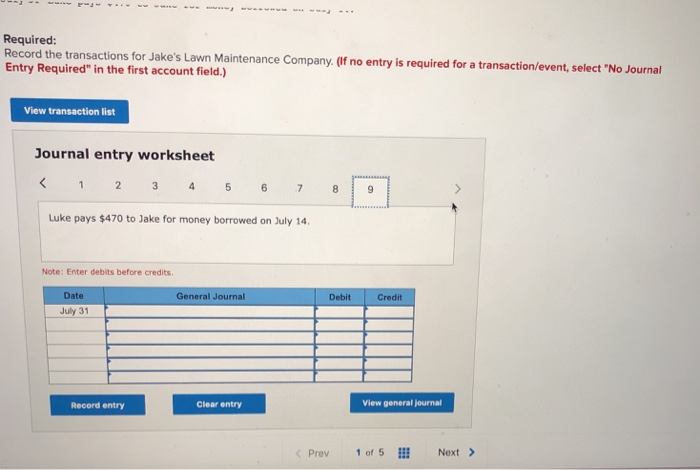

Jake owns a lawn maintenance company, and Luk occurred e owns a machine repair shop. For the month of July, the following transactions July 3 Jake provides 1awn services to Luke's repair shop os account, $370 July 6 One of July 9 Luke pays $370 to Jake for 1avn services provided on July July 14 Luke borrows $470 from Jake by signing a note July 18 Jake purchases advertising in a local nevspaper for the remai July 20 Jake pays $320 to Luke for services provided on July 6 Jake's movers nal functions. Luke provides repair services to Jake on aeeount 5320. of July and pays cash, $110 uly 27 Luke performs repair services for other eustomers for cash, 8670 July 30 uke pays employee salaries for the month, $170. July 31 Luke pays $470 to Jake for money borroved on July 14. Required: Record the transactions for Jake's Lawn Maintenance Company. (If no entry is required for a t Entry Required" in the first account field.) ransaction/event, select "No Journal View transaction list Journal entry worksheet Jake provides lawn services to Luke's repair shop on account, $370 Note: Enter debits before credits Next > Required: Record the transactions for Jake's Lawn Maintenance Company. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Jake provides lawn services to Luke's repair shop on account, $370 Note: Enter debits before credits. Date General Journal Debit Credit July 03 Record entry Clear entry View general journal Required: Record the transactions for Jake's Lawn Maintenance Company. (If no entry is required for a transaction/event, select "No Jo Entry Required" in the first account field.) View transaction list Journal entry worksheet One of Jake's mowers malfunctions. Luke provides repair services to Jake on account, $320 Note: Enter debits before credits. General Journal Debit Credit Date July 06 View general journal Clear entry Record entry Prev 1 of 5 Next > Required: Record the transactions for Jake's Lawn Maintenance Company. (If no entry is required for a transaction/event, select "No Journa Entry Required" in the first account field.) View transaction list ook Journal entry worksheet rint rences Luke pays $370 to Jake for lawn services provided on July 3. Note: Enter debits before credits Debit Credit Date General Journal July 09 View general journal Clear entry Record entry Nevt> Required: Record the transactions for Jake's Lawn Maintenance Company. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Luke borrows $470 from Jake by signing a note. Note: Enter debits before credits Date General Journal Debit Credit July 14 View general journal Record entry Clear entry c Prev 1 of5E Next> Required Record the transactions for Jake's Lawn Maintenance Company. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Jake purchases advertising in a local newspaper for the remainder of July and pays cash, $110. Note: Enter debits before credits Debit Credit Date General Journal July 18 View general journal Clear entry Record entry Required Record the transactions for Jake's Lawn Maintenance Company.(If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Jake pays $320 to Luke for services provided on July 6 Note: Enter debits before credts Date General Journal Debit Credit July 20 Clear entry View general journal Record entry equired: Record the transactions for Jake's Lawn Maintenance Company. (f no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list ournal entry worksheet Luke performs repair services for other customers for cash, $670. Note: Enter debits before credits Date General Journal Debit Credit July 27 Clear entry View general journal Record entry Prev 1 of E Next> Required: Record the transactions for Jake's Lawn Maintenance Company. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Luke pays $470 to Jake for money borrowed on July 14 Note: Enter debits before credits. Date General Journal Debit Credit July 31 Clear entry View general journal Record entry Prev1of5l Next