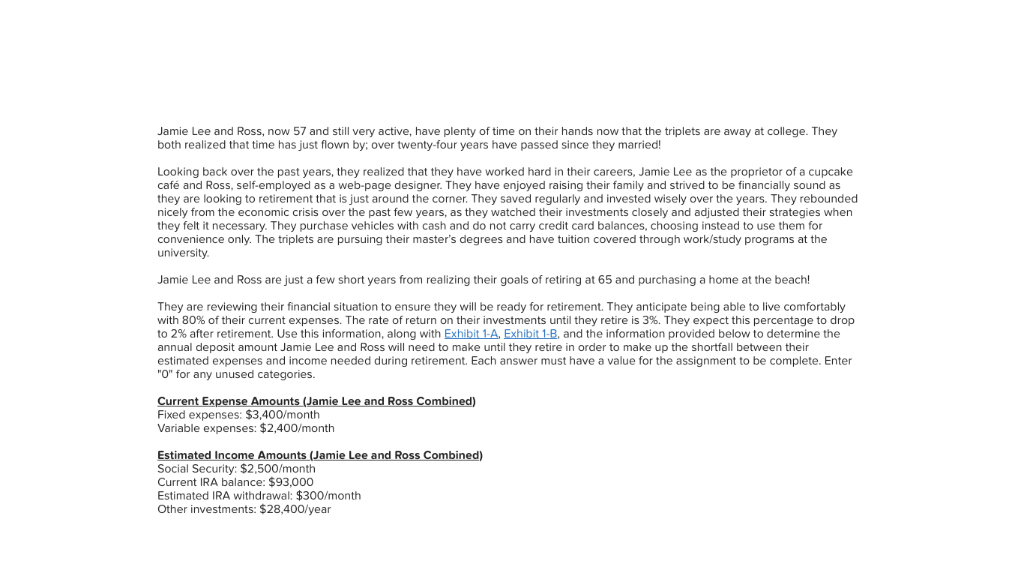

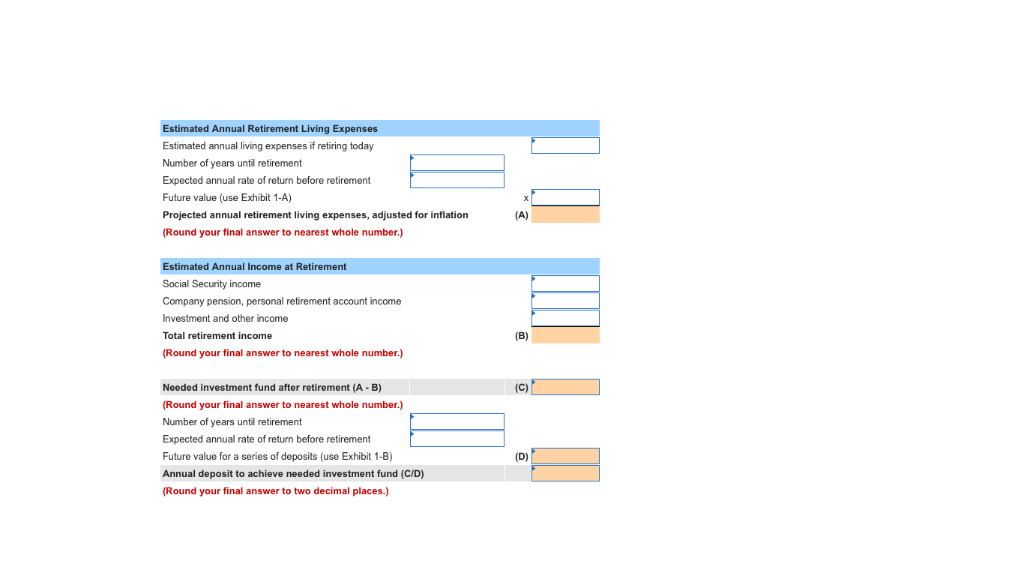

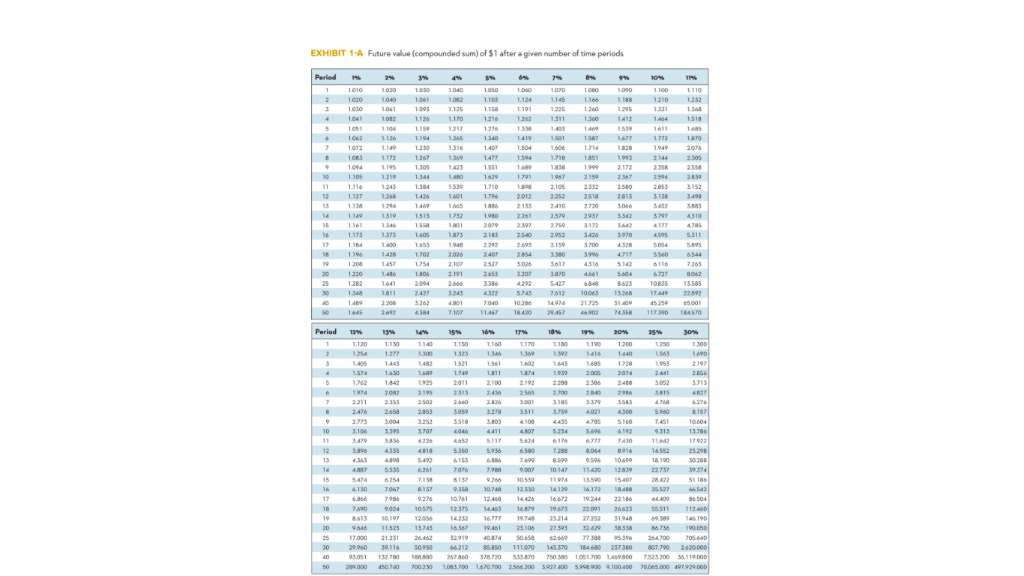

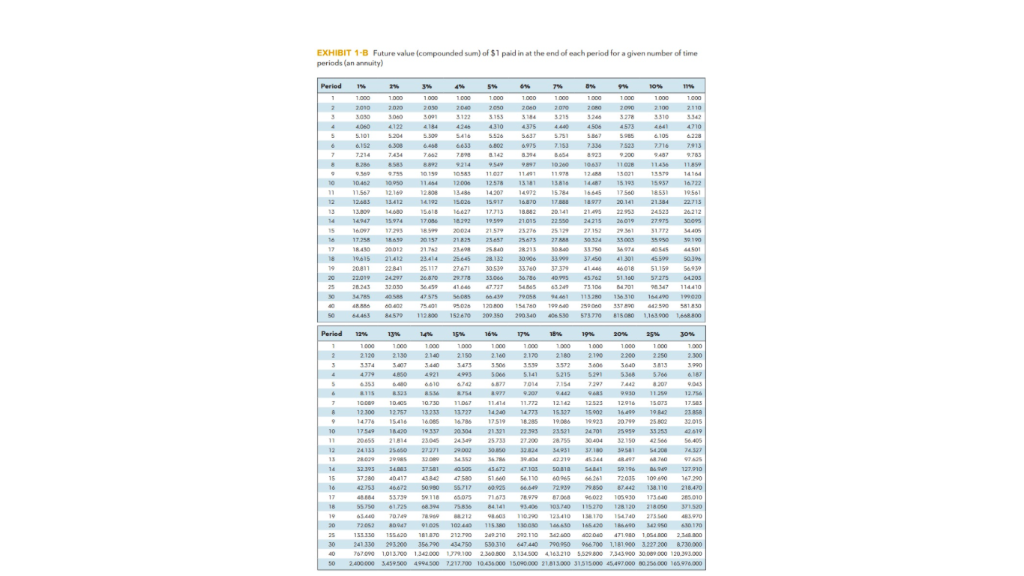

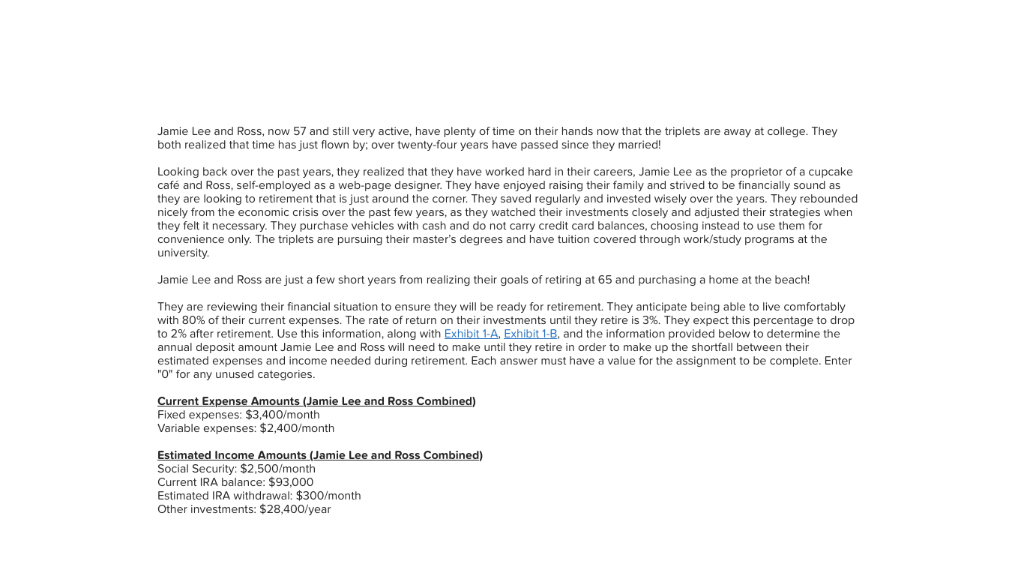

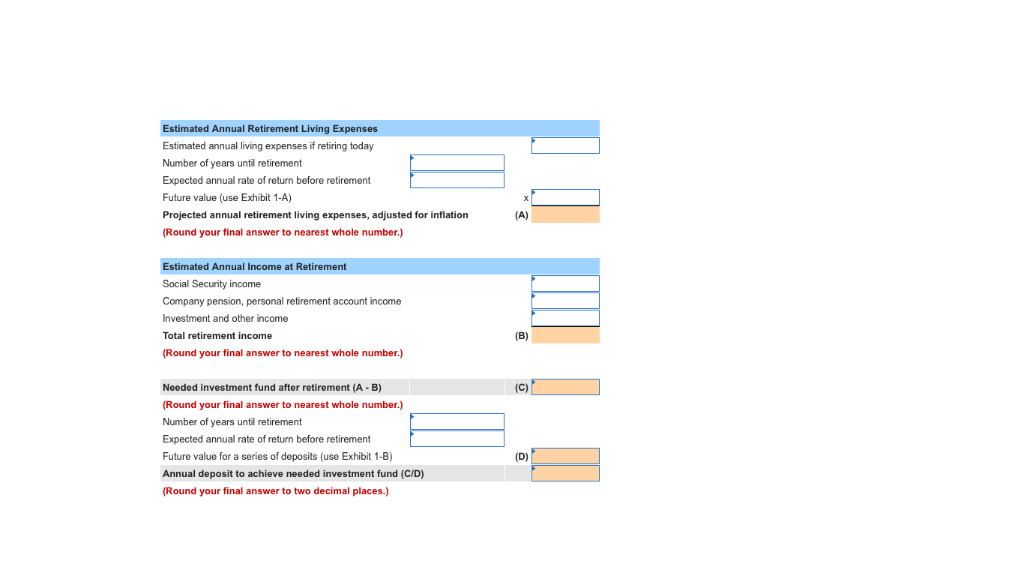

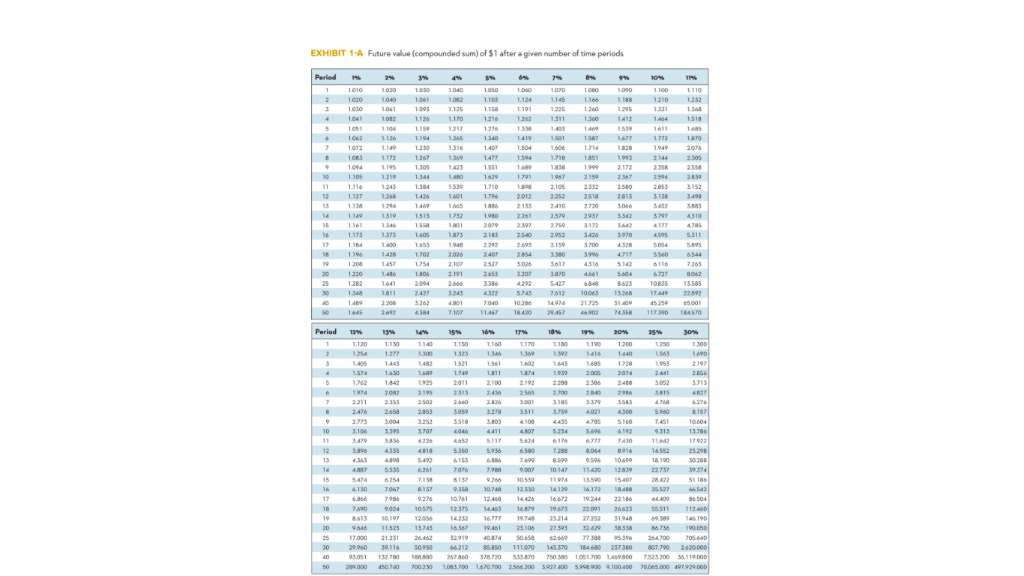

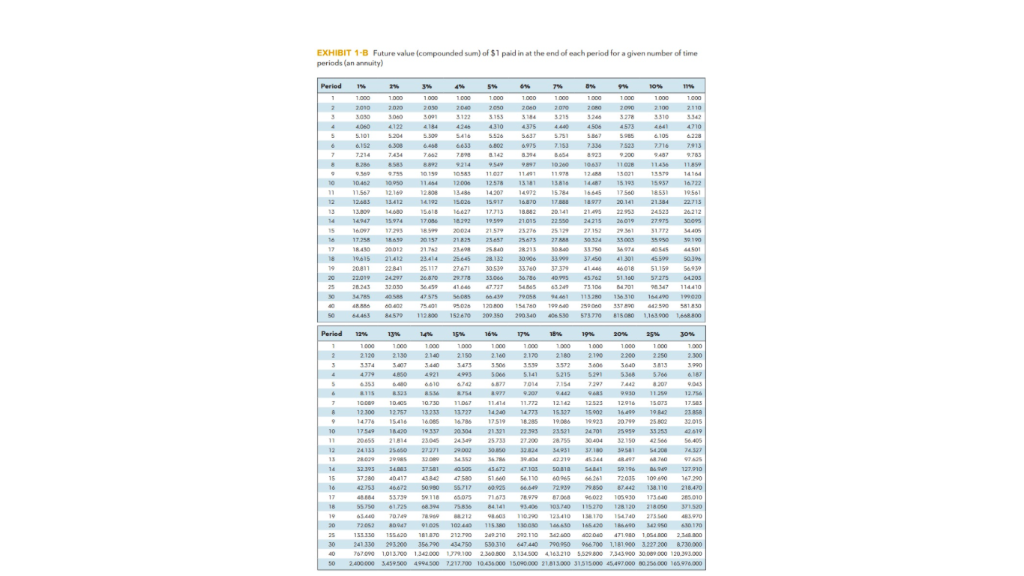

Jamie Lee and Ross, now 57 and still very active, have plenty of time on their hands now that the triplets are away at college. They both realized that time has just flown by; over twenty-four years have passed since they married! Looking back over the past years, they realized that they have worked hard in their careers, Jamie Lee as the proprietor of a cupcake caf and Ross, self-employed as a web-page designer. They have enjoyed raising their family and strived to be financially sound as they are looking to retirement that is just around the corner. They saved regularly and invested wisely over the years. They rebounded nicely from the economic crisis over the past few years, as they watched their investments closely and adjusted their strategies when they felt it necessary. They purchase vehicles with cash and do not carry credit card balances, choosing instead to use them for convenience only. The triplets are pursuing their master's degrees and have tuition covered through work/study programs at the university Jamie Lee and Ross are just a few short years from realizing their goals of retiring at 65 and purchasing a home at the beach! They are reviewing their financial situation to ensure they will be ready for retirement. They anticipate being able to live comfortably with 80% of their current expenses. The rate of return on their investments until they retire is 3%. They expect this percentage to drop to 2% after retirement. Use this information, along with Exhibit 1-A, Exhibit B, and the information provided below to determine the annual deposit amount Jamie Lee and Ross will need to make until they retire in order to make up the shortfall between their estimated expenses and income needed during retirement. Each answer must have a value for the assignment to be complete. Enter "O" for any unused categories. Fixed expenses: $3,400/month Variable expenses: $2,400/month in Social Security: $2,500/month Current IRA balance: $93,000 Estimated IRA withdrawal: $300/month Other investments: $28,400/year Estimated Annual Retirement Living Expenses Estimated annual living expenses if retiring today Number of years until retirement Expected annual rate of return before retirement[ Future value (use Exhibit 1-A) Projected annual retirement living expenses, adjusted for inflation (Round your final answer to nearest whole number.) Estimated Annual Income at Retirement Social Security income Company pension, personal retirement account income Investment and other income Total retirement income Round your final answer to nearest whole number.) Needed investment fund after retirement (A B) Round your final answer to nearest whole number.) Number of years until retirement Expected annual rate of return before retirement Future value for a series of deposits (use Exhibit 1-B) Annual deposit to achieve needed investment fund (C/D) (Round your final answer to two decimal places.) EXHIBIT 1-A Period 1% 4104 02 1518 15871677 17730 9492076 9672153 367259428 710182.105 142616011762012 2.252 2518 2813 3138349 1332 2720 7974310 142817022026 4717560 30 13481 2427 3243 4322 5743 7A12 0063 308 3262 40 2.840 2986 82476 2asa 2853 3059 1278 1511 S799 4023 4300 soo a1S 05 12 6 4335 asi 350 5956 6580 38 8064 8916 552 43575535261 1307067 8157 283022.737 9646 11.52515745 165 1451 25 10627.395229 58538 6 756 7,00021.2 26.462 32919 40 874 5058 2 738 95396 24 700 EXHIBIT 1-B Future value (compounded sum) of $1 paid in at the end of each perlod for a given number of time periods (an annuity) Period % 540600203000 4 4060 1224184444310437540 4506 573641 710 2.010 0202030204020502060200 00 202100 2110 1414947 15.974 17086 1.292 195 21015 22500 24013 26019 27,975 30,095| 18 9615 21.412 23.414 2S645 132 30.006 33999 37450 41301 4SS09 50.396 | So 44 84572 112800 15260 209 350 200340 0 STSTO 5 160 1668800 ,. 2120 2100 2140 2150 2 160 70 2180 2190 2200 2250 2100 4$93402250 42753466725090 55.17 92 664 2939 985 87442 138 110218470 7090 1013 00 134 300 163210 5529 800 734390 000 120.33 000 Jamie Lee and Ross, now 57 and still very active, have plenty of time on their hands now that the triplets are away at college. They both realized that time has just flown by; over twenty-four years have passed since they married! Looking back over the past years, they realized that they have worked hard in their careers, Jamie Lee as the proprietor of a cupcake caf and Ross, self-employed as a web-page designer. They have enjoyed raising their family and strived to be financially sound as they are looking to retirement that is just around the corner. They saved regularly and invested wisely over the years. They rebounded nicely from the economic crisis over the past few years, as they watched their investments closely and adjusted their strategies when they felt it necessary. They purchase vehicles with cash and do not carry credit card balances, choosing instead to use them for convenience only. The triplets are pursuing their master's degrees and have tuition covered through work/study programs at the university Jamie Lee and Ross are just a few short years from realizing their goals of retiring at 65 and purchasing a home at the beach! They are reviewing their financial situation to ensure they will be ready for retirement. They anticipate being able to live comfortably with 80% of their current expenses. The rate of return on their investments until they retire is 3%. They expect this percentage to drop to 2% after retirement. Use this information, along with Exhibit 1-A, Exhibit B, and the information provided below to determine the annual deposit amount Jamie Lee and Ross will need to make until they retire in order to make up the shortfall between their estimated expenses and income needed during retirement. Each answer must have a value for the assignment to be complete. Enter "O" for any unused categories. Fixed expenses: $3,400/month Variable expenses: $2,400/month in Social Security: $2,500/month Current IRA balance: $93,000 Estimated IRA withdrawal: $300/month Other investments: $28,400/year Estimated Annual Retirement Living Expenses Estimated annual living expenses if retiring today Number of years until retirement Expected annual rate of return before retirement[ Future value (use Exhibit 1-A) Projected annual retirement living expenses, adjusted for inflation (Round your final answer to nearest whole number.) Estimated Annual Income at Retirement Social Security income Company pension, personal retirement account income Investment and other income Total retirement income Round your final answer to nearest whole number.) Needed investment fund after retirement (A B) Round your final answer to nearest whole number.) Number of years until retirement Expected annual rate of return before retirement Future value for a series of deposits (use Exhibit 1-B) Annual deposit to achieve needed investment fund (C/D) (Round your final answer to two decimal places.) EXHIBIT 1-A Period 1% 4104 02 1518 15871677 17730 9492076 9672153 367259428 710182.105 142616011762012 2.252 2518 2813 3138349 1332 2720 7974310 142817022026 4717560 30 13481 2427 3243 4322 5743 7A12 0063 308 3262 40 2.840 2986 82476 2asa 2853 3059 1278 1511 S799 4023 4300 soo a1S 05 12 6 4335 asi 350 5956 6580 38 8064 8916 552 43575535261 1307067 8157 283022.737 9646 11.52515745 165 1451 25 10627.395229 58538 6 756 7,00021.2 26.462 32919 40 874 5058 2 738 95396 24 700 EXHIBIT 1-B Future value (compounded sum) of $1 paid in at the end of each perlod for a given number of time periods (an annuity) Period % 540600203000 4 4060 1224184444310437540 4506 573641 710 2.010 0202030204020502060200 00 202100 2110 1414947 15.974 17086 1.292 195 21015 22500 24013 26019 27,975 30,095| 18 9615 21.412 23.414 2S645 132 30.006 33999 37450 41301 4SS09 50.396 | So 44 84572 112800 15260 209 350 200340 0 STSTO 5 160 1668800 ,. 2120 2100 2140 2150 2 160 70 2180 2190 2200 2250 2100 4$93402250 42753466725090 55.17 92 664 2939 985 87442 138 110218470 7090 1013 00 134 300 163210 5529 800 734390 000 120.33 000