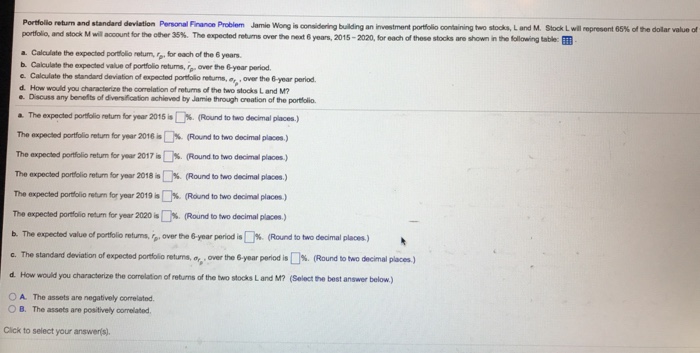

Jamie Wong is considering building an investment portfolio containing two stocks, L and M. Stock L will represent 65% of the and stock M will account for the other 35%. The expected returns over the next 6 years, 2015-2020, for each of these stocks are shown in the following table a. Calculate the expected portfolio return, r_p, for each of the 6 years. b Calculate the expected value of portfolio returns, sigma_t_g over the 6-year period. c Calculate the standard deviation of expected portfolio returns, sigma_t_g, over the 6 year period. d How would you characterize the correlation of returns of the two stocks L and M? e. Discuss any benefits of achieved by Jamie through creation of the portfolio. a The expected portfolio return for year 2015 is % (Round to two decimal places.) The expected portfolio return for year 2016 is % (Round to two decimal places) The expected portfolio return for year 2017 is % (Round to two decimal places) The expected portfolio return for year 2018 is % (Round to two decimal places.) The expected portfolio return for year 2019 is % (Round to two decimal places.) The expected portfolio return for year 2020 is % (Round to two decimal places.) b. The expected value of portfolio returns, r_p over the 6-year period is % (Round two decimal places) c The standard deviation of expected portfolio returns, er_p over the 6-year period is Round no two decimal places) d How would you characterize the correlation of returns of the two stocks L and M? (Select the best answer below.) A The assets are negatively correlated. B. The assets are positively correlated. Jamie Wong is considering building an investment portfolio containing two stocks, L and M. Stock L will represent 65% of the and stock M will account for the other 35%. The expected returns over the next 6 years, 2015-2020, for each of these stocks are shown in the following table a. Calculate the expected portfolio return, r_p, for each of the 6 years. b Calculate the expected value of portfolio returns, sigma_t_g over the 6-year period. c Calculate the standard deviation of expected portfolio returns, sigma_t_g, over the 6 year period. d How would you characterize the correlation of returns of the two stocks L and M? e. Discuss any benefits of achieved by Jamie through creation of the portfolio. a The expected portfolio return for year 2015 is % (Round to two decimal places.) The expected portfolio return for year 2016 is % (Round to two decimal places) The expected portfolio return for year 2017 is % (Round to two decimal places) The expected portfolio return for year 2018 is % (Round to two decimal places.) The expected portfolio return for year 2019 is % (Round to two decimal places.) The expected portfolio return for year 2020 is % (Round to two decimal places.) b. The expected value of portfolio returns, r_p over the 6-year period is % (Round two decimal places) c The standard deviation of expected portfolio returns, er_p over the 6-year period is Round no two decimal places) d How would you characterize the correlation of returns of the two stocks L and M? (Select the best answer below.) A The assets are negatively correlated. B. The assets are positively correlated