Question

Jamie Lee Jackson, age 27, full-time student and part-time bakery employee, has just moved into a bungalow-style, unfurnished home of her own. The house is

Jamie Lee Jackson, age 27, full-time student and part-time bakery employee, has just moved into a bungalow-style, unfurnished home of her own. The house is only a one-bedroom, but the rent is manageable and has plenty of room for Jamie Lee. She decided to give notice to her roommate that she would be leaving the apartment and the shared expenses after the incident with the stolen checkbook and credit cards a few weeks back. Jamie had to dip in to her emergency savings account to help cover the deposit and moving expenses, as she had not planned to move out of the apartment and be on her own this soon.

Jamie is in need of a few appliances, as there is a small laundry room, but no washer or dryer, nor is there a refrigerator in the kitchen. She will also need a living room set and a television because the only furniture she currently has is a bedroom suite. Jamie is so excited to finally have the say in how she will furnish the bungalow, and she began shopping for her home as soon as the lease was signed.

The home appliance store, Acme Home Goods, was the first stop as Jamie chose a stacking washer and dryer set, which would fit comfortably in the laundry space provided. A stainless steel refrigerator was her next choice, and the salesperson quickly began to write up the order. Jamie was informed that if she opened up a credit card through the appliance store that she would receive a discount of 10% off her total purchase. As she waited for her credit to be approved, she decided to continue shopping for her other needed items.

Living room furniture was next on the list as Jamie went to the local home furnishings retailer who had endless choices of complete sofa sets that included the coffee and end tables as well as matching lamps. Jamie chose a contemporary-style set and, again, was offered the tempting deal of opening a credit card through the store in exchange for a percentage off her purchase and free delivery. On to the big box retailer where Jamie then chose a 52" 1080p LED HDTV. For the third time, a percentage off her first purchase at the big box retailer was all that was needed to get Jamie to sign on the dotted line of the credit card application.

Jamie Lee wants to determine if she can afford the monthly payments for all of her purchases before she completes the application process. Use the information below to determine her debt payment-to-income ratio.

Current Financial Situation

| Assets: | Income: | ||

| Checking account | $2,050 | Gross monthly salary | $3,000 |

| Savings account | $7,700 | Net income | $2,225 |

| Emergency fund savings account | $3,200 | Monthly Expenses: | |

| IRA balance | $460 | Rent obligation | $400 |

| Car | $3,300 | Utilities/Electric | $95 |

| Liabilities: | Utilities/Water | $65 | |

| Student loan | $11,300 | Utilities/Cable | $90 |

| (Jamie is still a full-time student, so no payments are required on the loan until after graduation) | Food | $150 | |

| Gas/Maintenance | $155 | ||

| Credit card payment | $0 | ||

| Acme Home Goods (Washer/dryer and refrigerator) | $1,800 | Acme Home Goods | $44 |

| Local Home Furnishings (Sofa set) | $1,900 | Local Home Furnishings | $52 |

| Big Box Store (52" LED HDTV) | $1,300 | Big Box Store | $32 |

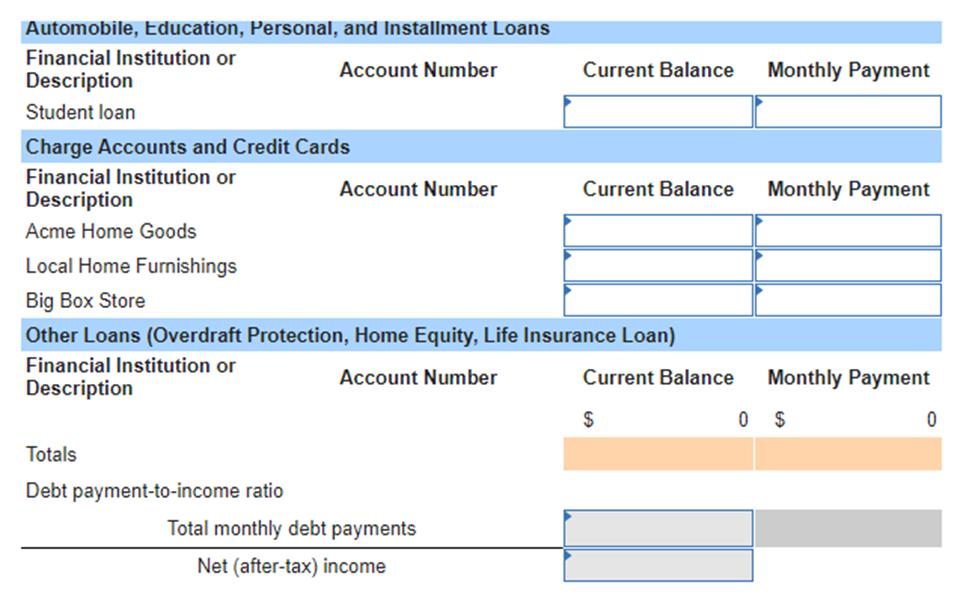

Automobile, Education, Personal, and Installment Loans Financial Institution or Account Number Current Balance Monthly Payment Description Student loan Charge Accounts and Credit Cards Financial Institution or Account Number Current Balance Monthly Payment Description Acme Home Goods Local Home Furnishings Big Box Store Other Loans (Overdraft Protection, Home Equity, Life Insurance Loan) Financial Institution or Account Number Description Totals Debt payment-to-income ratio Total monthly debt payments Net (after-tax) income Current Balance Monthly Payment $ 0 $ 0

Step by Step Solution

3.36 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

To determine Jamie Lees debt paymenttoincome ratio we need to calculate her total monthly debt pay...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started