Answered step by step

Verified Expert Solution

Question

1 Approved Answer

James and Tom Johnson are 60% and 40% partners, respectively, in JT Partnership. Their beginning basis is $50,000 for James and $51,000 for Tom. The

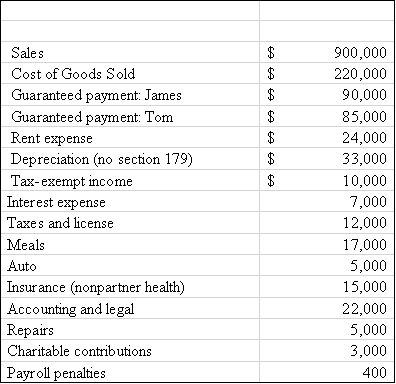

James and Tom Johnson are 60% and 40% partners, respectively, in JT Partnership. Their beginning basis is $50,000 for James and $51,000 for Tom. The partnership had the following activity during the year 2:

Compute:

- Self-employment income for James

- Self-employment income for Tom

- Ending basis for James

- Ending basis for Tom

- Ordinary income of partnership

A A A A A A A Sales Cost of Goods Sold Guaranteed payment: James Guaranteed payment: Tom Rent expense Depreciation (no section 179) Tax-exempt income Interest expense Taxes and license Meals Auto Insurance (nonpartner health) Accounting and legal Repairs Charitable contributions Payroll penalties 900,000 220,000 90,000 85,000 24,000 33,000 10,000 7,000 12,000 17,000 5,000 15,000 22,000 5,000 3,000 400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started