Answered step by step

Verified Expert Solution

Question

1 Approved Answer

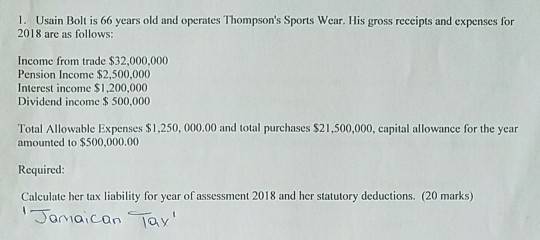

Jamaica Tax!!! 1. Usain Bolt is 66 years old and operates Thompson's Sports Wear. His gross receipts and expenses for 2018 are as follows: Income

Jamaica Tax!!!

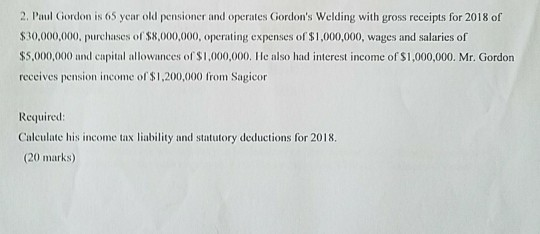

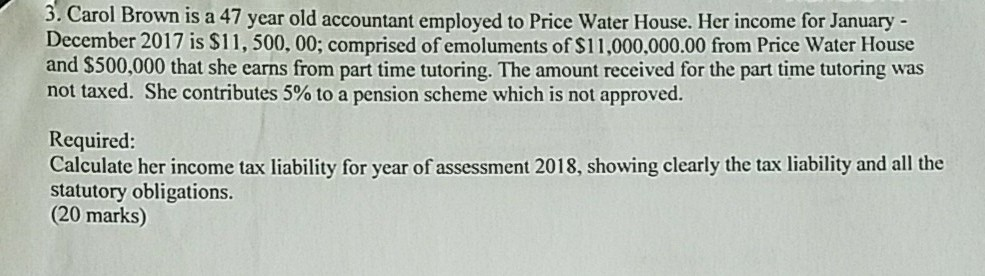

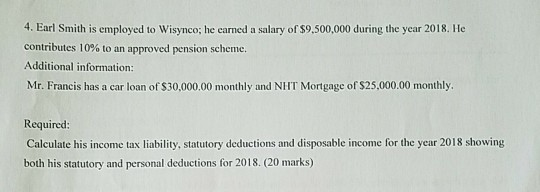

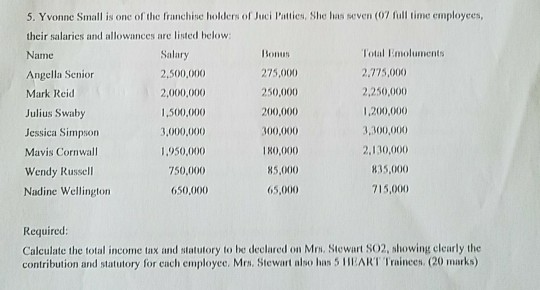

1. Usain Bolt is 66 years old and operates Thompson's Sports Wear. His gross receipts and expenses for 2018 are as follows: Income from trade $32,000,000 Pension Income $2,500,000 Interest income $1.200,000 Dividend income $ 500,000 Total Allowable Expenses $1,250,000.00 and total purchases $21,500,000, capital allowance for the year amounted to $500,000.00 Required: Calculate her tax liability for year of assessment 2018 and her statutory deductions. (20 marks) Jamaican Tax' 2. Paul Gordon is 65 year old pensioner and operates Gordon's Welding with gross receipts for 2018 of $30,000,000, purchases of $8,000,000, operating expenses of $1,000,000, wages and salaries of $5,000,000 and capital allowances of $1,000,000. He also had interest income of $1,000,000. Mr. Gordon receives pension income of $1,200,000 from Sagicor Required: Calculate his income tax liability and statutory deductions for 2018, (20 marks) 3. Carol Brown is a 47 year old accountant employed to Price Water House. Her income for January - December 2017 is $11,500.00: comprised of emoluments of $11,000,000.00 from Price Water House and $500,000 that she earns from part time tutoring. The amount received for the part time tutoring was not taxed. She contributes 5% to a pension scheme which is not approved. Required: Calculate her income tax liability for year of assessment 2018, showing clearly the tax liability and all the statutory obligations. (20 marks) 4. Earl Smith is employed to Wisynco; he earned a salary of $9,500,000 during the year 2018. He contributes 10% to an approved pension scheme. Additional information: Mr. Francis has a car loan of $30,000.00 monthly and NHT Mortgage of $25,000.00 monthly. Required: Calculate his income tax liability, statutory deductions and disposable income for the year 2018 showing both his statutory and personal deductions for 2018. (20 marks) 5. Yvonne Small is one of the franchise holders of Juci Patties. She has seven (07 full time employees, their salaries and allowances are listed below Name Salary Total Emoluments Angella Senior 2.500.000 275,000 2,775,000 Mark Reid 2,000,000 250,000 2,250,000 Julius Swaby 1.500,000 200,000 1,200,000 Jessica Simpson 3,000,000 300,000 3,300,000 Mavis Cornwall 1.950,000 180,000 2,130,000 Wendy Russell 750,000 85,000 835,000 Nadine Wellington 650,000 65,000 715,000 Required: Calculate the total income tax and statutory to be declared on Mes, Stewart SO2, showing clearly the contribution and statutory for each employee. Mrs. Stewart also has 5 TIEART Trainees (20 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started