Answered step by step

Verified Expert Solution

Question

1 Approved Answer

James Silva is a management accountant at Kleebler - Olson, where he is in charge of their investment portfolio. James worked with a data

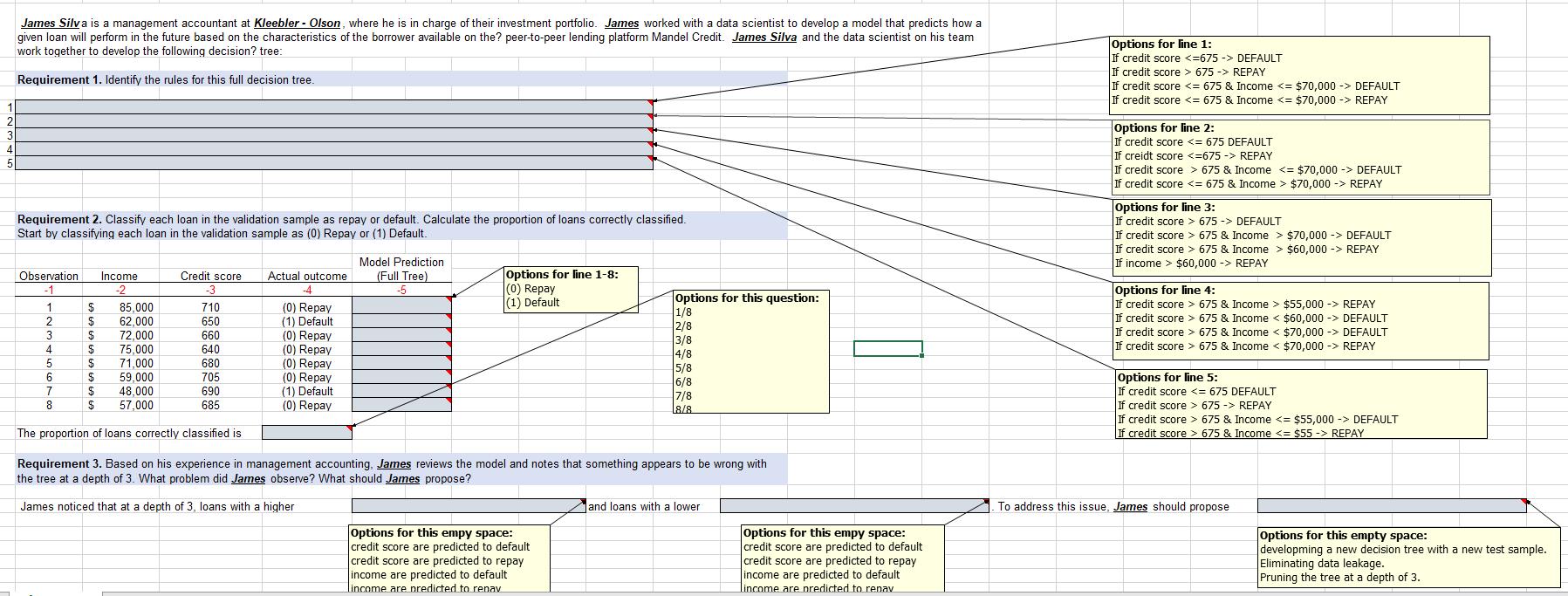

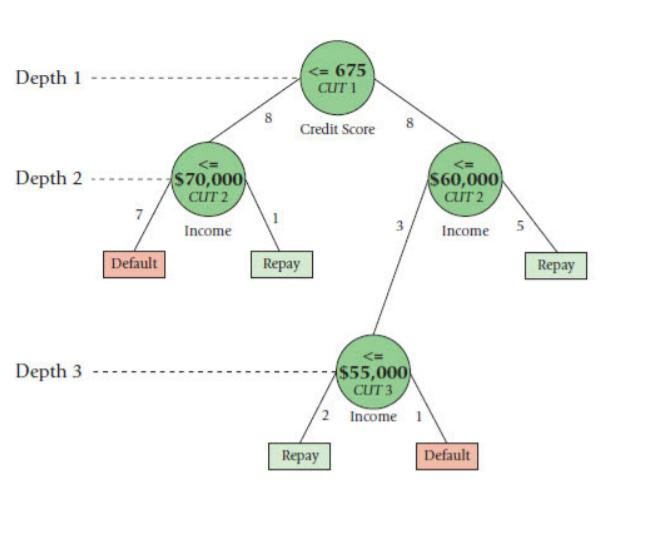

James Silva is a management accountant at Kleebler - Olson, where he is in charge of their investment portfolio. James worked with a data scientist to develop a model that predicts how a given loan will perform in the future based on the characteristics of the borrower available on the? peer-to-peer lending platform Mandel Credit. James Silva and the data scientist on his team work together to develop the following decision? tree: Options for line 1: If credit score DEFAULT If credit score > 675 -> REPAY If credit score 675 -> DEFAULT If credit score > 675 & Income > $70,000 -> DEFAULT If credit score > 675 & Income > $60,000 -> REPAY If income > $60,000 -> REPAY Requirement 2. Classify each lon in the validation sample as repay or default. Calculate the proportion of loans correctly classified. Start by classifying each loan in the validation sample as (0) Repay or (1) Default. Model Prediction (Full Tree) -5 Options for line 1-8: (0) Repay (1) Default Observation Income Credit score Actual outcome Options for line 4: If credit score > 675 & Income > $55,000 -> REPAY If credit score > 675 & Income < $60,000 -> DEFAULT If credit score > 675 & Income < $70,000 -> DEFAULT If credit score > 675 & Income < $70,000 -> REPAY -1 -2 -3 -4 Options for this question: 1/8 2/8 3/8 4/8 5/8 6/8 7/8 L8/8 1 $ $ 85,000 62,000 72,000 75,000 71,000 59,000 48,000 710 (0) Repay (1) Default (0) Repay (0) Repay (0) Repay (0) Repay (1) Default (0) Repay 650 3 660 4 640 680 Options for line 5: If credit score 675 -> REPAY If credit score > 675 & Income DEFAULT If credit score > 675 & Income REPAY 6. 705 690 685 $ 8 57,000 The proportion of loans correctly classified is Requirement 3. Based on his experience in management accounting, James reviews the model and notes that something appears to be wrong with the tree at a depth of 3. What problem did James observe? What should James propose? James noticed that at a depth of 3, loans with a higher and loans with a lower To address this issue, James should propose Options for this empy space: credit score are predicted to default credit score are predicted to repay income are predicted to default lincome are nredicted to renav Options for this empy space: credit score are predicted to default credit score are predicted to repay income are predicted to default lincome are nredicted to renav Options for this empty space: developming a new decision tree with a new test sample. Eliminating data leakage. Pruning the tree at a depth of 3.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

REQUIREMENT 1 1 Option 3 If Credit score Repay 3 Option 3 If credit score 675 income 60000 Repay ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started