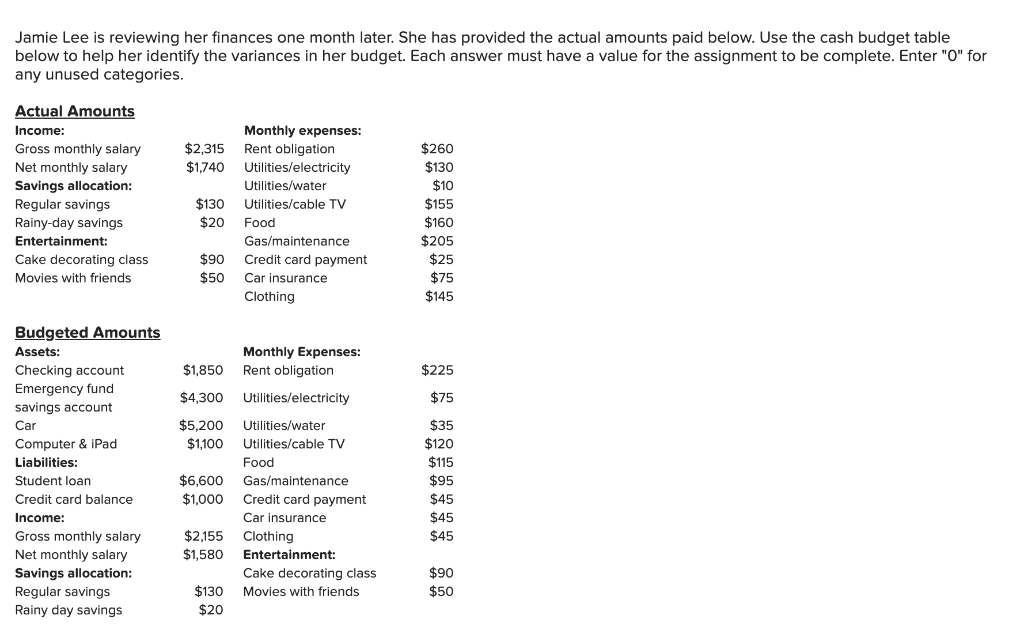

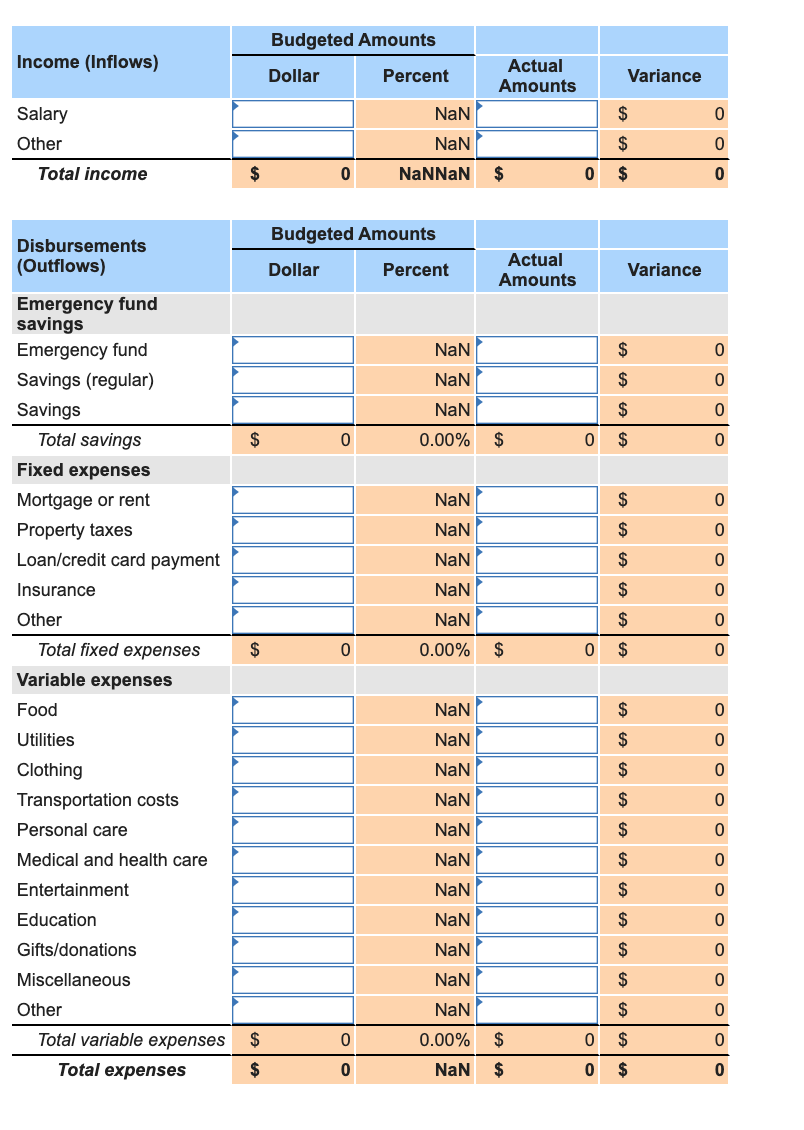

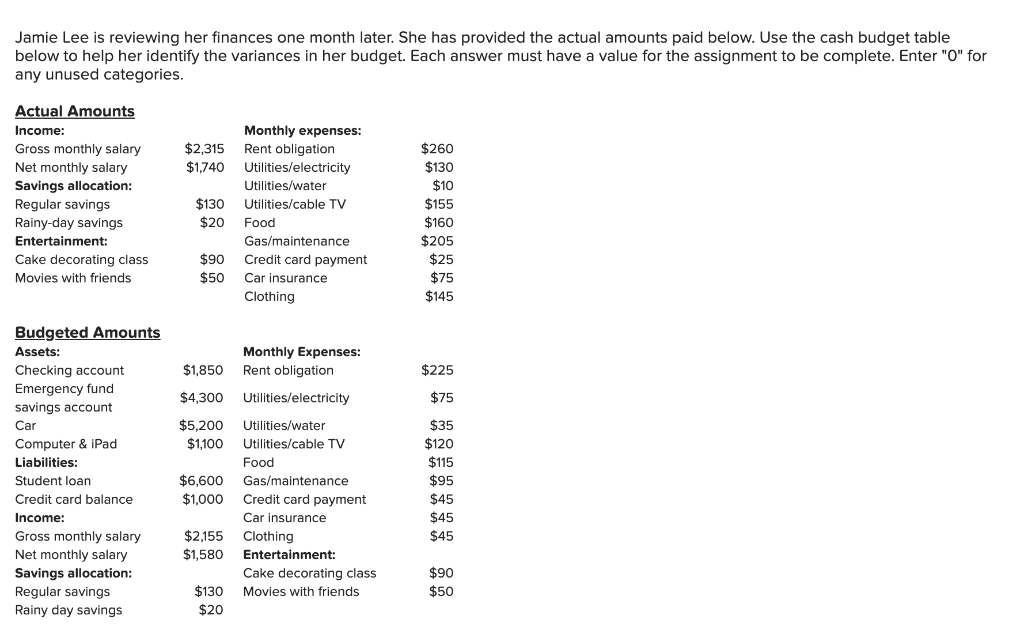

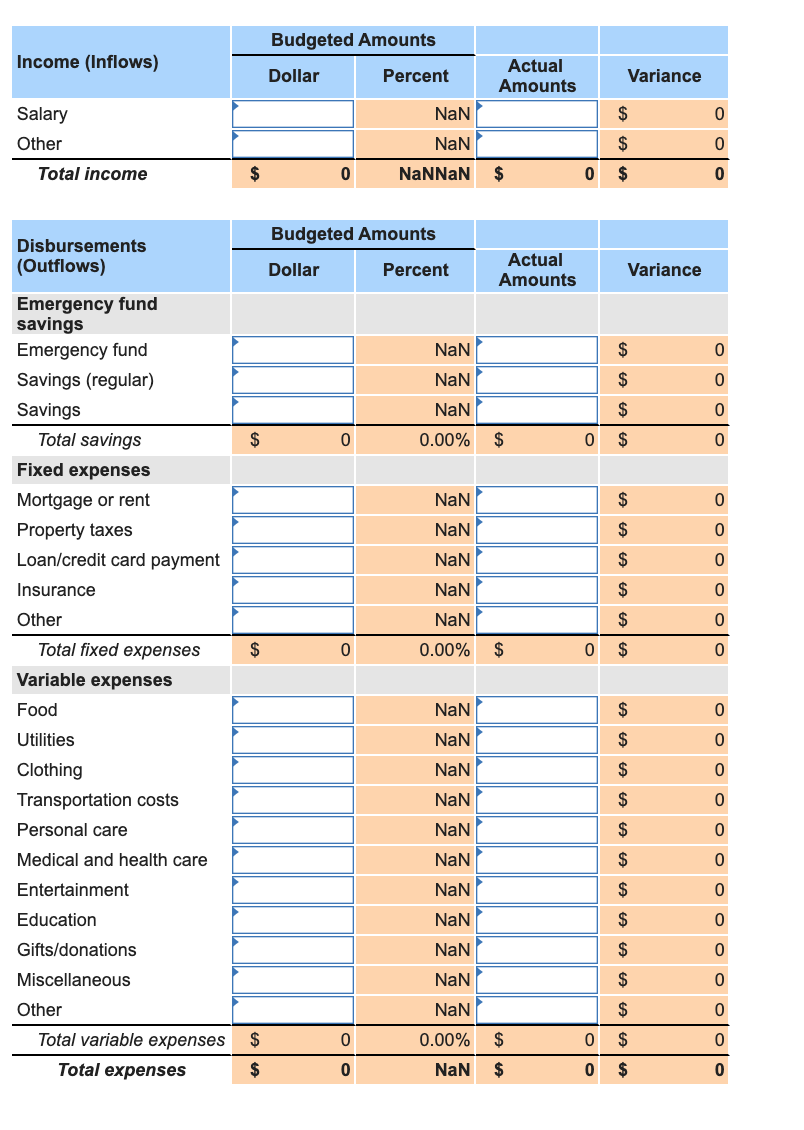

Jamie Lee is reviewing her finances one month later. She has provided the actual amounts paid below. Use the cash budget table below to help her identify the variances in her budget. Each answer must have a value for the assignment to be complete. Enter "0" for any unused categories.

Jamie Lee is reviewing her finances one month later. She has provided the actual amounts paid below. Use the cash budget table below to help her identify the variances in her budget. Each answer must have a value for the assignment to be complete. Enter "0" for any unused categories. $2,315 $1,740 Actual Amounts Income: Gross monthly salary Net monthly salary Savings allocation: Regular savings Rainy-day savings Entertainment: Cake decorating class Movies with friends $130 $20 Monthly expenses: Rent obligation Utilities/electricity Utilities/water Utilities/cable TV Food Gas/maintenance Credit card payment Car insurance Clothing $260 $130 $10 $155 $160 $205 $25 $75 $145 $90 $50 $1,850 Monthly Expenses: Rent obligation Utilities/electricity $225 $4,300 $75 $5,200 $1,100 Budgeted Amounts Assets: Checking account Emergency fund savings account Car Computer & iPad lities Student loan Credit card balance Income: Gross monthly salary Net monthly salary Savings allocation: Regular savings Rainy day savings $6,600 $1,000 Utilities/water Utilities/cable TV Food Gas/maintenance Credit card payment Car insurance Clothing Entertainment: Cake decorating class Movies with friends $35 $120 $115 $95 $45 $45 $45 $2.155 $1,580 $90 $50 $130 $20 Budgeted Amounts Income (Inflows) Dollar Percent Actual Amounts Variance NaN $ 0 Salary Other Total income NaN $ 0 $ 0 NaNNaN $ 0 $ 0 Budgeted Amounts Dollar Percent Actual Amounts Variance NaN $ 0 $ 0 NaN NaN $ Disbursements (Outflows) Emergency fund savings Emergency fund Savings (regular) Savings Total savings Fixed expenses Mortgage or rent Property taxes Loan/credit card payment Insurance 0 $ 0 0.00% $ 0 $ 0 NaN $ 0 NaN $ 0 NaN $ 0 Nan $ 0 NaN $ 0 $ 0 0.00% $ 0 $ 0 Other Total fixed expenses Variable expenses Food NaN $ 0 NaN $ 0 NaN $ 0 NaN $ 0 NaN $ 0 Utilities Clothing Transportation costs Personal care Medical and health care Entertainment Education Gifts/donations NaN $ 0 NaN $ 0 NaN $ 0 NaN $ 0 Miscellaneous $ 0 NaN NaN $ 0 Other Total variable expenses $ 0 $ 0 $ 0 0.00% NaN Total expenses $ 0 $ 0 $ 0 Jamie Lee is reviewing her finances one month later. She has provided the actual amounts paid below. Use the cash budget table below to help her identify the variances in her budget. Each answer must have a value for the assignment to be complete. Enter "0" for any unused categories. $2,315 $1,740 Actual Amounts Income: Gross monthly salary Net monthly salary Savings allocation: Regular savings Rainy-day savings Entertainment: Cake decorating class Movies with friends $130 $20 Monthly expenses: Rent obligation Utilities/electricity Utilities/water Utilities/cable TV Food Gas/maintenance Credit card payment Car insurance Clothing $260 $130 $10 $155 $160 $205 $25 $75 $145 $90 $50 $1,850 Monthly Expenses: Rent obligation Utilities/electricity $225 $4,300 $75 $5,200 $1,100 Budgeted Amounts Assets: Checking account Emergency fund savings account Car Computer & iPad lities Student loan Credit card balance Income: Gross monthly salary Net monthly salary Savings allocation: Regular savings Rainy day savings $6,600 $1,000 Utilities/water Utilities/cable TV Food Gas/maintenance Credit card payment Car insurance Clothing Entertainment: Cake decorating class Movies with friends $35 $120 $115 $95 $45 $45 $45 $2.155 $1,580 $90 $50 $130 $20 Budgeted Amounts Income (Inflows) Dollar Percent Actual Amounts Variance NaN $ 0 Salary Other Total income NaN $ 0 $ 0 NaNNaN $ 0 $ 0 Budgeted Amounts Dollar Percent Actual Amounts Variance NaN $ 0 $ 0 NaN NaN $ Disbursements (Outflows) Emergency fund savings Emergency fund Savings (regular) Savings Total savings Fixed expenses Mortgage or rent Property taxes Loan/credit card payment Insurance 0 $ 0 0.00% $ 0 $ 0 NaN $ 0 NaN $ 0 NaN $ 0 Nan $ 0 NaN $ 0 $ 0 0.00% $ 0 $ 0 Other Total fixed expenses Variable expenses Food NaN $ 0 NaN $ 0 NaN $ 0 NaN $ 0 NaN $ 0 Utilities Clothing Transportation costs Personal care Medical and health care Entertainment Education Gifts/donations NaN $ 0 NaN $ 0 NaN $ 0 NaN $ 0 Miscellaneous $ 0 NaN NaN $ 0 Other Total variable expenses $ 0 $ 0 $ 0 0.00% NaN Total expenses $ 0 $ 0 $ 0