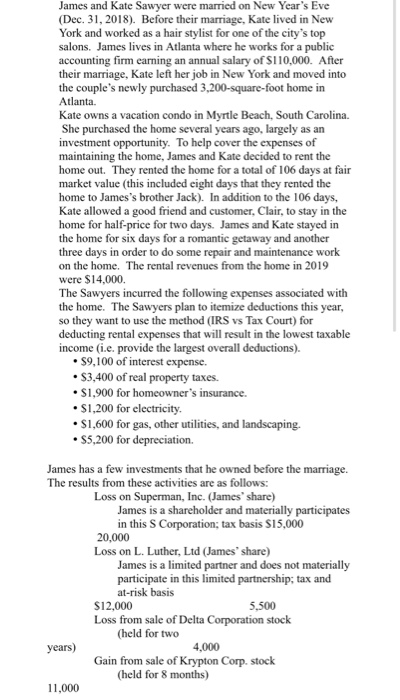

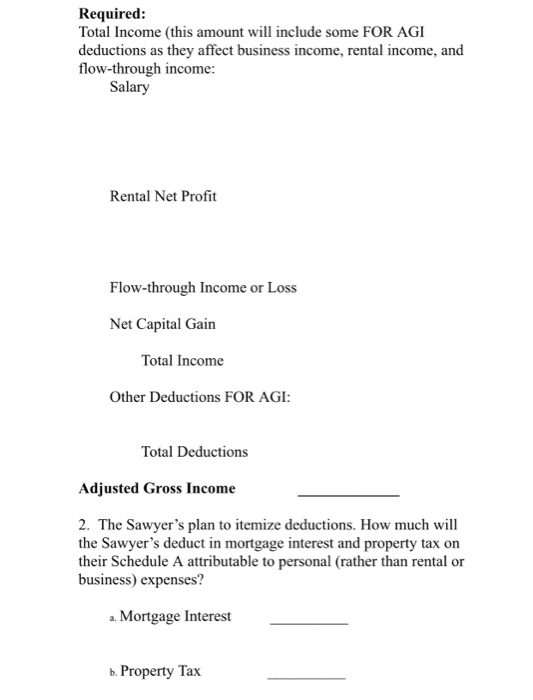

James and Kate Sawyer were married on New Year's Eve (Dec. 31, 2018). Before their marriage, Kate lived in New York and worked as a hair stylist for one of the city's top salons. James lives in Atlanta where he works for a public accounting firm earning an annual salary of $110,000. After their marriage, Kate left her job in New York and moved into the couple's newly purchased 3,200-square-foot home in Atlanta Kate owns a vacation condo in Myrtle Beach, South Carolina. She purchased the home several years ago, largely as an investment opportunity. To help cover the expenses of maintaining the home, James and Kate decided to rent the home out. They rented the home for a total of 106 days at fair market value (this included eight days that they rented the home to James's brother Jack). In addition to the 106 days, Kate allowed a good friend and customer, Clair, to stay in the home for half-price for two days. James and Kate stayed in the home for six days for a romantic getaway and another three days in order to do some repair and maintenance work on the home. The rental revenues from the home in 2019 were $14,000. The Sawyers incurred the following expenses associated with the home. The Sawyers plan to itemize deductions this year, so they want to use the method (IRS vs Tax Court) for deducting rental expenses that will result in the lowest taxable income (i.e. provide the largest overall deductions). $9,100 of interest expense. $3,400 of real property taxes. $1,900 for homeowner's insurance. $1,200 for electricity $1,600 for gas, other utilities, and landscaping. S5,200 for depreciation. James has a few investments that he owned before the marriage. The results from these activities are as follows: Loss on Superman, Inc. (James' share) James is a shareholder and materially participates in this S Corporation, tax basis S15,000 20,000 Loss on L. Luther, Ltd (James' share) James is a limited partner and does not materially participate in this limited partnership: tax and at-risk basis $12,000 5,500 Loss from sale of Delta Corporation stock (held for two years) 4,000 Gain from sale of Krypton Corp. stock (held for 8 months) 11,000 Required: Total Income (this amount will include some FOR AGI deductions as they affect business income, rental income, and flow-through income: Salary Rental Net Profit Flow-through Income or Loss Net Capital Gain Total Income Other Deductions FOR AGI: Total Deductions Adjusted Gross Income 2. The Sawyer's plan to itemize deductions. How much will the Sawyer's deduct in mortgage interest and property tax on their Schedule A attributable to personal (rather than rental or business) expenses? a. Mortgage Interest b. Property Tax James and Kate Sawyer were married on New Year's Eve (Dec. 31, 2018). Before their marriage, Kate lived in New York and worked as a hair stylist for one of the city's top salons. James lives in Atlanta where he works for a public accounting firm earning an annual salary of $110,000. After their marriage, Kate left her job in New York and moved into the couple's newly purchased 3,200-square-foot home in Atlanta Kate owns a vacation condo in Myrtle Beach, South Carolina. She purchased the home several years ago, largely as an investment opportunity. To help cover the expenses of maintaining the home, James and Kate decided to rent the home out. They rented the home for a total of 106 days at fair market value (this included eight days that they rented the home to James's brother Jack). In addition to the 106 days, Kate allowed a good friend and customer, Clair, to stay in the home for half-price for two days. James and Kate stayed in the home for six days for a romantic getaway and another three days in order to do some repair and maintenance work on the home. The rental revenues from the home in 2019 were $14,000. The Sawyers incurred the following expenses associated with the home. The Sawyers plan to itemize deductions this year, so they want to use the method (IRS vs Tax Court) for deducting rental expenses that will result in the lowest taxable income (i.e. provide the largest overall deductions). $9,100 of interest expense. $3,400 of real property taxes. $1,900 for homeowner's insurance. $1,200 for electricity $1,600 for gas, other utilities, and landscaping. S5,200 for depreciation. James has a few investments that he owned before the marriage. The results from these activities are as follows: Loss on Superman, Inc. (James' share) James is a shareholder and materially participates in this S Corporation, tax basis S15,000 20,000 Loss on L. Luther, Ltd (James' share) James is a limited partner and does not materially participate in this limited partnership: tax and at-risk basis $12,000 5,500 Loss from sale of Delta Corporation stock (held for two years) 4,000 Gain from sale of Krypton Corp. stock (held for 8 months) 11,000 Required: Total Income (this amount will include some FOR AGI deductions as they affect business income, rental income, and flow-through income: Salary Rental Net Profit Flow-through Income or Loss Net Capital Gain Total Income Other Deductions FOR AGI: Total Deductions Adjusted Gross Income 2. The Sawyer's plan to itemize deductions. How much will the Sawyer's deduct in mortgage interest and property tax on their Schedule A attributable to personal (rather than rental or business) expenses? a. Mortgage Interest b. Property Tax