Answered step by step

Verified Expert Solution

Question

1 Approved Answer

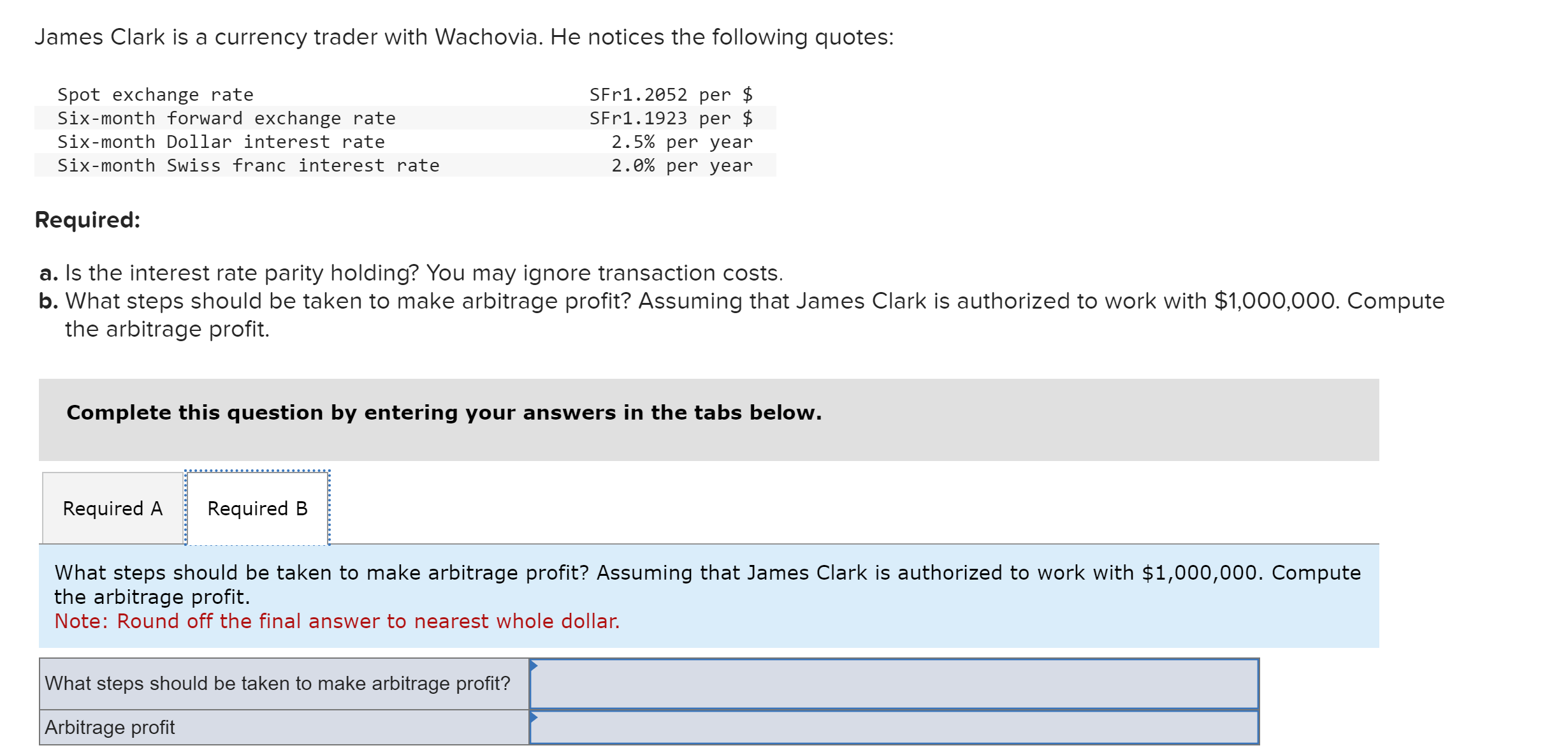

James Clark is a currency trader with Wachovia. He notices the following quotes: Spot exchange rate Six - month forward exchange rate Six - month

James Clark is a currency trader with Wachovia. He notices the following quotes:

Spot exchange rate

Sixmonth forward exchange rate

Sixmonth Dollar interest rate

Sixmonth Swiss franc interest rate

SFr per $

SFr per $

per year

per year

Required:

a Is the interest rate parity holding? You may ignore transaction costs.

b What steps should be taken to make arbitrage profit? Assuming that James Clark is authorized to work with $ Compute

the arbitrage profit.

Complete this question by entering your answers in the tabs below.

What steps should be taken to make arbitrage profit? Assuming that James Clark is authorized to work with $ Compute

the arbitrage profit.

Note: Round off the final answer to nearest whole dollar.

What steps should be taken to make arbitrage profit?

Arbitrage profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started