Answered step by step

Verified Expert Solution

Question

1 Approved Answer

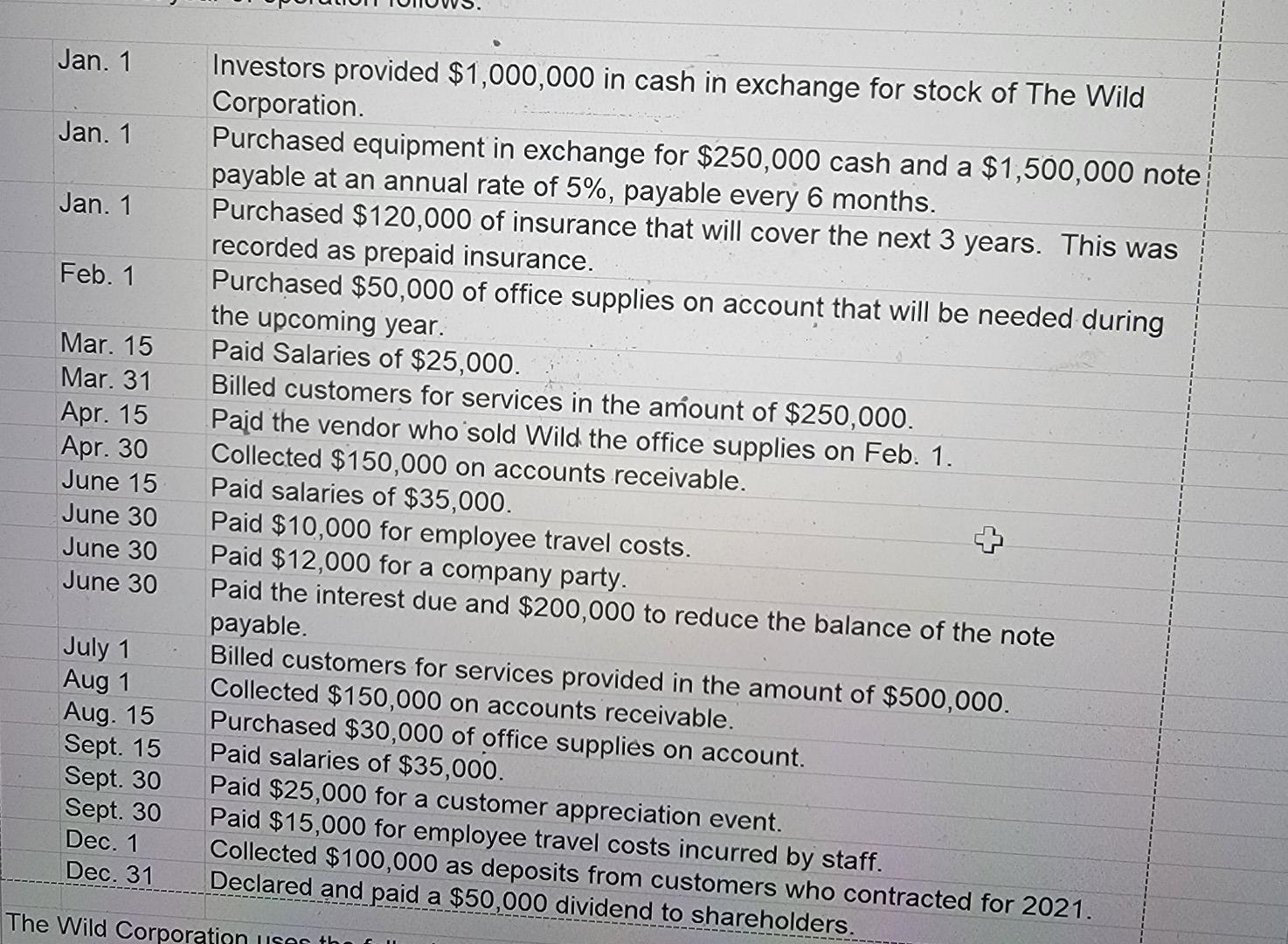

Jan. 1 Investors provided $1,000,000 in cash in exchange for stock of The Wild Corporation Jan. 1 Purchased equipment in exchange for $250,000 cash and

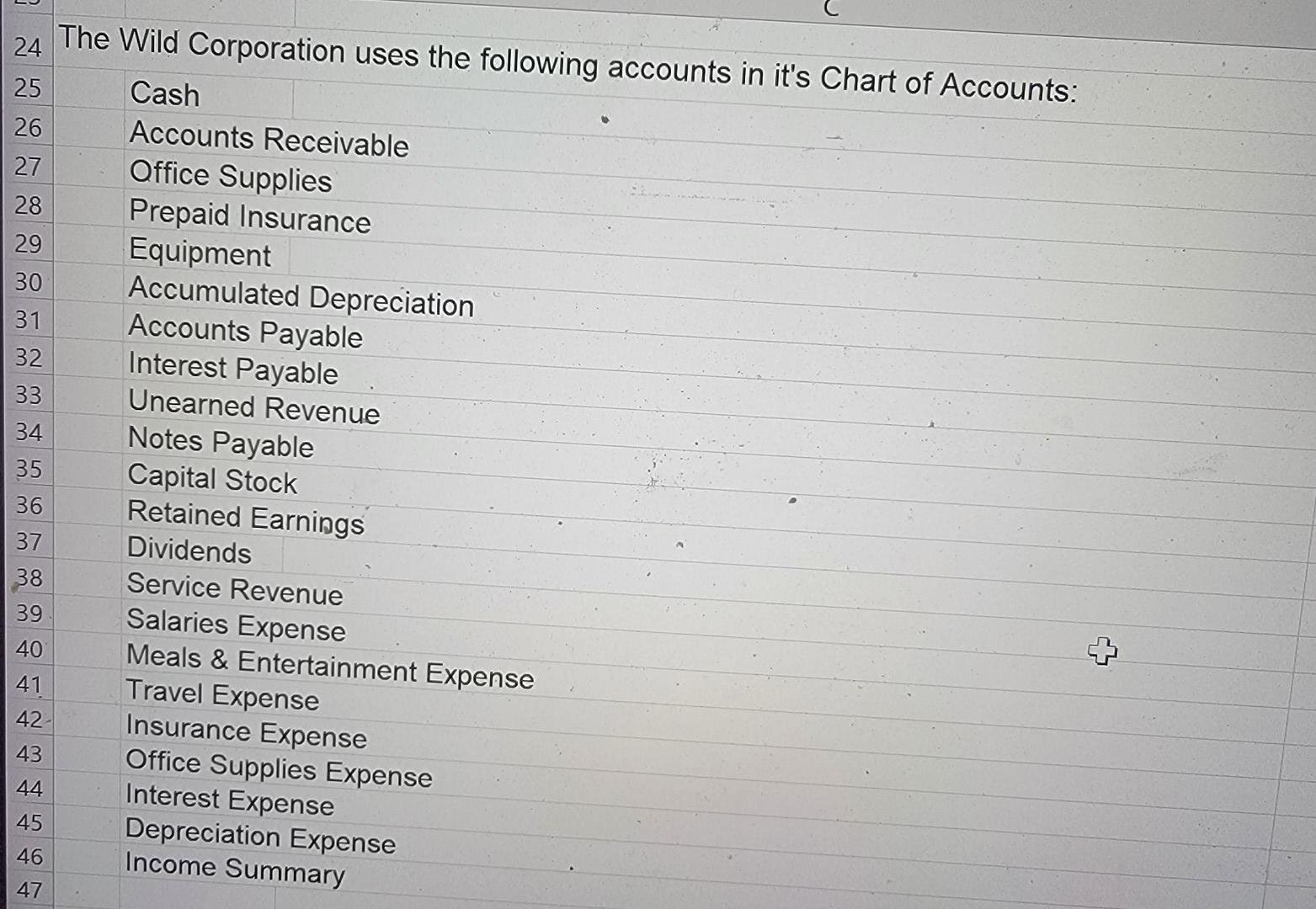

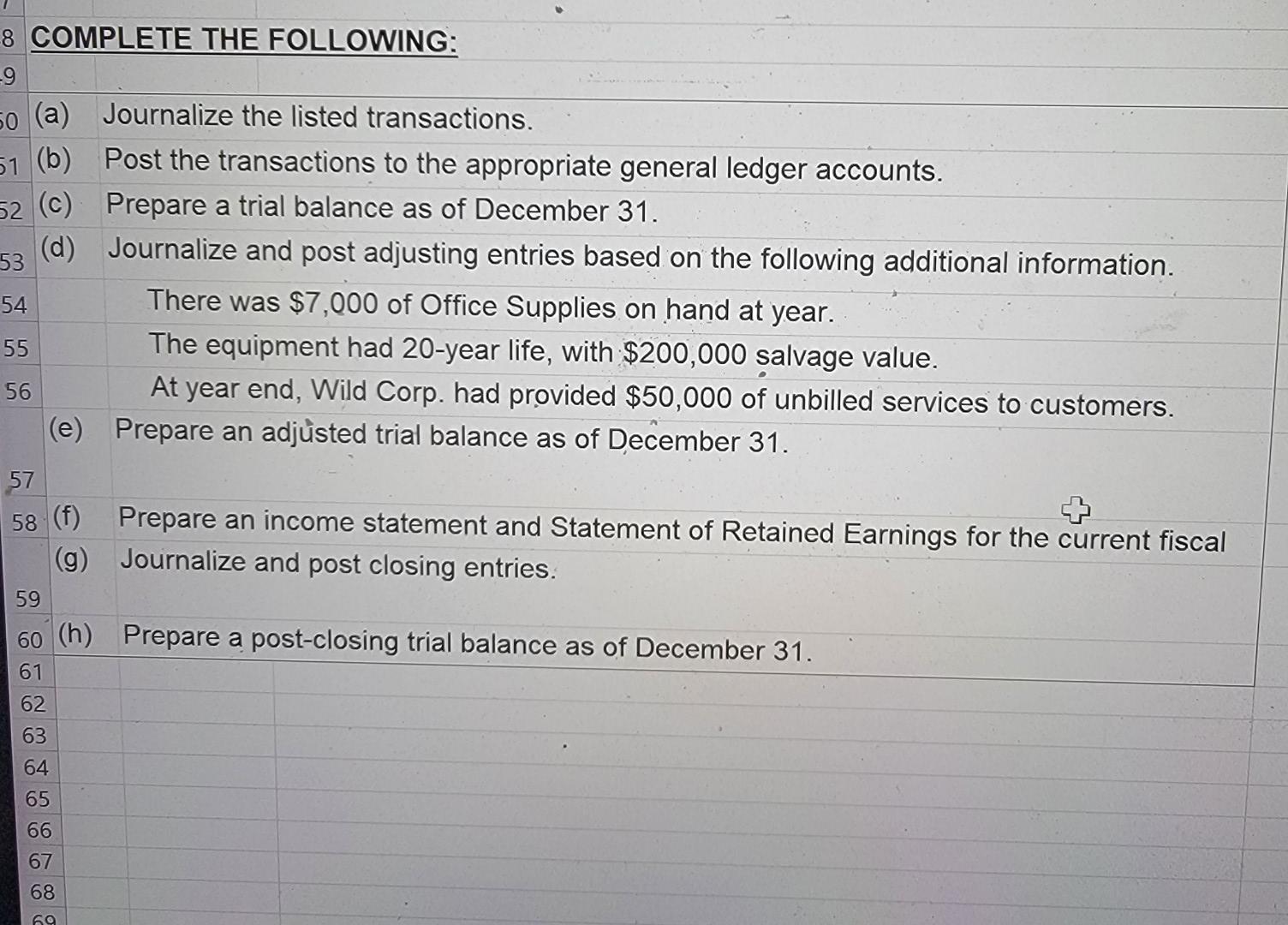

Jan. 1 Investors provided $1,000,000 in cash in exchange for stock of The Wild Corporation Jan. 1 Purchased equipment in exchange for $250,000 cash and a $1,500,000 note payable at an annual rate of 5%, payable every 6 months. Jan. 1 Purchased $120,000 of insurance that will cover the next 3 years. This was recorded as prepaid insurance. Feb. 1 Purchased $50,000 of office supplies on account that will be needed during the upcoming year. Mar. 15 Paid Salaries of $25,000. Mar. 31 Billed customers for services in the amount of $250,000. Apr. 15 Paid the vendor who sold Wild the office supplies on Feb. 1. Apr. 30 Collected $150,000 on accounts receivable. June 15 Paid salaries of $35,000. June 30 Paid $10,000 for employee travel costs. June 30 Paid $12,000 for a company party. June 30 Paid the interest due and $200,000 to reduce the balance of the note payable. July 1 Billed customers for services provided in the amount of $500,000. Aug 1 Collected $150,000 on accounts receivable. Aug. 15 Purchased $30,000 of office supplies on account. Sept. 15 Paid salaries of $35,000. Sept. 30 Paid $25,000 for a customer appreciation event. Sept. 30 Paid $15,000 for employee travel costs incurred by staff. Dec. 1 Collected $100,000 as deposits from customers who contracted for 2021. Dec. 31 Declared and paid a $50,000 dividend to shareholders. The Wild Corporation uses the 24 The Wild Corporation uses the following accounts in it's Chart of Accounts: 25 Cash 26 Accounts Receivable 27 Office Supplies 28 Prepaid Insurance 29 Equipment 30 Accumulated Depreciation 31 Accounts Payable 32 Interest Payable 33 Unearned Revenue 34 Notes Payable 35 Capital Stock 36 Retained Earnings 37 Dividends 38 Service Revenue 39 Salaries Expense 40 Meals & Entertainment Expense 41 Travel Expense Insurance Expense Office Supplies Expense Interest Expense 45 Depreciation Expense 46 Income Summary 42 43 44 47 8 COMPLETE THE FOLLOWING: -9 50 (a) Journalize the listed transactions. 51 (b) Post the transactions to the appropriate general ledger accounts. 52 C Prepare a trial balance as of December 31. 53 (d) Journalize and post adjusting entries based on the following additional information. 54 There was $7,000 of Office Supplies on hand at year. 55 The equipment had 20-year life, with $200,000 salvage value. 56 At year end, Wild Corp. had provided $50,000 of unbilled services to customers. (e) Prepare an adjusted trial balance as of December 31. 57 58 (f) Prepare an income statement and Statement of Retained Earnings for the current fiscal (g) Journalize and post closing entries. 59 60 (h) Prepare a post-closing trial balance as of December 31. 61 62 63 64 65 66 67 68 60

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started