Question

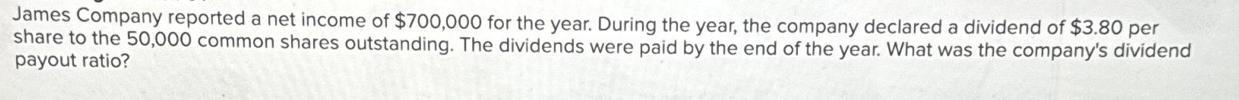

James Company reported a net income of $700,000 for the year. During the year, the company declared a dividend of $3.80 per share to

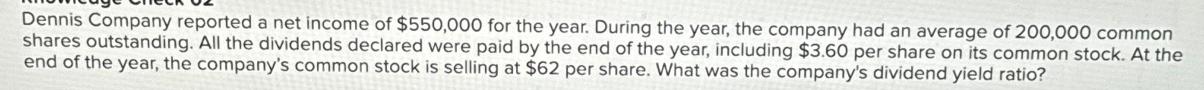

James Company reported a net income of $700,000 for the year. During the year, the company declared a dividend of $3.80 per share to the 50,000 common shares outstanding. The dividends were paid by the end of the year. What was the company's dividend payout ratio? Dennis Company reported a net income of $550,000 for the year. During the year, the company had an average of 200,000 common shares outstanding. All the dividends declared were paid by the end of the year, including $3.60 per share on its common stock. At the end of the year, the company's common stock is selling at $62 per share. What was the company's dividend yield ratio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The dividend payout ratio is a financial ratio that indicates the proportion of a companys earnings ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Belverd E. Needles, Marian Powers

11th edition

1133769314, 053847601X, 9781133715023, 978-1133769316, 1133715028, 978-0538476010

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App