Question

James and Esther Johnson are husband and wife and file a joint return. They live at 45678 S.W. 112th Street, Homestead, FL 33033. James, who

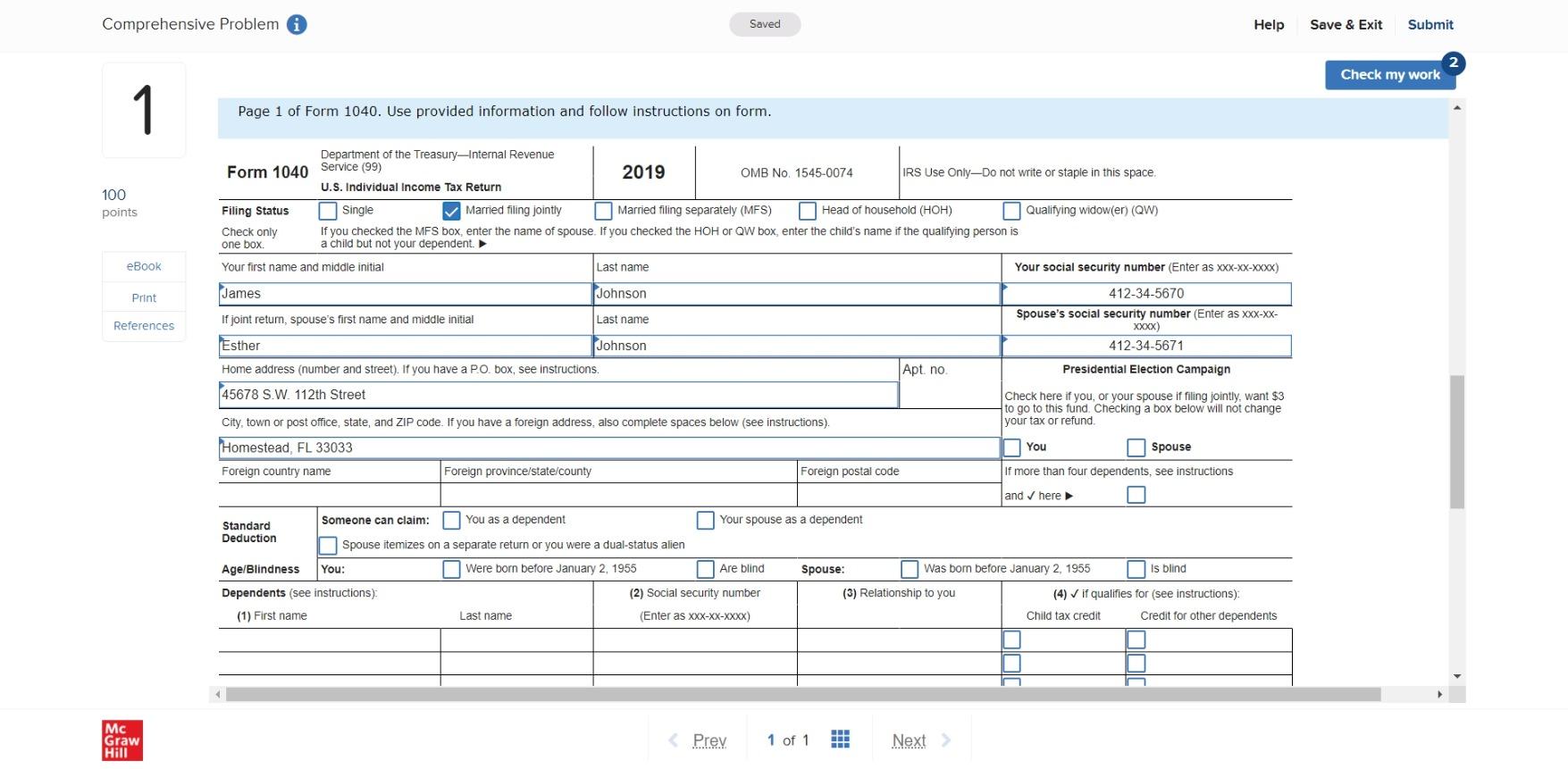

James and Esther Johnson are husband and wife and file a joint return. They live at 45678 S.W. 112th Street, Homestead, FL 33033. James, who is 67 years old (date of birth 12/14/1952), is retired and receiving social security benefits, and Esther, who is 66 years old (date of birth 6/11/1953), is also retired but working on a part-time basis. Their social security numbers are 412-34-5670 and 412-34-5671, respectively.

Annual social security income for James is $22,000 (SSA-1099, box 5) and for Esther is $13,800 (SSA-1099, box 5).

Interest received by them from Central Bank is $2,545 (1099-INT, box 1). No income tax withholding was made.

Esther is working part-time as an interior decorator as an employee of Decorating House, a corporation. Her form W-2 shows the following information:

| Wages | = | $ | 25,000.00 | |

| Federal W/H | = | $ | 2,500.00 | |

| Social security wages | = | $ | 25,000.00 | |

| Social security W/H | = | $ | 1,550.00 | |

| Medicare wages | = | $ | 25,000.00 | |

| Medicare W/H | = | $ | 362.50 | |

Their itemized deductions are as follows:

- Mortgage interest on their main home, $12,500.

- Real estate taxes, $7,600.

- Personal property taxes, $185.

- Doctors' expenses unreimbursed by insurance, $7,400.

- Medical insurance premiums for the year, $2,400.

- Prescribed medicine, $1,995.

- Vitamins, $300.

- Total cash contributions to their church, $675. The contributions were made over the course of the year and no individual contribution was greater than $250.

- Tax preparation fees for their 2018 return, $325, paid in 2019.

- Lottery tickets bought by Esther during the year, $750. Winnings received, $940 (W-2G, box 1). Income tax withholding on winnings, $35 (W-2G, box 4).

Because the Johnsons live in Florida, where there is no state income tax, they will deduct the estimation of the general sales tax related to the area in which they live. The most efficient way to do this is by using the Sales Tax Calculator on the IRS website at https://www.irs.gov/Individuals/Sales-Tax-Deduction-Calculator. A key point to remember in using the calculator is that income for this calculation also includes the nontaxable portion of social security benefits.

Required:

Prepare their individual income tax return using the appropriate forms. They do not want to contribute to the presidential election campaign and do not want anyone to be a third-party designee. For any missing information, make reasonable assumptions. (List the names of the taxpayers and any income they receive in the order in which they appear in the problem. Input all the values as positive numbers unless otherwise stated in the forms. Instructions can be found on certain cells within the forms. Round your final answers to the nearest whole dollar amount.)

Use the appropriate Tax Tables or Tax Rate Schedules.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started