Answered step by step

Verified Expert Solution

Question

1 Approved Answer

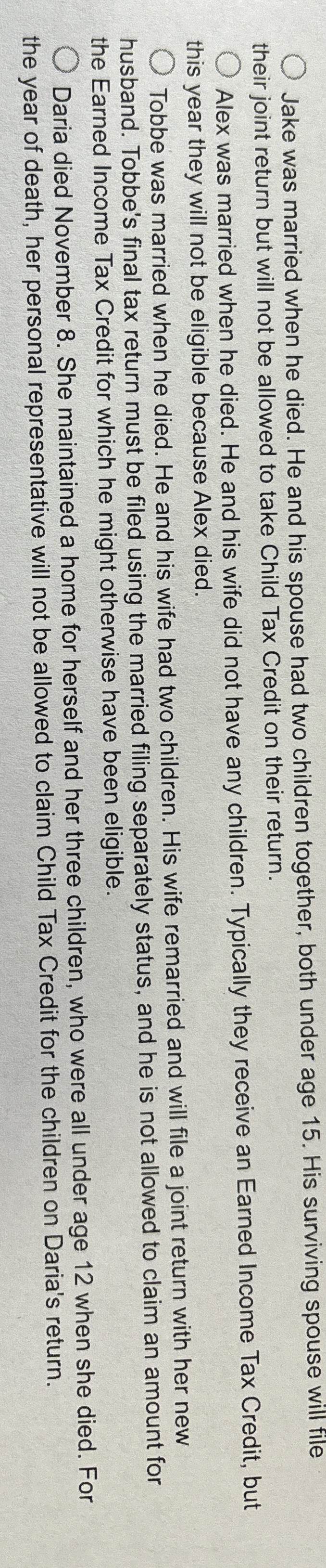

Jake was married when he died. He and his spouse had two children together, both under age 1 5 . His surviving spouse will file

Jake was married when he died. He and his spouse had two children together, both under age His surviving spouse will file

their joint return but will not be allowed to take Child Tax Credit on their return.

Alex was married when he died. He and his wife did not have any children. Typically they receive an Earned Income Tax Credit, but

this year they will not be eligible because Alex died.

Tobbe was married when he died. He and his wife had two children. His wife remarried and will file a joint return with her new

husband. Tobbe's final tax return must be filed using the married filing separately status, and he is not allowed to claim an amount for

the Earned Income Tax Credit for which he might otherwise have been eligible.

Daria died November She maintained a home for herself and her three children, who were all under age when she died. For

the year of death, her personal representative will not be allowed to claim Child Tax Credit for the children on Daria's return.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started