Question

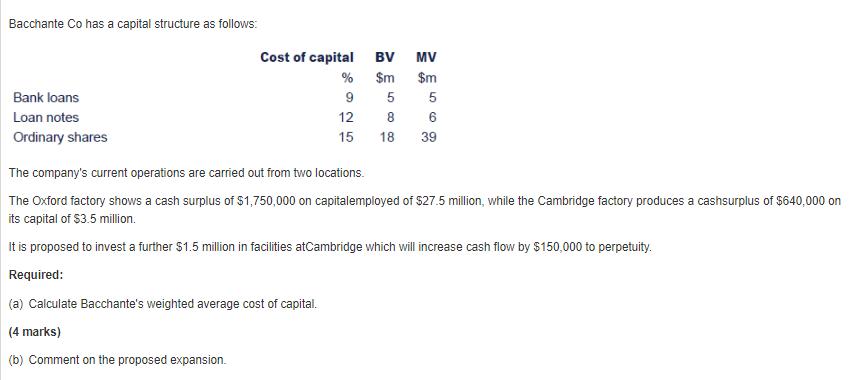

Bacchante Co has a capital structure as follows: Bank loans Loan notes Ordinary shares Cost of capital BV MV $m $m 5 5 6

Bacchante Co has a capital structure as follows: Bank loans Loan notes Ordinary shares Cost of capital BV MV $m $m 5 5 6 8 18 39 % 9 12 15 The company's current operations are carried out from two locations. The Oxford factory shows a cash surplus of $1,750,000 on capitalemployed of $27.5 million, while the Cambridge factory produces a cashsurplus of $640,000 on its capital of $3.5 million. It is proposed to invest a further $1.5 million in facilities atCambridge which will increase cash flow by $150,000 to perpetuity. Required: (a) Calculate Bacchante's weighted average cost of capital. (4 marks) (b) Comment on the proposed expansion.

Step by Step Solution

3.56 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Bacchantes weighted average cost of capital is 69 WACC 5 x 005 9 x 008 12 x 006 5 9 12 006...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Survey of Accounting

Authors: Carl S. Warren

7th edition

1285974360, 1285183487, 9781285974361, 978-1285183480

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App