Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sale-Sucre plc specialises in the production and sale of pizzas. It is considering increasing production and plans to invest in a new kitchen oven

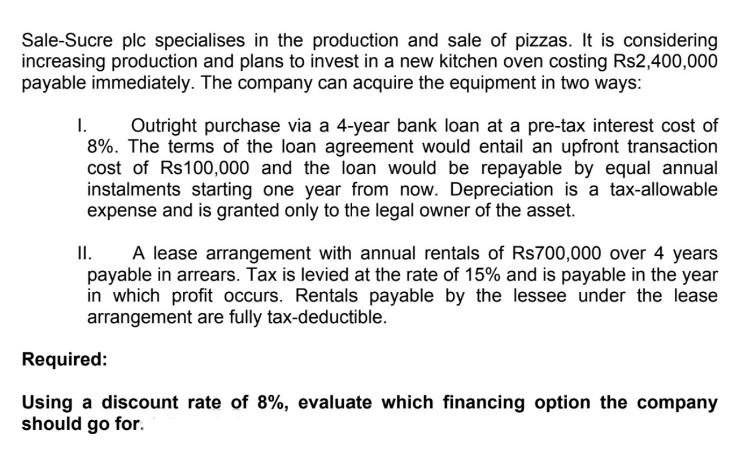

Sale-Sucre plc specialises in the production and sale of pizzas. It is considering increasing production and plans to invest in a new kitchen oven costing Rs2,400,000 payable immediately. The company can acquire the equipment in two ways: I. Outright purchase via a 4-year bank loan at a pre-tax interest cost of 8%. The terms of the loan agreement would entail an upfront transaction cost of Rs100,000 and the loan would be repayable by equal annual instalments starting one year from now. Depreciation is a tax-allowable expense and is granted only to the legal owner of the asset. II. A lease arrangement with annual rentals of Rs700,000 over 4 years payable in arrears. Tax is levied at the rate of 15% and is payable in the year in which profit occurs. Rentals payable by the lessee under the lease arrangement are fully tax-deductible. Required: Using a discount rate of 8%, evaluate which financing option the company should go for.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To evaluate the financing options we need to calculate the present value of cash flows associated wi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started