Question

James & Co., which has excess capacity, received a special order for 4,000 units at a price of $18 per unit. Currently, production and sales

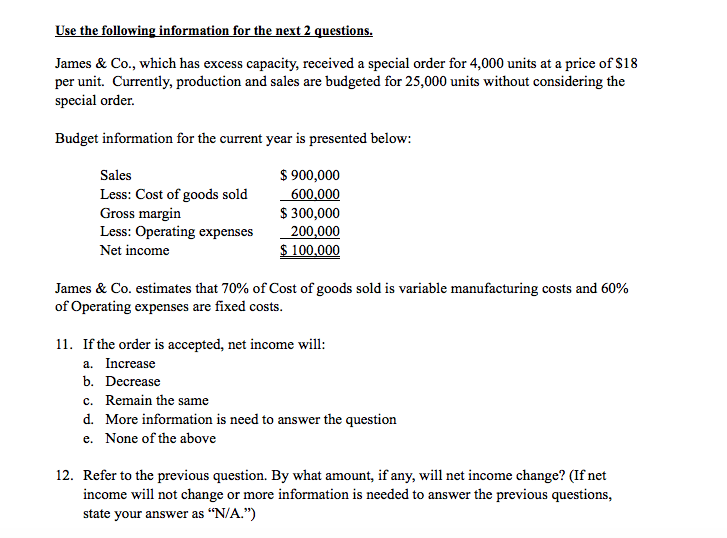

James & Co., which has excess capacity, received a special order for 4,000 units at a price of $18 per unit. Currently, production and sales are budgeted for 25,000 units without considering the special order.

Budget information for the current year is presented below:

Sales $ 900,000 Less: Cost of goods sold 600,000 Gross margin $ 300,000 Less: Operating expenses 200,000 Net income $ 100,000

James & Co. estimates that 70% of Cost of goods sold is variable manufacturing costs and 60% of Operating expenses are fixed costs.

11.If the order is accepted, net income will: a.Increase b.Decrease c.Remain the same d.More information is need to answer the question e.None of the above

12.Refer to the previous question. By what amount, if any, will net income change? (If net income will not change or more information is needed to answer the previous questions, state your answer as N/A.)

Use the following information for the next 2 questions. James & Co., which has excess capacity, received a special order for 4,000 units at a price of $18 per unit. Currently, production and sales are budgeted for 25,000 units without considering the special order. Budget information for the current year is presented below: Sales Less: Cost of goods sold Gross margin Less: Operating expenses Net income $ 900,000 600,000 $ 300,000 200,000 $ 100,000 James & Co. estimates that 70% of Cost of goods sold is variable manufacturing costs and 60% of Operating expenses are fixed costs. 11. If the order is accepted, net income will: a. Increase b. Decrease c. Remain the same d. More information is need to answer the question e. None of the above 12. Refer to the previous question. By what amount, if any, will net income change? (If net income will not change or more information is needed to answer the previous questions, state your answer as "N/A.")

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started