Question

A, B, C were partners sharing profits in the proportion of 1/2, 1/3 and 1/6 respectively. On 31st March 1997 their capital stood as

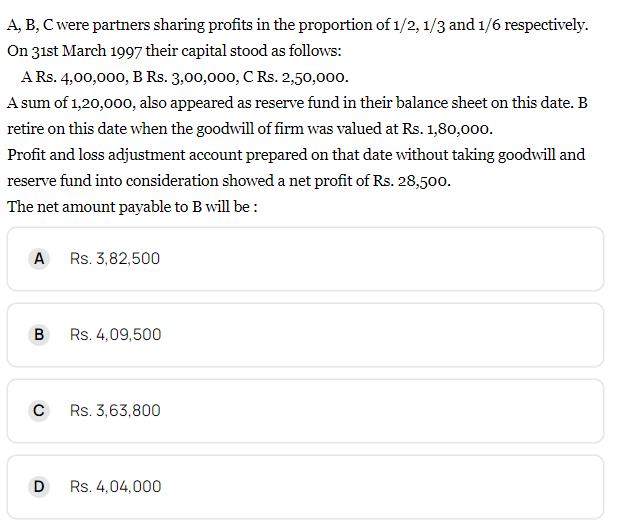

A, B, C were partners sharing profits in the proportion of 1/2, 1/3 and 1/6 respectively. On 31st March 1997 their capital stood as follows: A Rs. 4,00,000, B Rs. 3,00,000, C Rs. 2,50,000. A sum of 1,20,000, also appeared as reserve fund in their balance sheet on this date. B retire on this date when the goodwill of firm was valued at Rs. 1,80,000. Profit and loss adjustment account prepared on that date without taking goodwill and reserve fund into consideration showed a net profit of Rs. 28,500. The net amount payable to B will be: A B C D Rs. 3,82,500 Rs. 4,09,500 Rs. 3,63,800 Rs. 4,04,000

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Particulars To Bs Loom Afc Therefore B is the Bs Cap...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Using Financial Accounting Information The Alternative to Debits and Credits

Authors: Gary A. Porter, Curtis L. Norton

8th edition

1111534918, 978-1111534912

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App