Answered step by step

Verified Expert Solution

Question

1 Approved Answer

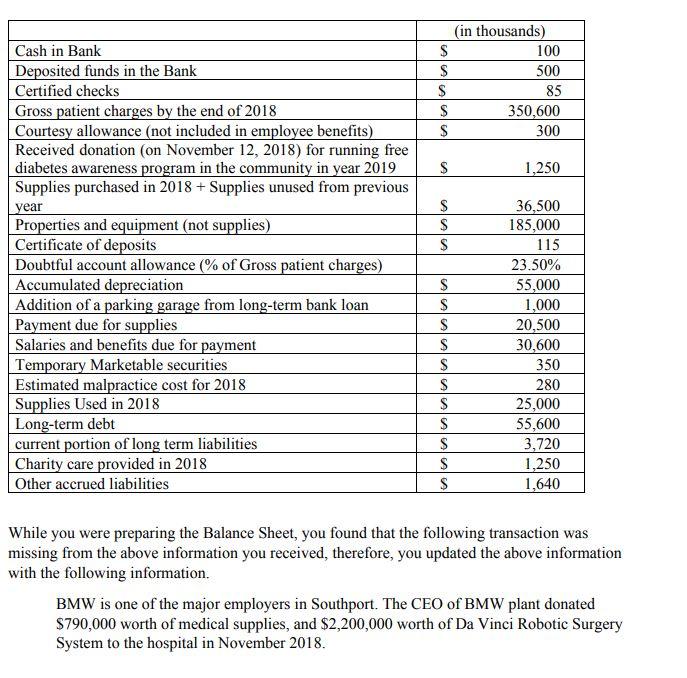

prepare Balance Sheet for December 31, 2018 for Miller hospital on an Excel spreadsheet. Following are the transaction recorded. Cash in Bank Deposited funds in

prepare Balance Sheet for December 31, 2018 for Miller hospital on an Excel spreadsheet. Following are the transaction recorded.

Cash in Bank Deposited funds in the Bank Certified checks Gross patient charges by the end of 2018 Courtesy allowance (not included in employee benefits) Received donation (on November 12, 2018) for running free diabetes awareness program in the community in year 2019 Supplies purchased in 2018 + Supplies unused from previous year Properties and equipment (not supplies) Certificate of deposits Doubtful account allowance (% of Gross patient charges) Accumulated depreciation Addition of a parking garage from long-term bank loan Payment due for supplies Salaries and benefits due for payment Temporary Marketable securities Estimated malpractice cost for 2018 Supplies Used in 2018 Long-term debt current portion of long term liabilities Charity care provided in 2018 Other accrued liabilities S $ S S $ S $ $ S S S S S S $ $ S S $ $ (in thousands) 100 500 85 350,600 300 1,250 36,500 185,000 115 23.50% 55,000 1,000 20,500 30,600 350 280 25,000 55,600 3,720 1,250 1,640 While you were preparing the Balance Sheet, you found that the following transaction was missing from the above information you received, therefore, you updated the above information with the following information. BMW is one of the major employers in Southport. The CEO of BMW plant donated $790,000 worth of medical supplies, and $2,200,000 worth of Da Vinci Robotic Surgery System to the hospital in November 2018.

Step by Step Solution

★★★★★

3.41 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

17 Federal Income Tax withheld from Forms W2 and 1099 When you prepare your federal return and calcu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started