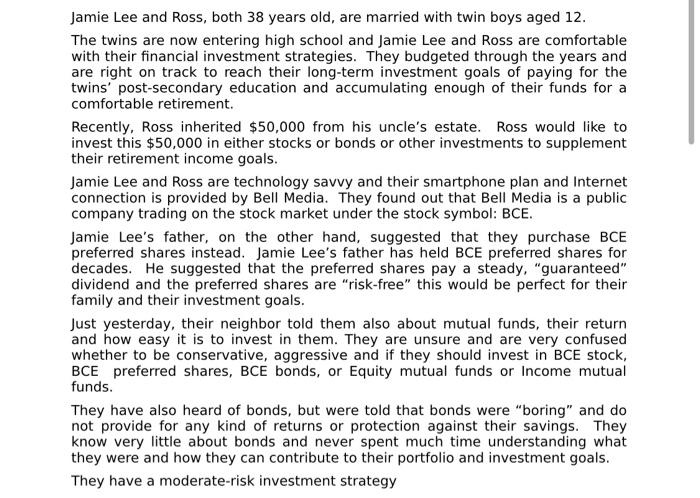

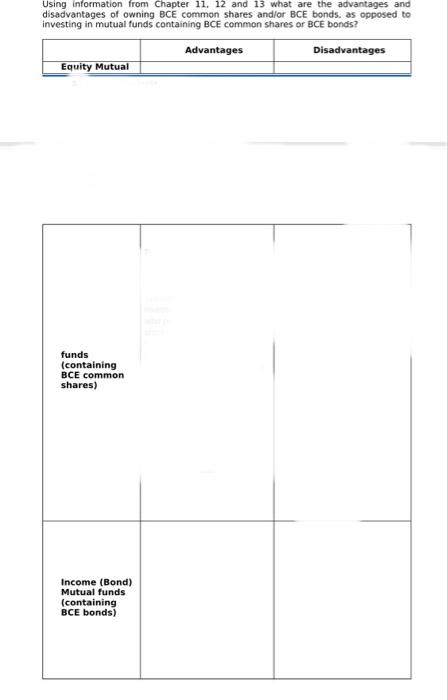

Jamie Lee and Ross, both 38 years old, are married with twin boys aged 12. The twins are now entering high school and Jamie Lee and Ross are comfortable with their financial investment strategies. They budgeted through the years and are right on track to reach their long-term investment goals of paying for the twins' post-secondary education and accumulating enough of their funds for a comfortable retirement. Recently, Ross inherited $50,000 from his uncle's estate. Ross would like to invest this $50,000 in either stocks or bonds or other investments to supplement their retirement income goals. Jamie Lee and Ross are technology savvy and their smartphone plan and Internet connection is provided by Bell Media. They found out that Bell Media is a public company trading on the stock market under the stock symbol: BCE. Jamie Lee's father, on the other hand, suggested that they purchase BCE preferred shares instead. Jamie Lee's father has held BCE preferred shares for decades. He suggested that the preferred shares pay a steady, "guaranteed" dividend and the preferred shares are "risk-free" this would be perfect for their family and their investment goals. Just yesterday, their neighbor told them also about mutual funds, their return and how easy it is to invest in them. They are unsure and are very confused whether to be conservative, aggressive and if they should invest in BCE stock, BCE preferred shares, BCE bonds, or Equity mutual funds or Income mutual funds. They have also heard of bonds, but were told that bonds were "boring" and do not provide for any kind of returns or protection against their savings. They know very little about bonds and never spent much time understanding what they were and how they can contribute to their portfolio and investment goals. They have a moderate-risk investment strategy Using information from Chapter 11, 12 and 13 what are the advantages and disadvantages of owning BCE common shares andior BCE bonds, as opposed to investing in mutual funds containing BCE common shares or BCE bonds