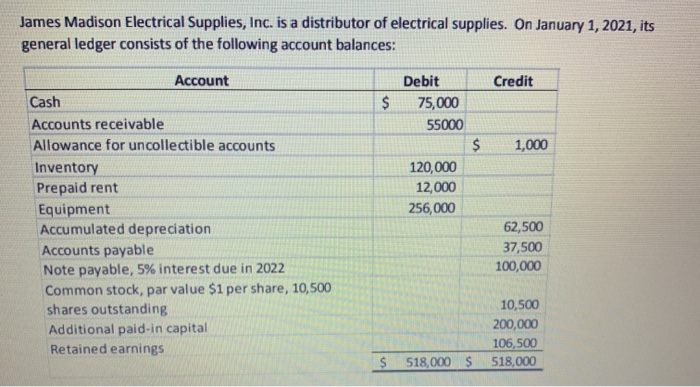

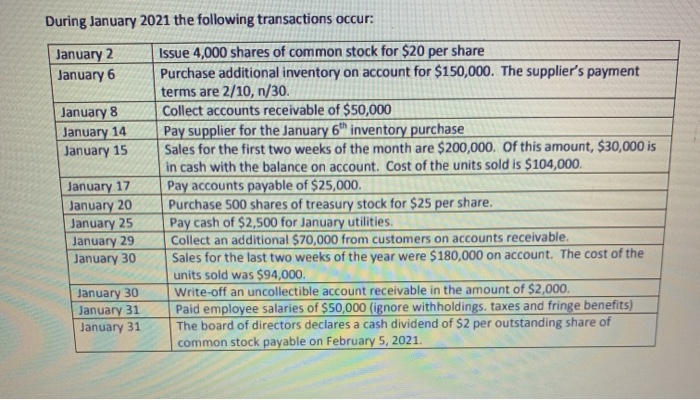

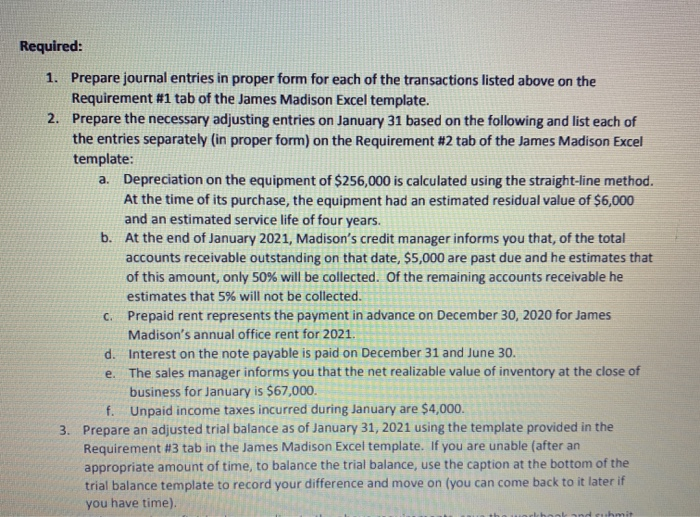

James Madison Electrical Supplies, Inc. is a distributor of electrical supplies. On January 1, 2021, its general ledger consists of the following account balances: Credit $ Debit 75,000 55000 $ 1,000 120,000 12,000 256,000 Account Cash Accounts receivable Allowance for uncollectible accounts Inventory Prepaid rent Equipment Accumulated depreciation Accounts payable Note payable, 5% interest due in 2022 Common stock, par value $1 per share, 10,500 shares outstanding Additional paid-in capital Retained earnings 62,500 37,500 100,000 10,500 200,000 106,500 518,000 10 518,000 $ During January 2021 the following transactions occur January 2 January 6 January 8 January 14 January 15 January 17 January 20 January 25 January 29 January 30 Issue 4,000 shares of common stock for $20 per share Purchase additional inventory on account for $150,000. The supplier's payment terms are 2/10, n/30. Collect accounts receivable of $50,000 Pay supplier for the January 6th inventory purchase Sales for the first two weeks of the month are $200,000. Of this amount, $30,000 is in cash with the balance on account. Cost of the units sold is $104,000. Pay accounts payable of $25,000. Purchase 500 shares of treasury stock for $25 per share. Pay cash of $2,500 for January utilities Collect an additional $70,000 from customers on accounts receivable. Sales for the last two weeks of the year were $180,000 on account. The cost of the Sales for the last units sold was $94,000. Write-off an uncollectible account receivable in the amount of $2,000 Paid employee salaries of $50,000 (ignore withholdings, taxes and fringe benefits) The board of directors declares a cash dividend of $2 per outstanding share of common stock payable on February 5, 2021. January 31 January 31 Required: 1. Prepare journal entries in proper form for each of the transactions listed above on the Requirement #1 tab of the James Madison Excel template. 2. Prepare the necessary adjusting entries on January 31 based on the following and list each of the entries separately (in proper form) on the Requirement #2 tab of the James Madison Excel template: a. Depreciation on the equipment of $256,000 is calculated using the straight-line method At the time of its purchase, the equipment had an estimated residual value of $6,000 and an estimated service life of four years. b. At the end of January 2021, Madison's credit manager informs you that, of the total accounts receivable outstanding on that date, $5,000 are past due and he estimates that of this amount, only 50% will be collected. Of the remaining accounts receivable he estimates that 5% will not be collected. C. Prepaid rent represents the payment in advance on December 30, 2020 for James Madison's annual office rent for 2021. d. Interest on the note payable is paid on December 31 and June 30. e. The sales manager informs you that the net realizable value of inventory at the close of business for January is $67,000. f. Unpaid income taxes incurred during January are $4,000. 3. Prepare an adjusted trial balance as of January 31, 2021 using the template provided in the Requirement #3 tab in the James Madison Excel template. If you are unable (after an appropriate amount of time, to balance the trial balance, use the caption at the bottom of the trial balance template to record your difference and move on (you can come back to it later if you have time)