Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jake Stevenson is 35 years old and works full-time as an assistant manager at a retail store. He is married to Erika Stevenson who

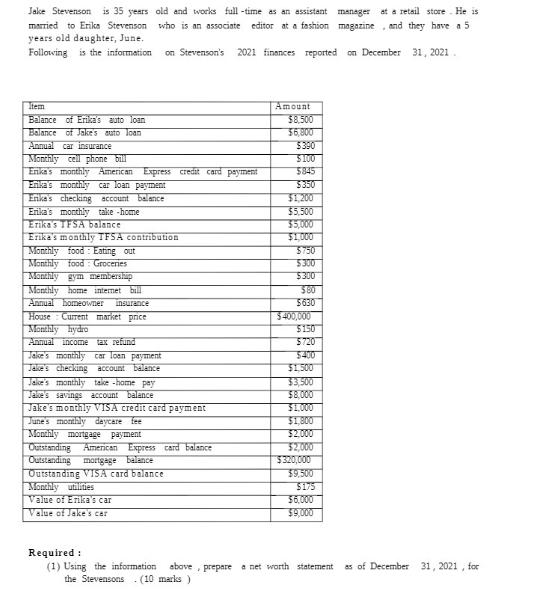

Jake Stevenson is 35 years old and works full-time as an assistant manager at a retail store. He is married to Erika Stevenson who is an associate editor at a fashion magazine and they have a 5 years old daughter, June. Following is the information on Stevenson's 2021 finances reported on December 31, 2021. Item Balance of Erikas auto loan Balance of Jake's auto loan Annual car insurance Monthly cell phone bill Erika's monthly American Express credit card payment Erika's monthly car loan payment Erika's checking account balance Erika's monthly take-home Erika's IFSA balance Erika's monthly TFSA contribution Monthly food: Eating out Monthly food Groceries Monthly gym membership Monthly home internet bill Annual homeowner insurance House Current market price Monthly hydro Annual income tax refund Jake's monthly car loan payment Jake's checking account balance Jake's monthly take-home pay Jake's savings account balance Jake's monthly VISA credit card payment June's monthly daycare fee Monthly mortgage payment Outstanding American Express card balance Outstanding mortgage balance Outstanding VISA card balance Monthly utilities Value of Erika's car Value of Jake's car Amount $8.500 $6,800 $390 $100 $845 $350 $1,200 $5,500 $5,000 $1,000 $750 $300 $300 $80 5630 $400,000 $150 5720 $400 $1,500 $3,500 $8,000 $1,000 $1,800 $2,000 $2,000 $320,000 $9,500 $175 $6,000 $9,000 Required: (1) Using the information above, prepare a net worth statement as of December 31, 2021, for the Stevensons (10 marks)

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Assets Enlas Auto Loan Balance 8500 Jakes Auto Loan Balance 6800 Enkas Checking Account Balance 5500 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started