Answered step by step

Verified Expert Solution

Question

1 Approved Answer

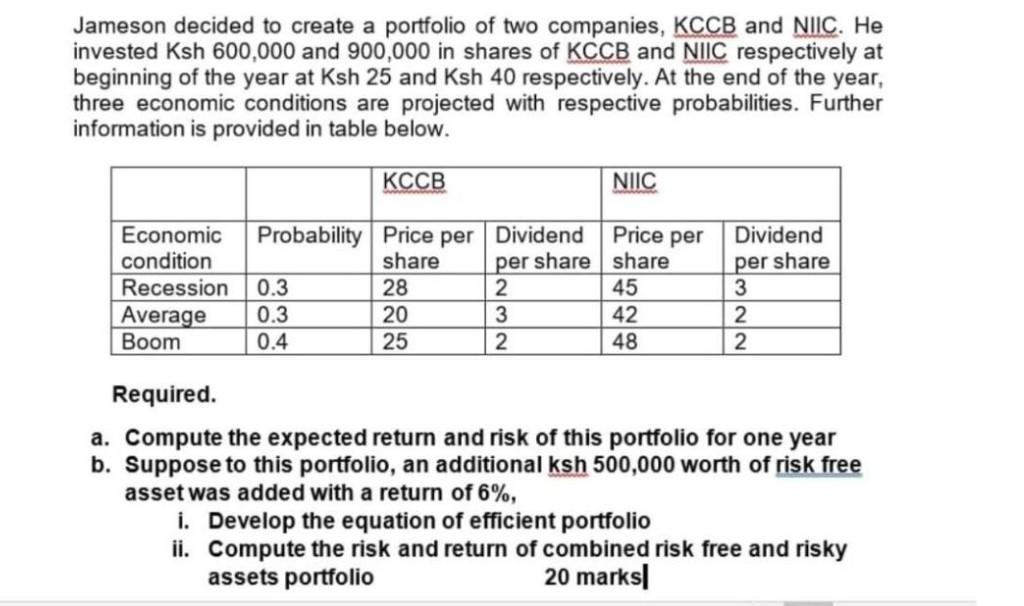

Jameson decided to create a portfolio of two companies, KCCB and NIIC. He invested Ksh 600,000 and 900,000 in shares of KCCB and NIIC respectively

Jameson decided to create a portfolio of two companies, KCCB and NIIC. He invested Ksh 600,000 and 900,000 in shares of KCCB and NIIC respectively at beginning of the year at Ksh 25 and Ksh 40 respectively. At the end of the year, three economic conditions are projected with respective probabilities. Further information is provided in table below. KCCB NIIC Price per Dividend per share Economic condition Recession Average Boom Probability Price per Dividend share per share share 0.3 28 2 45 0.3 20 3 42 0.4 25 2 48 3 2 2 Required. a. Compute the expected return and risk of this portfolio for one year b. Suppose to this portfolio, an additional ksh 500,000 worth of risk free asset was added with a return of 6%, i. Develop the equation of efficient portfolio ii. Compute the risk and return of combined risk free and risky assets portfolio 20 marks Jameson decided to create a portfolio of two companies, KCCB and NIIC. He invested Ksh 600,000 and 900,000 in shares of KCCB and NIIC respectively at beginning of the year at Ksh 25 and Ksh 40 respectively. At the end of the year, three economic conditions are projected with respective probabilities. Further information is provided in table below. KCCB NIIC Price per Dividend per share Economic condition Recession Average Boom Probability Price per Dividend share per share share 0.3 28 2 45 0.3 20 3 42 0.4 25 2 48 3 2 2 Required. a. Compute the expected return and risk of this portfolio for one year b. Suppose to this portfolio, an additional ksh 500,000 worth of risk free asset was added with a return of 6%, i. Develop the equation of efficient portfolio ii. Compute the risk and return of combined risk free and risky assets portfolio 20 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started