Answered step by step

Verified Expert Solution

Question

1 Approved Answer

James Corporation acquired 85% of Justice Corporation's common stock on January 1, 2021, for $1,269,900. At that date, Justice reported common stock outstanding of

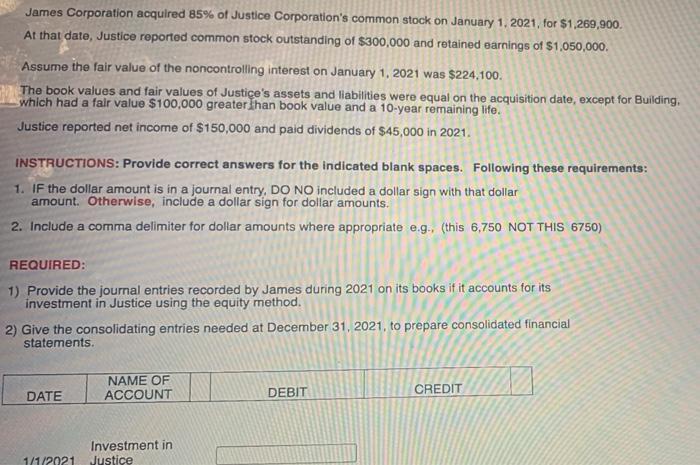

James Corporation acquired 85% of Justice Corporation's common stock on January 1, 2021, for $1,269,900. At that date, Justice reported common stock outstanding of $300,000 and retained earnings of $1,050,000. Assume the fair value of the noncontrolling interest on January 1, 2021 was $224,100. The book values and fair values of Justice's assets and liabilities were equal on the acquisition date, except for Building. which had a fair value $100,000 greater than book value and a 10-year remaining life. Justice reported net income of $150,000 and paid dividends of $45,000 in 2021. INSTRUCTIONS: Provide correct answers for the indicated blank spaces. Following these requirements: 1. IF the dollar amount is in a journal entry, DO NO included a dollar sign with that dollar amount. Otherwise, include a dollar sign for dollar amounts. 2. Include a comma delimiter for dollar amounts where appropriate e.g., (this 6,750 NOT THIS 6750) REQUIRED: 1) Provide the journal entries recorded by James during 2021 on its books if it accounts for its investment in Justice using the equity method. 2) Give the consolidating entries needed at December 31, 2021, to prepare consolidated financial statements. DATE NAME OF ACCOUNT Investment in 1/1/2021 Justice DEBIT CREDIT

Step by Step Solution

★★★★★

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 a a Prepare journal entries to record James duny 2021 Jurnal account Investment i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started