Question

James has recently inherited $2,000,000 and has been investigating the possibility of buying shares as an investment. Initially, he is looking to maximise his income.

James has recently inherited $2,000,000 and has been investigating the possibility of buying shares as an investment. Initially, he is looking to maximise his income. He is also desirous of ensuring that the company has sufficient liquidity to make dividend payments.

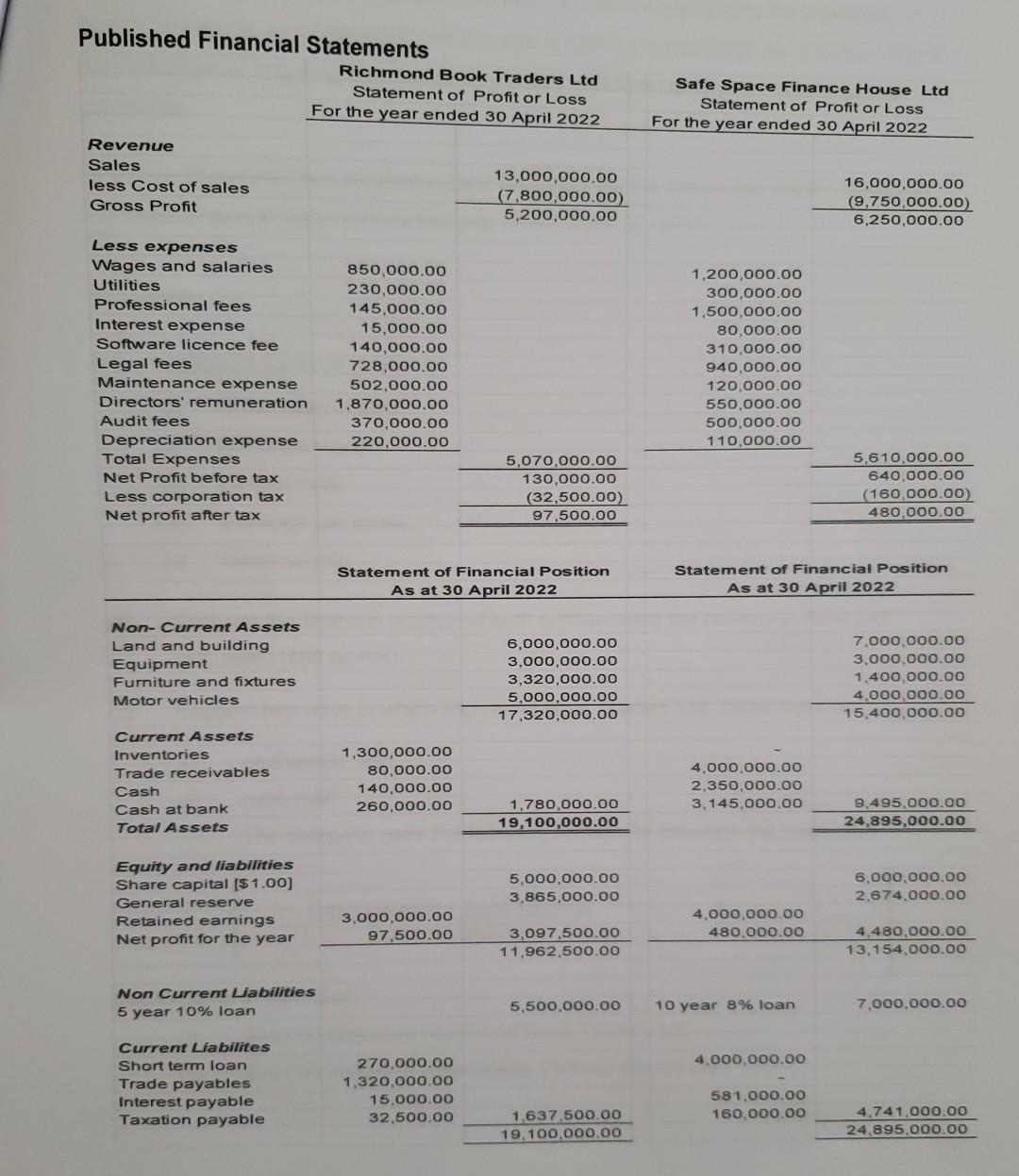

He has researched two companies and has provided the above information bases on the latest financial statement for the year ended April 30,2022.

Required:

(a) Calculate for each entity:

(i) Gross profit margin (ii) Net profit margin (ii) Current ratio (iv) Earnings per share (v) Gearing ratio

(b) Evaluate the financial position of both entities usinf the ratios you have just calculated. [500 words]

(c) Suggest two ways in which Richmond Book Traders Ltd. could improve:

(i) profitability; and (ii) cash ratio

The company uses the following formula to calculate the cash ratio :

Cash balance + Bank Balance Current liabilities

James plans to purchase: (i) 500,000 shares in Richmond Book Traders Ltd

(i) 200,000 shares in Safe Space Finance House Ltd

d) Calculate the dividend James would expect to receive should each entity decide yo declare a dividend of 6 cents per share and 20 cents per share respectively.

Published Financial Statements Revenue Sales less Cost of sales Gross Profit Less expenses Wages and salaries Utilities Professional fees Interest expense Software licence fee Legal fees Maintenance expense Directors' remuneration Audit fees Depreciation expense Total Expenses Net Profit before tax Less corporation tax Net profit after tax Non- Current Assets Land and building Equipment Furniture and fixtures Motor vehicles Current Assets Inventories Trade receivables Cash Cash at bank Total Assets Equity and liabilities Share capital [$1.00] General reserve Retained earnings Net profit for the year Non Current Liabilities 5 year 10% loan Current Liabilites Short term loan Trade payables Interest payable Taxation payable Richmond Book Traders Ltd Statement of Profit or Loss For the year ended 30 April 2022 13,000,000.00 (7,800,000.00) 5,200,000.00 850,000.00 230,000.00 145,000.00 15,000.00 140,000.00 728,000.00 502,000.00 1,870,000.00 370,000.00 220,000.00 5,070,000.00 130,000.00 (32,500.00) 97,500.00 Statement of Financial Position As at 30 April 2022 6,000,000.00 3,000,000.00 3,320,000.00 5,000,000.00 17,320,000.00 1,300,000.00 80,000.00 140,000.00 260,000.00 1,780,000.00 19,100,000.00 5,000,000.00 3,865,000.00 3,000,000.00 97,500.00 3,097,500.00 11,962,500.00 5,500,000.00 270,000.00 1,320,000.00 15,000.00 32,500.00 1,637,500.00 19,100,000.00 Safe Space Finance House Ltd Statement of Profit or Loss For the year ended 30 April 2022 16,000,000.00 (9,750,000.00) 6,250,000.00 1,200,000.00 300,000.00 1,500,000.00 80,000.00 310,000.00 940,000.00 120,000.00 550,000.00 500,000.00 110,000.00 5,610,000.00 640,000.00 (160,000.00) 480,000.00 Statement of Financial Position As at 30 April 2022 7,000,000.00 3,000,000.00 1,400,000.00 4,000,000.00 15,400,000.00 4,000,000.00 2,350,000.00 3,145,000.00 9,495,000.00 24,895,000.00 6,000,000.00 2,674,000.00 4,000,000.00 480,000.00 4,480,000.00 13,154,000.00 10 year 8% loan 7,000,000.00 4,000,000.00 581,000.00 160,000.00 4,741,000.00 24,895,000.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started