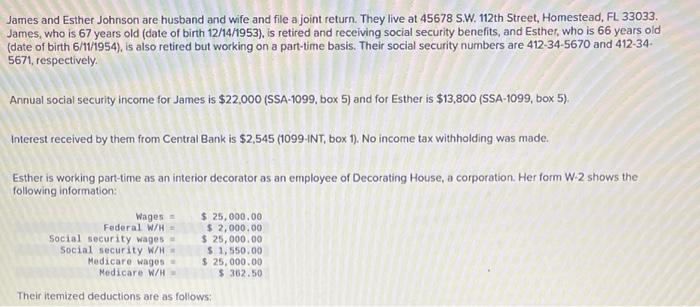

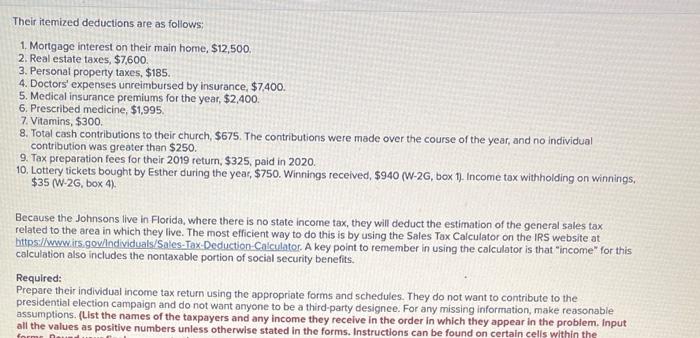

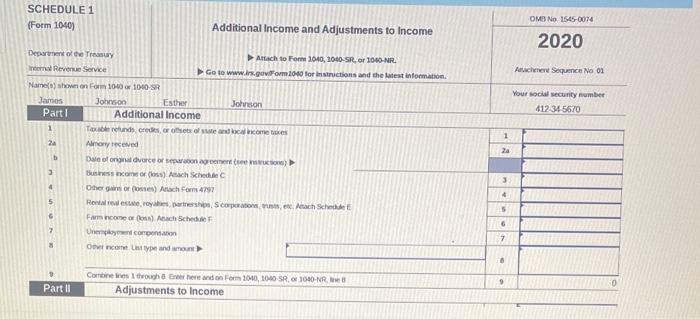

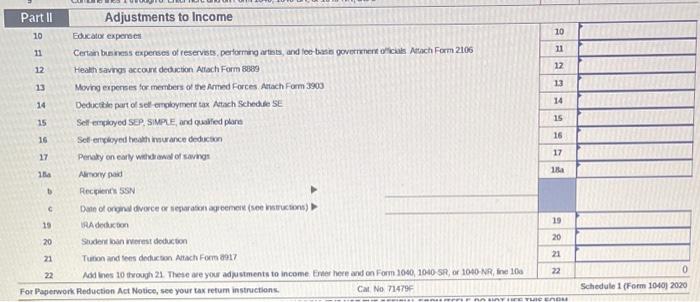

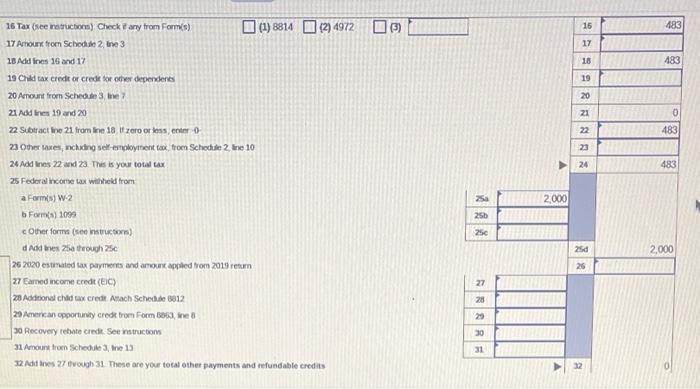

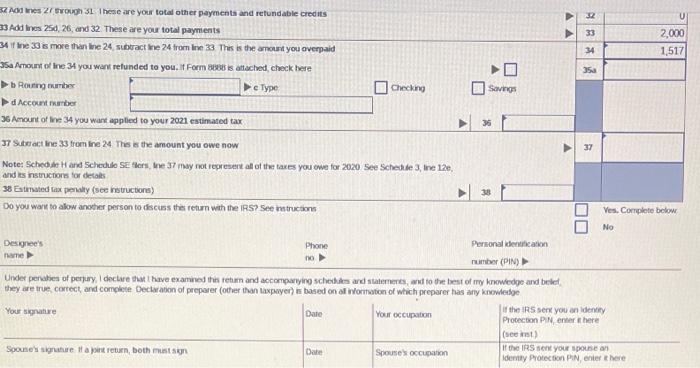

James and Esther Johnson are husband and wife and file a joint return. They live at 45678 S.W. 112th Street, Homestead, FL 33033. James, who is 67 years old (date of birth 12/14/1953), is retired and receiving social security benefits, and Esther, who is 66 years oid (date of birth 6/11/1954 ), is also retired but working on a part-time basis. Their social security numbers are 412-34-5670 and 412-34. 5671, respectively. Annual social security income for James is $22,000 (SSA-1099, box 5) and for Esther is $13,800 (SSA-1099, box 5). Interest received by them from Central Bank is $2,545 (1099-INT, box 1). No income tax withholding was made. Esther is working part-time as an interior decorator as an employee of Decorating House, a corporation. Her form W-2 shows the foliowing information: Their itemized deductions are as follows: Their itemized deductions are as follows: 1. Mortgage interest on their main home, $12,500. 2. Real estate taxes, $7,600 3. Personal property taxes, $185. 4. Doctors' expenses unreimbursed by insurance, $7,400. 5. Medical insurance premiums for the year, $2,400. 6. Prescribed medicine, $1,995. 7. Vitamins, $300. 8. Total cash contributions to their church, \$675. The contributions were made over the course of the year, and no individual contribution was greater than $250. 9. Tax preparation fees for their 2019 return, $325, paid in 2020. 10. Lottery tickets bought by Esther during the year, $750. Winnings received, $940(W2G, box 1). Income tax withholding on winnings, $35(W2G, box 4) Because the Johnsons live in Florida, where there is no state income tax, they will deduct the estimation of the general sales tax related to the area in which they live. The most efficient way to do this is by using the Sales Tax Calculator on the IRS website at bittps:/lwwwirs.govilndividuals/Sales-Tax-Deduction-Calculator. A key point to remember in using the calculator is that "income" for this calculation also includes the nontaxable portion of social security benefits. Required: Prepare their individusi income tax return using the appropriate forms and schedules. They do not want to contribute to the presidential election campaign and do not want anyone to be a third-party designce. For any missing information, make reasonable assumptions. (List the names of the taxpayers and any income they receive in the order in which they appear in the problem. Input all the values as positive numbers unless otherwise stated in the forms. Instructions can be found on certain cellswithin the SCHEDULE 1 OMBNO. 1545-0074 (Form 10s0) Additional Income and Adjustments to Income 2020 Departine od the Irasury Attach to Fom 1010, 1040-5r, or 1040-NR. inerial Revenue Serve Go to mww.ins.govforma0es for instructians and the lutest intormation. Aeschenet Sequence No 01 Nanesi) showe on firm 1060 or 106089 16 Tax (see notructons) Check E any from Fam(s) (1) 8814(2)4972 (3) 17 Aviour from Schod be 2, tre 3 28 Add lines 19 and 17 19 Chid tax credt or crede tor other dependent 20 Avourt trom Sched be 3 , he? ? 21 Asd lies 19 and 20 22 Sibtract ine 21 from ine 18 if 2 ero or kess, ener -0 23 Other waxes, nchiding sel-enploytsont tax, from Schodile 2 the 10 24 Add lnes 22 and 23 . This is your total tax 25 Fedcral incone war withied from \begin{tabular}{|l|r|} \hline 15 & 483 \\ \hline 17 & \\ \hline 18 & 483 \\ \hline 19 & \\ \hline 20 & \\ \hline 21 & 0 \\ \hline 22 & 483 \\ \hline 23 & \\ \hline 24 & 483 \\ \hline \end{tabular} a Formis) W-2 b Farndi) 109 cother forma (see nstructorn) d Add bnes 25 throwh 25co 262020 estinated lax paymeres and anours appled trom 2019 retum 27 Camed ncone credt (EIC) 28 Addoond chld ux creal. Awach Schedde Ba12 29 Anercan opportunity credk from Form bowa, ine 6 30 Aecovery rebote ciede See intruction 31 Amount tion Scheode 3, the 13 22. Adi anes 27 trough 31. These are your total other payments and refundable credits 32 Aod mes 21 sroung 31 these are your totad other paymenta and refundable credits 33 Add lnes 25d,26, and 32 . These are your total paymients 34 it the 33 is more than line 24, suboract ine 24 from lne 33 . This is the amount you overpaid 35 A Anoum of ine 34 you want refunded to you. If Form 3806 is attached, check here b Pourng mather d Acceunt matber Checking sovros 36 Anount of line 34 you want applied to your 2021 eatimated tax 37 Sute act line 33 trom ine 24 The is the amount you owe now Note: Sched ie H and Schicdulo SE Ilens, Ine 37 may not represert all of the taxes you owe for 2020 see Schedile 3, ine 12e, and iss instructions for detalts 36 Eatrated tax penaly (see nstructions) Do you wark to alow anoher person to dscuss the return wath the IRS? 5 see intructions Ves, Corridete below No Designee's Phome Personal derericaion nwate number (PIN) they are true correct, and complele Dectrabion of preporer (other than laxpayer) is based on al inforthaton of which preparer has any knowhesge Your signatire