Answered step by step

Verified Expert Solution

Question

1 Approved Answer

James and Lily did some estate planning a few years ago. James had substantial wealth from a non-RRSP investment he made before they were married.

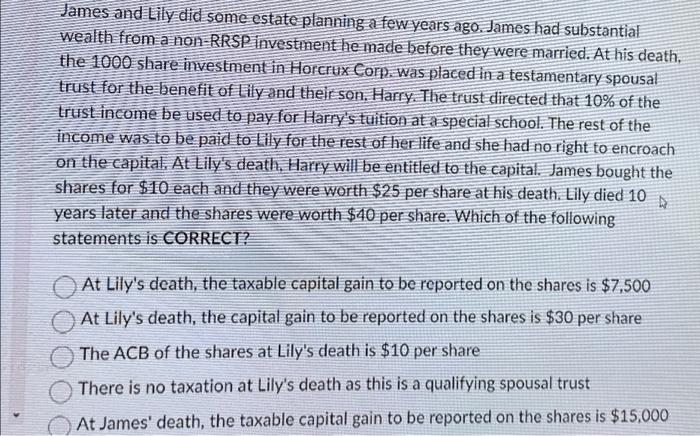

James and Lily did some estate planning a few years ago. James had substantial wealth from a non-RRSP investment he made before they were married. At his death, the 1000 share investment in Horcrux Corp. was placed in a testamentary spousal trust for the benefit of Lily and their son, Harry. The trust directed that 10% of the trust income be used to pay for Harry's tuition at a special school. The rest of the income was to be paid to Lily for the rest of her life and she had no right to encroach on the capital. At Lily's death, Harry will be entitled to the capital. James bought the shares for $10 each and they were worth $25 per share at his death. Lily died 10 4 years later and the shares were worth $40 per share. Which of the following statements is CORRECT? At Lily's death, the taxable capital gain to be reported on the shares is $7,500 At Lily's death, the capital gain to be reported on the shares is $30 per share The ACB of the shares at Lily's death is $10 per share There is no taxation at Lily's death as this is a qualifying spousal trust At James' death, the taxable capital gain to be reported on the shares is $15,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started