Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jakobs, Penn, and Lundt are partners with beginning-of-year capital balances of $400,000, $320,000, and $160,000, respectively. The partners agreed to share income and loss

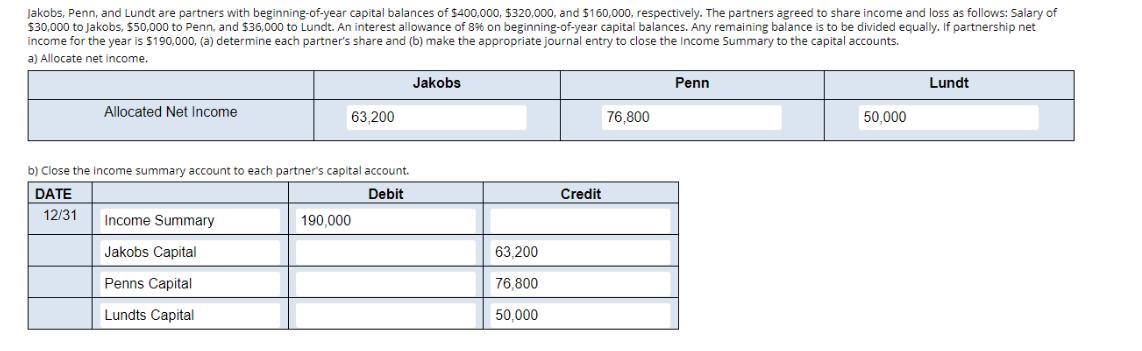

Jakobs, Penn, and Lundt are partners with beginning-of-year capital balances of $400,000, $320,000, and $160,000, respectively. The partners agreed to share income and loss as follows: Salary of $30,000 to Jakobs, $50,000 to Penn, and $36,000 to Lundt. An interest allowance of 8% on beginning-of-year capital balances. Any remaining balance is to be divided equally. If partnership net income for the year is $190,000, (a) determine each partner's share and (b) make the appropriate journal entry to close the Income Summary to the capital accounts. a) Allocate net income. Allocated Net Income Jakobs 63,200 b) Close the income summary account to each partner's capital account. DATE 12/31 Income Summary Jakobs Capital Penns Capital Lundts Capital Debit 190,000 63,200 76,800 50,000 Credit Penn 76,800 Lundt 50,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To allocate the net income and make the appropriate journal entry to close the Income Summary to the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started