Question

James Felon is a self-employed surfboard maker in 2020. His Schedule C net income is $126,503 for the year. He also has a part-

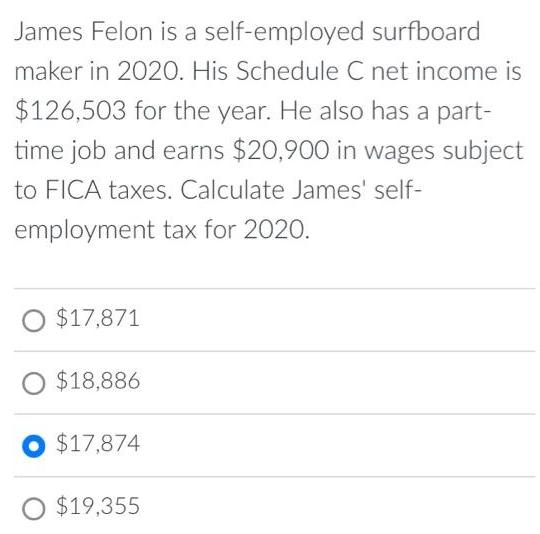

James Felon is a self-employed surfboard maker in 2020. His Schedule C net income is $126,503 for the year. He also has a part- time job and earns $20,900 in wages subject to FICA taxes. Calculate James' self- employment tax for 2020. O $17,871 O $18,886 $17,874 O $19,355

Step by Step Solution

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Answer is highlightied in yellow Wage limit for year 202...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Federal Taxation 2014 Comprehensive

Authors: Timothy J. Rupert, Thomas R. Pope, Kenneth E. Anderson

27th Edition

978-0133452006, 013345200X, 978-0133450118, 133450112, 978-0133438598

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App