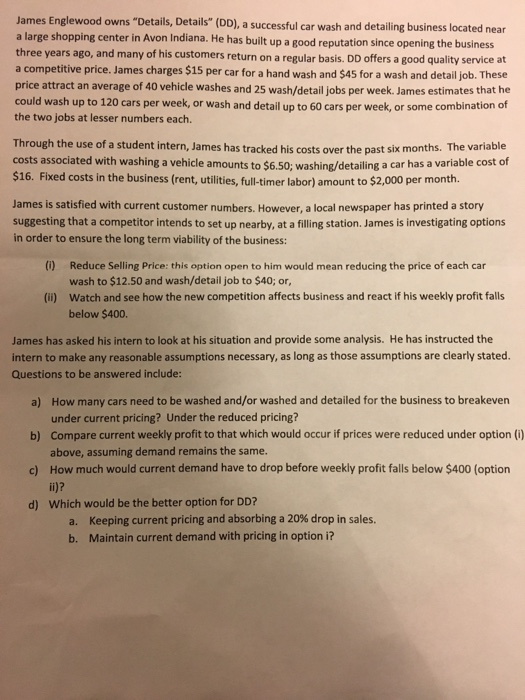

James Englewood owns "Details, Details" (DD), a successful car wash and detailing business located near a large shopping center in Avon Indiana. He has built up a good reputation since opening the business three years ago, and many of his customers return on a rerular basis. DD offers a good quality service at a competitive price. James charges $15 per car for a hand wash and $45 for a wash and detail job. These price attract an average of 40 vehicle washes and 25 wash/detail jobs per week. James estimates that he could wash up to 120 cars per week, or wash and detail up to 60 cars per week, or some combination of the two jobs at lesser numbers each. Through the use of a student intern, James has tracked his costs over the past six months. The variable costs associated with washing a vehicle amounts to $650: washing detailing a car has a variable cost of $16. Fixed costs in the business (rent, utilities, full-timer labor) amount to $2,000 per mon James is satisfied with current customer numbers. However, a local newspaper has printed a story suggesting that a competitor intends to set up nearby. at a filling station. James is investigating options in order to ensure the long term viability of the business: (0) Reduce Selling Price: this option open to him would mean reducing the price of each car wash to $12.50 and wash/detail job to $40; or, (II) Watch and see how the new competition affects business and react if his weekly profit falls below $400. James has asked his intern to look at his situation and provide some analysis. He has instructed the intern to make any reasonable assumptions necessary, as long as those assumptions are clearly stated. Questions to be answered include: a) How many cars need to be washed and/or washed and detailed for the business to breakeven under current pricing? Under the reduced pricing? b) Compare current weekly profit to that which would occur if prices were reduced under option (0) above, assuming demand remains the same. c) How much would current demand have to drop before weekly profit falls below $400 (option ii)? d) Which would be the better option for DD? a. Keeping current pricing and absorbing a 20% drop in sales. b. Maintain current demand with pricing in option