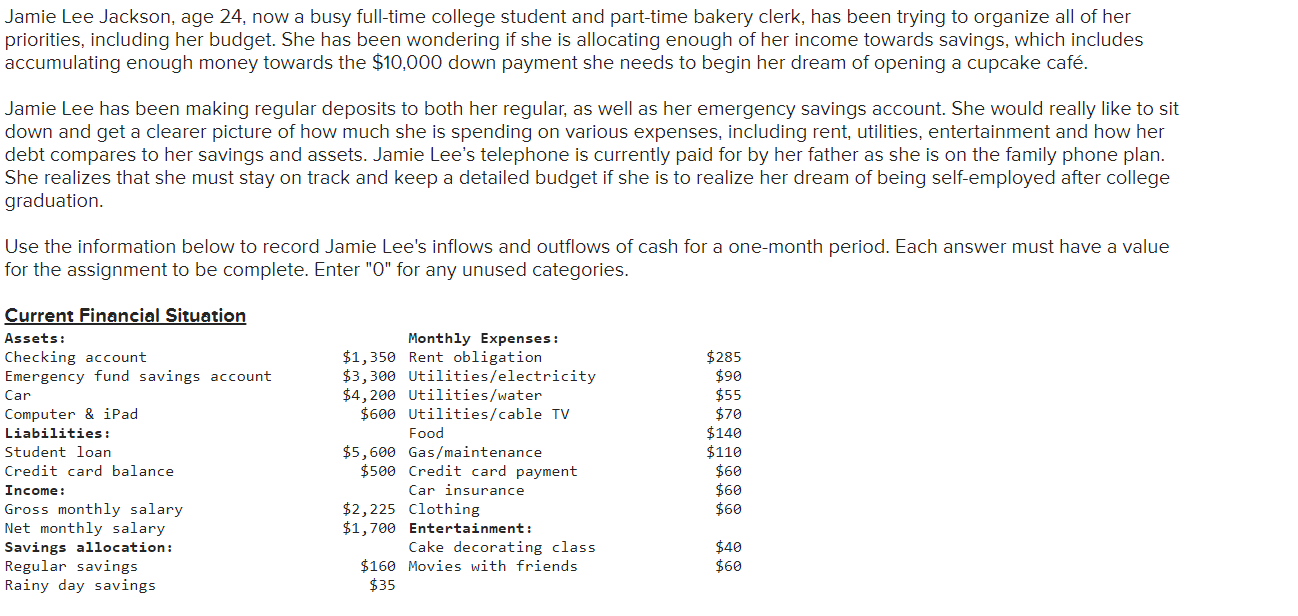

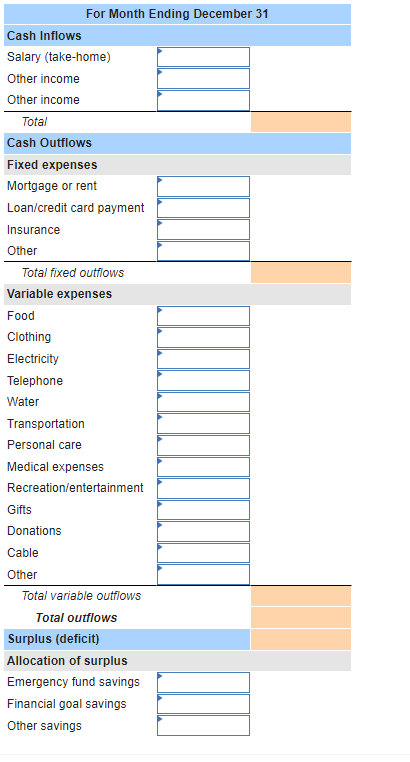

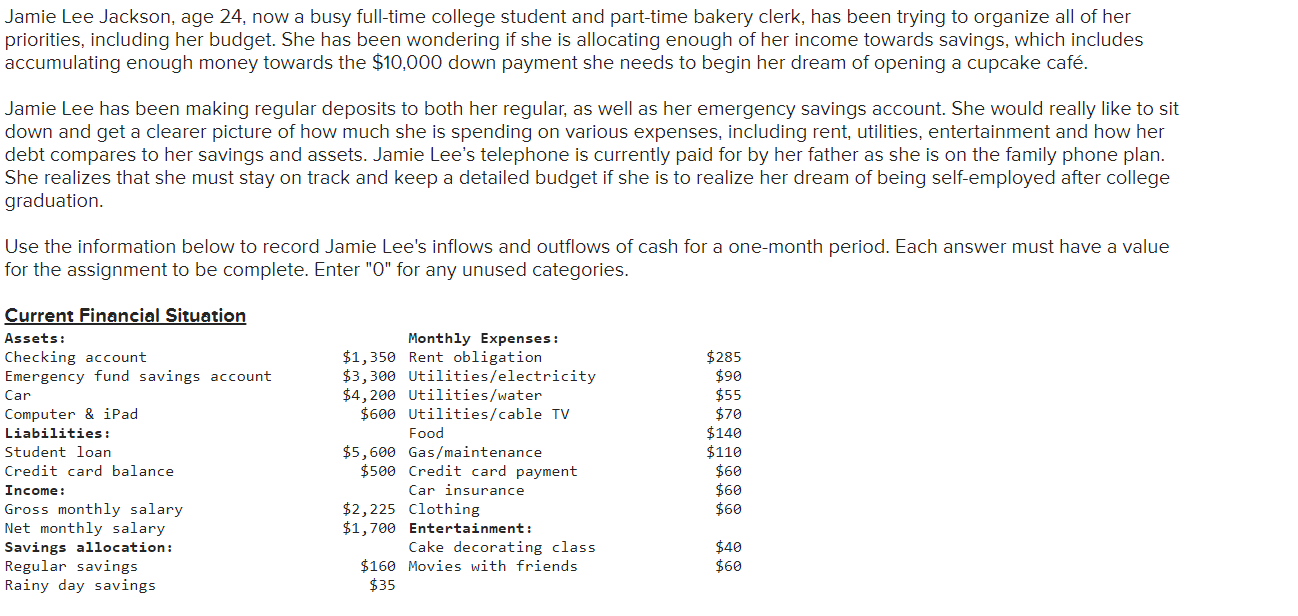

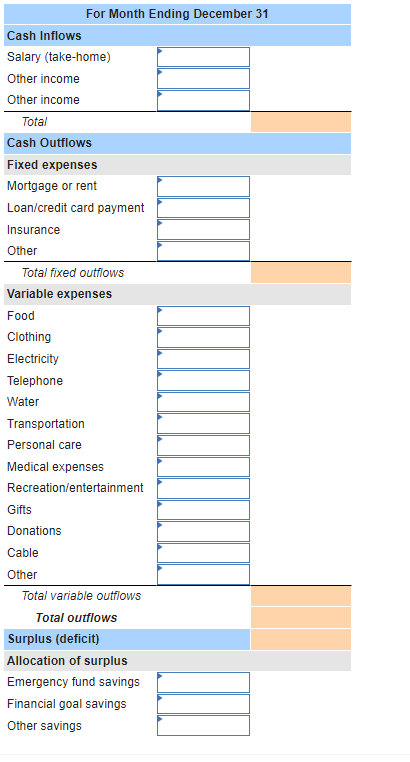

Jamie Lee Jackson, age 24, now a busy full-time college student and part-time bakery clerk, has been trying to organize all of her priorities, including her budget. She has been wondering if she is allocating enough of her income towards savings, which includes accumulating enough money towards the $10,000 down payment she needs to begin her dream of opening a cupcake caf. Jamie Lee has been making regular deposits to both her regular, as well as her emergency savings account. She would really like to sit down and get a clearer picture of how much she is spending on various expenses, including rent, utilities, entertainment and how her debt compares to her savings and assets. Jamie Lee's telephone is currently paid for by her father as she is on the family phone plan. She realizes that she must stay on track and keep a detailed budget if she is to realize her dream of being self-employed after college graduation. Use the information below to record Jamie Lee's inflows and outflows of cash for a one-month period. Each answer must have a value for the assignment to be complete. Enter "O" for any unused categories. Current Financial Situation Assets: Checking account Emergency fund savings account Car Computer & iPad Liabilities: Student loan Credit card balance Income: Gross monthly salary Net monthly salary Savings allocation: Regular savings Rainy day savings Monthly Expenses: $1,350 Rent obligation $3,300 Utilities/electricity $4,200 Utilities/water $600 Utilities/cable TV Food $5,600 Gas/maintenance $500 Credit card payment Car insurance $2,225 Clothing $1,700 Entertainment: Cake decorating class $160 Movies with friends $35 $285 $90 $55 $70 $140 $110 $60 $60 $60 $40 $60 For Month Ending December 31 Cash Inflows Salary (take-home) Other income Other income Total Cash Outflows Fixed expenses Mortgage or rent Loan/credit card payment Insurance Other Total fixed outflows Variable expenses Food Clothing Electricity Telephone Water Transportation Personal care Medical expenses Recreation/entertainment Gifts Donations Cable Other Total variable outflows Total outflows Surplus (deficit) Allocation of surplus Emergency fund savings Financial goal savings Other savings Jamie Lee Jackson, age 24, now a busy full-time college student and part-time bakery clerk, has been trying to organize all of her priorities, including her budget. She has been wondering if she is allocating enough of her income towards savings, which includes accumulating enough money towards the $10,000 down payment she needs to begin her dream of opening a cupcake caf. Jamie Lee has been making regular deposits to both her regular, as well as her emergency savings account. She would really like to sit down and get a clearer picture of how much she is spending on various expenses, including rent, utilities, entertainment and how her debt compares to her savings and assets. Jamie Lee's telephone is currently paid for by her father as she is on the family phone plan. She realizes that she must stay on track and keep a detailed budget if she is to realize her dream of being self-employed after college graduation. Use the information below to record Jamie Lee's inflows and outflows of cash for a one-month period. Each answer must have a value for the assignment to be complete. Enter "O" for any unused categories. Current Financial Situation Assets: Checking account Emergency fund savings account Car Computer & iPad Liabilities: Student loan Credit card balance Income: Gross monthly salary Net monthly salary Savings allocation: Regular savings Rainy day savings Monthly Expenses: $1,350 Rent obligation $3,300 Utilities/electricity $4,200 Utilities/water $600 Utilities/cable TV Food $5,600 Gas/maintenance $500 Credit card payment Car insurance $2,225 Clothing $1,700 Entertainment: Cake decorating class $160 Movies with friends $35 $285 $90 $55 $70 $140 $110 $60 $60 $60 $40 $60 For Month Ending December 31 Cash Inflows Salary (take-home) Other income Other income Total Cash Outflows Fixed expenses Mortgage or rent Loan/credit card payment Insurance Other Total fixed outflows Variable expenses Food Clothing Electricity Telephone Water Transportation Personal care Medical expenses Recreation/entertainment Gifts Donations Cable Other Total variable outflows Total outflows Surplus (deficit) Allocation of surplus Emergency fund savings Financial goal savings Other savings