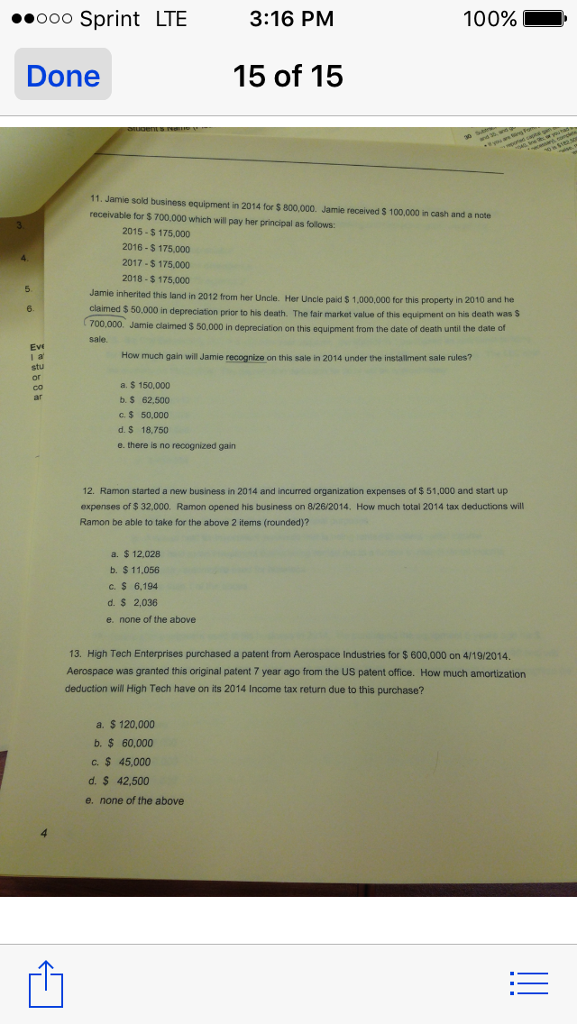

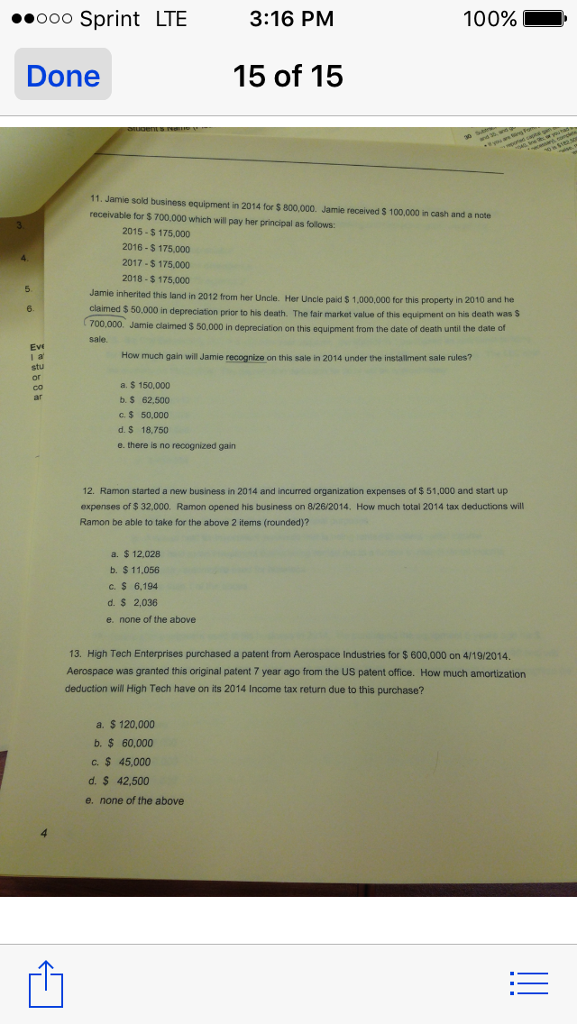

Jamie sold business equipment in 2014 for $800,000. Jamie received $100.000 in cash and a note receivable for $700,000 which will pay her principal as follows: 2015-$ 175,000 2016-$175,000 2017-$175.000 2018-$ 175,000 Jamie inherited this land in 2012 from her uncle. Her Uncle paid $1.000.000 for this property in 2010 and he claimed $50,000 in depreciation prior to his death. The fair market value of this equipment was s on his death $700.000, Jamie claimed $50.000 in depreciation on this equipment from the date of death until the date of sale. How much gain will Jamie recognize on this sale in 2014 under the installment sale rules? a. $150,000 b. $62, 500 c. $50,000 d. $18, 750 e. there is no recognized gain Ramon started a new business in 2014 and incurred organization expenses of $51,000 and start up expenses of $32,000. Ramon opened his business on 8/26/2014. How much total 2014 tax deductions will Ramon be able to take for the above 2 items (rounded)? a. $12, 028 b. $11.056 c. $6.194 d. $2, 036 e. none of the above High Tech Enterprises purchased a patent from Aerospace Industries for $600,000 on 4/19/2014. Aerospace was granted this original patent 7 year ago from the US patent office. How much amortization deduction will High Tech have on its 2014 Income tax return due to this purchase? a. $120,000 b. $60,000 c. $45,000 d. $42, 500 e. none of the above Jamie sold business equipment in 2014 for $800,000. Jamie received $100.000 in cash and a note receivable for $700,000 which will pay her principal as follows: 2015-$ 175,000 2016-$175,000 2017-$175.000 2018-$ 175,000 Jamie inherited this land in 2012 from her uncle. Her Uncle paid $1.000.000 for this property in 2010 and he claimed $50,000 in depreciation prior to his death. The fair market value of this equipment was s on his death $700.000, Jamie claimed $50.000 in depreciation on this equipment from the date of death until the date of sale. How much gain will Jamie recognize on this sale in 2014 under the installment sale rules? a. $150,000 b. $62, 500 c. $50,000 d. $18, 750 e. there is no recognized gain Ramon started a new business in 2014 and incurred organization expenses of $51,000 and start up expenses of $32,000. Ramon opened his business on 8/26/2014. How much total 2014 tax deductions will Ramon be able to take for the above 2 items (rounded)? a. $12, 028 b. $11.056 c. $6.194 d. $2, 036 e. none of the above High Tech Enterprises purchased a patent from Aerospace Industries for $600,000 on 4/19/2014. Aerospace was granted this original patent 7 year ago from the US patent office. How much amortization deduction will High Tech have on its 2014 Income tax return due to this purchase? a. $120,000 b. $60,000 c. $45,000 d. $42, 500 e. none of the above