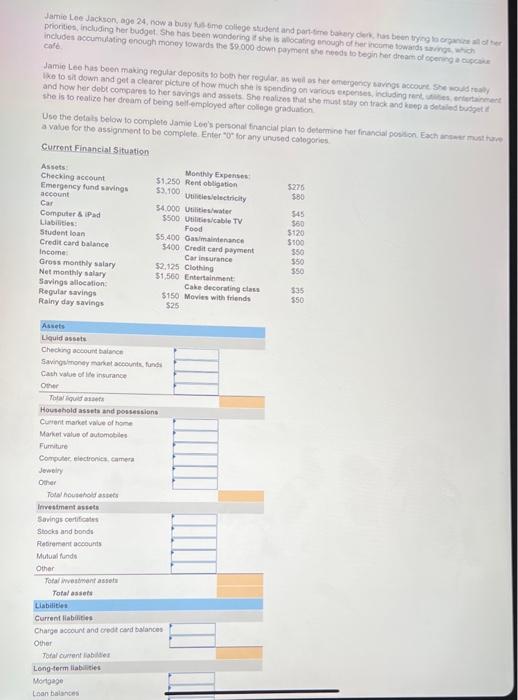

Jamie Lee Jackson, age 24. now a busy me college student and porttime bakery has been trygghet priorities, including her budget She has been wondering the socating enough of the income towards which includes accumulating enough money towards the $9.000 down payment sheds to begin her dream of cing cale Jamie Lee has been making regular deposits to bom borrego well as her omvergency savings account She way ke to sit down and get a clear picture of how much she is spending on various posuere erat and how her debt compares to her savings and assets. She realize that she must stay on track and wpaded buget she is to realize her dream of being employed after college graduation Use the details below to completo Jamie Lee's personal financial plan to determine the financial position. Each a vase for the assignment to be complete Enter for any used categories Current Financial Situation Assets Monthly Expenses Checking account $1250 Rent obligation 5275 Emergency fund savings 53.100 account Uselectricity $80 Car 54.000 Utilities/water 545 Computer & Pad $500 Utilities cable TV Liabilities: 560 Food $120 Student loan $5.400 Gaminance 5100 Credit card balance 5400 Credit card payment $50 Income Car Insurance $50 Gross monthly salary $2.125 Clothing Net monthly salary $1,560 Entertainment Savings allocation Cake decorating class Regular savings $150 Movies with friends $50 Rainy day savings $25 550 535 Assets Liquid assets Checking account balance Saving money manat counts. funds Cath Value of insurance One To liquids Household assets and possessions Current market value of home Market value of automobiles Furniture Computer electronics Camera Jewelry Other Total household assets Investment assets Savings certificates Stocks and bonds Retromant accounts Mutual funds Other Total Westment assets Total assets Liabilities Current liabi Charge account and credit card balances Other Total current Long-term liabilities Mortgage Loan balances Jamie Lee Jackson, age 24. now a busy me college student and porttime bakery has been trygghet priorities, including her budget She has been wondering the socating enough of the income towards which includes accumulating enough money towards the $9.000 down payment sheds to begin her dream of cing cale Jamie Lee has been making regular deposits to bom borrego well as her omvergency savings account She way ke to sit down and get a clear picture of how much she is spending on various posuere erat and how her debt compares to her savings and assets. She realize that she must stay on track and wpaded buget she is to realize her dream of being employed after college graduation Use the details below to completo Jamie Lee's personal financial plan to determine the financial position. Each a vase for the assignment to be complete Enter for any used categories Current Financial Situation Assets Monthly Expenses Checking account $1250 Rent obligation 5275 Emergency fund savings 53.100 account Uselectricity $80 Car 54.000 Utilities/water 545 Computer & Pad $500 Utilities cable TV Liabilities: 560 Food $120 Student loan $5.400 Gaminance 5100 Credit card balance 5400 Credit card payment $50 Income Car Insurance $50 Gross monthly salary $2.125 Clothing Net monthly salary $1,560 Entertainment Savings allocation Cake decorating class Regular savings $150 Movies with friends $50 Rainy day savings $25 550 535 Assets Liquid assets Checking account balance Saving money manat counts. funds Cath Value of insurance One To liquids Household assets and possessions Current market value of home Market value of automobiles Furniture Computer electronics Camera Jewelry Other Total household assets Investment assets Savings certificates Stocks and bonds Retromant accounts Mutual funds Other Total Westment assets Total assets Liabilities Current liabi Charge account and credit card balances Other Total current Long-term liabilities Mortgage Loan balances