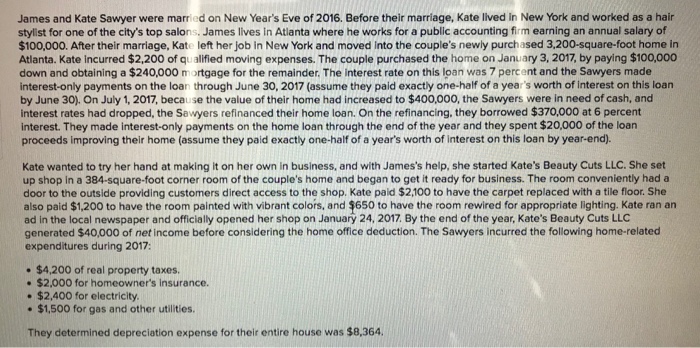

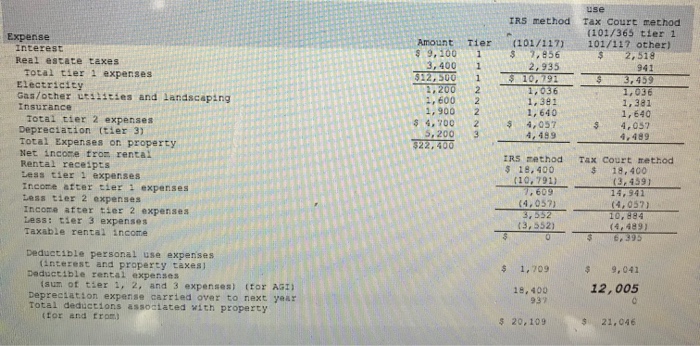

James and Kate Sawyer were married on New Year's Eve of 2016. Before their marriage, Kate lived in New York and worked as a hair stylist for one of the city's top salons, James lives in Atlanta where he works for a public accounting firm earning an annual salary of $100,000. After their marriage, Kate left her job in New York and moved into the couple's newly purchased 3,200-square-foot home in Atlanta. Kate Incurred $2,200 of qualfied moving expenses. The couple purchased the home on January 3, 2017, by paying $100,000 down and obtaining a $240,000 mortgage for the remainder. The interest rate on this loan was 7 percent and the Sawyers made interest-only payments on the loan through June 30, 2017 (assume they paid exactly one-half of a year's worth of interest on this loan by June 30). On July 1, 2017, because the value of their home had increased to $400,000, the Sawyers were in need of cash, and interest rates had dropped, the Sawyers refinanced their home loan. On the refinancing, they borrowed $370,000 at 6 percent interest. They made interest-only payments on the home loan through the end of the year and they spent $20,000 of the loan proceeds improving their home (assume they paid exactly one-half of a years worth of interest on this loan by year-end). Kate wanted to try her hand at making it on her own in business, and with James's help, she started Kate's Beauty Cuts LLC. She set up shop in a 384-square-foot corner room of the couple's home and began to get it ready for business. The room conveniently had a door to the outside providing customers direct access to the shop. Kate paid $2,100 to have the carpet replaced with a tile floor. She also paid $1,200 to have the room painted with vibrant colors, and $650 to have the room rewired for appropriate lighting. Kate ran an ad in the local newspaper and officially opened her shop on Januar 24, 2017. By the end of the year, Kate's Beauty Cuts LLC generated $40,000 of net income before considering the home office deduction. The Sawyers incurred the following home-related expenditures during 2017 $4,200 of real property taxes. $2,000 for homeowner's Insurance. $2,400 for electricity . $1,500 for gas and other utilities. They determined depreciation expense for their entire house was $8,364