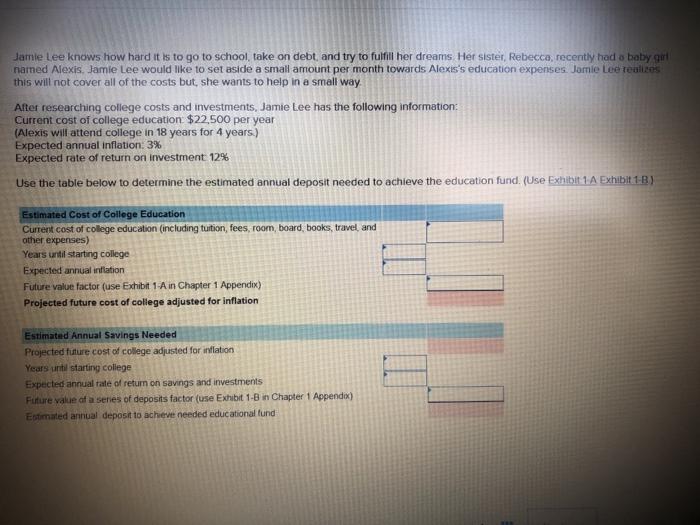

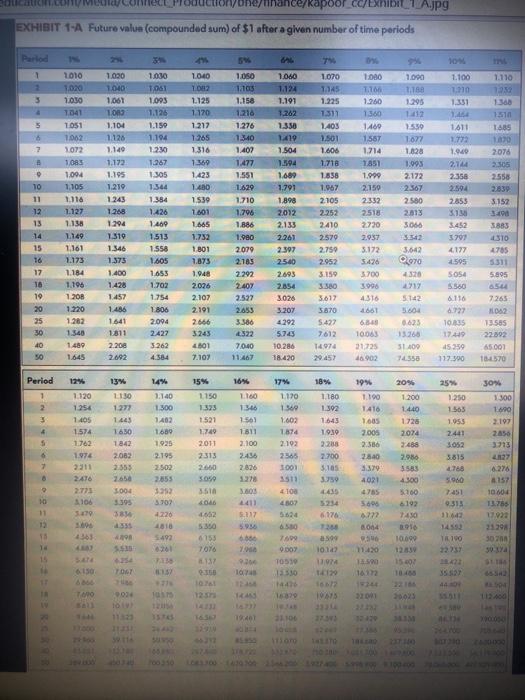

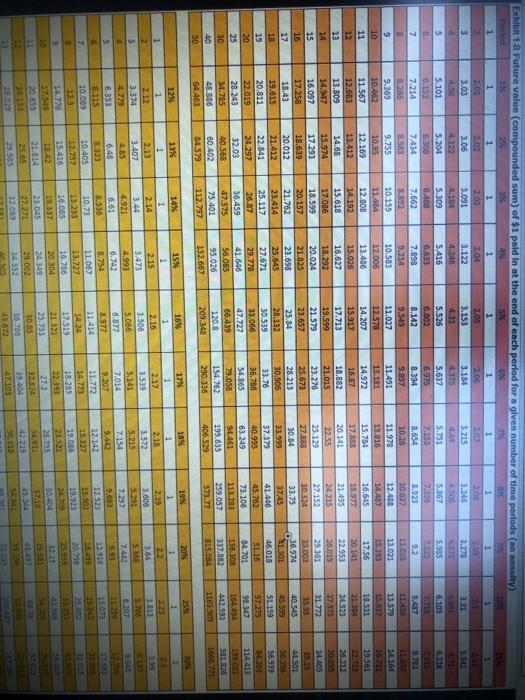

Jamie Lee knows how hard it is to go to school, take on debt, and try to fulfill her dreams Her sister, Rebecca, recently had a baby got narned Alexis. Jamie Lee would like to set aside a small amount per month towards Alexis's education expenses. Jamie Lee tealiens this will not cover all of the costs but, she wants to help in a small way After researching college costs and investments, Jamie Lee has the following information: Current cost of college education $22,500 per year (Alexis will attend college in 18 years for 4 years.) Expected annual inflation: 3% Expected rate of return on investment 12% Use the table below to determine the estimated annual deposit needed to achieve the education fund. (Use Exhibit 1 A Exhibit) Estimated Cost of College Education Current cost of college education (including tuition fees, room, board, books, travel and other expenses) Years until starting college Expected annual inflation Future value factor (use Exhibit 1 A in Chapter 1 Appendix) Projected future cost of college adjusted for inflation Estimated Annual Savings Needed Projected tuture cost of college adjusted for inflation Years uit starting college Expected annual rate of return on savings and investments Future value of a series of deposits factor (use Exhibit 1-B in Chapter 1 Appendix) Estimated annual deposit to acheve needed educational fund kapoor cc/ExhibAJPG EXHIBIT 1-A Future value (compounded sum) of $1 after a given number of time periods Perlod 1 1.050 1.090 1.110 1.100 . 1.331 3 1.366 5 5 8 2 1611 1.772 1.000 2.144 1.060 1.124 1.191 1.262 1.350 1419 1.504 1.594 1.609 1.791 1.898 2012 2.133 1885 1870 2070 2305 2.558 2639 3.152 2.356 2010 1020 1.030 1041 1051 1.062 1072 1,083 1.094 1,105 1116 1.127 1.138 1149 1.161 1.173 1.184 1.196 1.200 1.220 1.262 1.340 1.489 1.645 1.030 1061 1.093 1.126 1.150 1.194 1.230 1.267 1.305 1.344 1.384 1.426 1.460 1513 1.558 1.605 1055 1702 1754 1806 10 11 1.030 1.040 1.067 100 1.104 1.126 1.149 1.172 1.195 1.210 1.243 1.268 1294 1.310 1.346 1.373 1.400 1428 1.457 1.486 1641 1811 2.200 2.092 1040 102 1.125 1.170 1.217 1265 1316 1.360 1.423 1.430 1539 1601 1.665 1.752 1.801 1.875 1.948 2.026 2.107 2191 2666 3245 1.295 1412 1559 1077 1628 1.095 2.172 2.367 2.580 2013 3066 12 13 1.158 1.216 1.276 13.10 1.407 1.477 1.551 1.629 1.710 1.796 1.886 1.080 2.079 2.185 2.292 2.407 2.527 2.653 3.386 4322 7040 1.070 1345 1.225 1.317 1405 1.501 1.606 1718 1.858 1.967 2105 2.252 2410 2570 2.750 2.952 3.159 3.380 5.617 5870 5.427 7612 14,974 1.000 7.100 1.200 1.360 1400 1.587 1.714 1851 1.999 2.150 2.332 2518 2770 2.937 3.172 5.476 3.700 3.996 4316 4661 6348 10.063 21725 16902 14 2261 3883 310 1705 15 16 17 16 19 2.853 3130 3.452 3797 4.177 2595 S054 5580 8110 3.642 0.970 4320 5895 5.142 8 8 8 8 3 2.397 25.00 2.893 2854 3.026 3.207 4292 5743 10.286 18.420 2004 6423 7265 H02 13.555 22592 65000 1570 2.427 3.262 4.584 10035 17419 45359 117.500 13260 51100 74.550 50 7.107 Period 14% 25% 1 1.250 1.565 1.053 2 3 4 5 13% 1 130 1277 1.445 1650 1842 2012 2555 1120 1.256 1.405 1.574 1.762 1974 2011 2416 2.773 106 270 Soos 4361 1150 1.335 1521 1.749 2011 2315 2660 3050 3:51 6026 42 16% 1160 1.366 1561 1611 2.100 2454 2.826 1.140 1.300 1402 1669 1925 2.195 2.502 2.655 3292 3.102 220 4310 5492 17% 1170 1360 1.602 1.874 2.102 2565 3001 20% 1.200 1440 1728 2074 2458 2.986 18% 1180 1.392 1643 19.30 2.288 2.700 3105 19% 1.190 1416 1085 2.005 2.566 2.840 2379 4021 4785 5696 6722 2014 30% 1300 1690 2.197 2456 3713 2827 6:26 7 2441 3052 3.815 786 51960 3004 3.395 4100 4507 4435 3803 2411 5.117 MO 4300 5.100 6192 7430 1916 10.09 10604 13.78 7.923 1142 49 1.100 6.176 738 399 1017 18 14 15 3000 6.500 7609 0.00 T0519 12530 11420 150 6753 7,076 13 360 1 125 15. 6.15 0467 TO 1985 30 30023 10 1 3.03 9.700 14.164 1022 19.561 Exhibit 1-8 Future value (compounded sum) of $1 paid in at the end of each period for a given number of time periods (an annulty) 2x 6% 1 1 1 1 1 1 1 1 1 1 1 20 2.00 2.03 2.04 2.05 2.00 2.07 2.0 3 21 3.06 3.091 3.122 3.153 3.184 3.215 3.245 3.278 4.06 4.246 4:31 2.379 4.500 5 5.101 5.204 5.309 5.416 5.526 5.637 5.751 5.367 5.385 6.105 6 6.152 5.300 6. AGB 5.633 6.002 6.973 7.153 730 7 7.214 7.434 7.662 7.898 8.142 8.394 8.654 3.923 9.2 9,487 3235 8.583 3.592 9.549 9.897 10.26 10.637 9 9.369 9.755 10.159 10.583 11.027 11.491 11.978 12.488 13.021 13.579 10 10.462 10.95 11.464 12.006 12578 13.181 13.816 14.487 11 11.567 12.169 12.808 13.436 14.207 14.972 15,784 16,645 17.56 18.331 12 12.683 13.412 14.192 15.026 15.917 16.87 17.800 18.977 20.141 13 13.809 14.68 15.618 16.627 17.713 18.882 20.141 21.495 22.953 24.522 14 14.947 15.974 17.086 18.292 19.599 21.015 22.55 25.013 15 16.097 17.293 18.599 20.024 21.579 23.276 25.129 27.152 29.361 31.772 16 17.258 18.639 20.157 21.825 23.657 25.673 27.888 30.324 3595 17 18.43 20.012 21.762 23.698 25.84 28.213 30.84 33.75 36.974 40 545 18 19.615 21.412 23.414 25.645 28.132 30.906 33.999 37.45 1.301 45.599 19 20.811 22.841 25.117 27.671 30 539 33.76 37.379 41.446 46.018 51.159 24.297 26.87 20 29.778 40.995 22.019 33.066 45.252 36.786 $1.10 57 275 25 28.243 32.03 41.646 47.727 36.459 98.347 73.106 54.865 63.249 34,701 94.461 34.785 30 66.439 56.085 40.568 164.4M 47.575 79.058 113.283 95.026 75.401 60.402 48.686 40 337.882 199.635 120.8 154.762 442.591 259.057 406.529 50 1160 315.084 209.348 152.667 64.463 84.579 573.77 290.336 112.797 33 003 26.212 30.00 34 405 19.19 44501 50.700 56.539 5420 114 413 581.126 166871 25 1 15% 1 1 1 2 3 4 5 12% 1 2.12 3.374 4.729 6.353 8115 10.089 14% 1 2.14 3.44 4.921 1 2.15 3.473 4.993 6.742 18% 1 2.18 3.572 5.215 7.154 364 5368 19% 1 2.19 3.000 5.251 7.297 9.682 1520 17% 1 2.17 3.539 5.141 7.014 9.207 11.772 14.773 18.255 22.193 13% 1 2.13 3.407 485 6.48 2 10.405 12.757 15.416 13.42 21.614 25.65 3.013 5704 8.207 1115 15.073 6,61 12.142 12.10 16% 1 2.16 3.506 5.066 6.877 3.977 11.414 14.24 17.519 21.921 25.733 10.55 36.750 43,672 10.73 13.233 10,085 7 25.02 13.923 20.739 19.086 23521 20.755 31.931 25 11.067 13.727 16.786 20.300 24.349 29.092 34352 0.505 10 17.549 20.655 23.045 37.13 22.089 39 404 47.103