Answered step by step

Verified Expert Solution

Question

1 Approved Answer

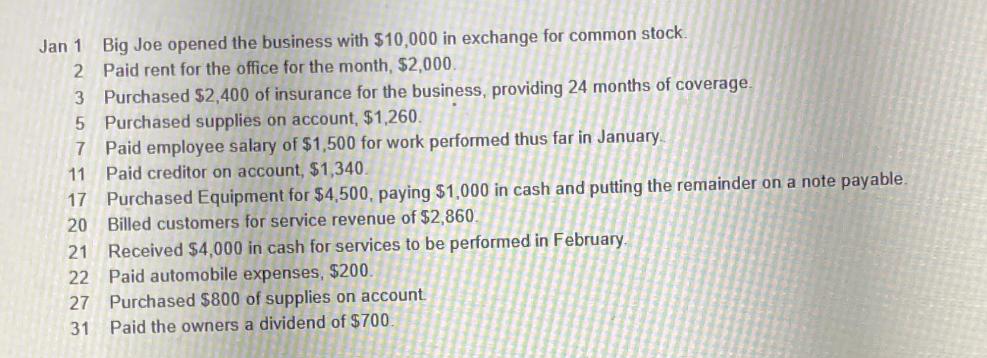

Jan 1 Big Joe opened the business with $10,000 in exchange for common stock. 2 Paid rent for the office for the month, $2,000.

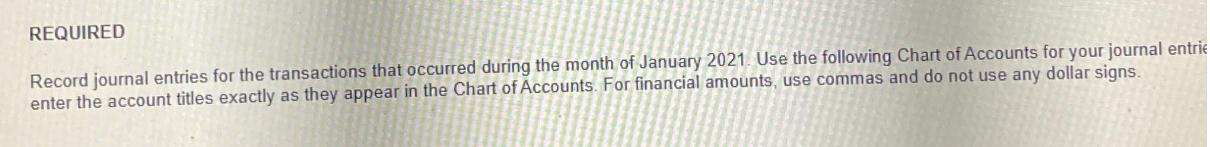

Jan 1 Big Joe opened the business with $10,000 in exchange for common stock. 2 Paid rent for the office for the month, $2,000. 3 Purchased $2,400 of insurance for the business, providing 24 months of coverage. 5 Purchased supplies on account, $1,260. 7 Paid employee salary of $1,500 for work performed thus far in January 17 Purchased Equipment for $4,500, paying $1,000 in cash and putting the remainder on a note payable. 11 Paid creditor on account, $1,340. 20 Billed customers for service revenue of $2,860. 21 Received $4,000 in cash for services to be performed in February. 22 Paid automobile expenses, $200. 27 Purchased $800 of supplies on account. 31 Paid the owners a dividend of $700. REQUIRED Record journal entries for the transactions that occurred during the month of January 2021. Use the following Chart of Accounts for your journal entrie enter the account titles exactly as they appear in the Chart of Accounts. For financial amounts, use commas and do not use any dollar signs.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Jan 1 Big Joe opened the business with 10000 in exchange for common stock Journal Entry Debit Cash 10000 Credit Common Stock 10000 Explanation This transaction reflects the initial investment made b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started