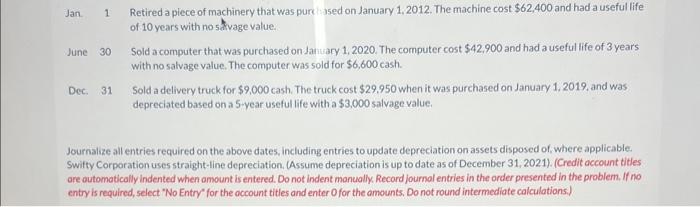

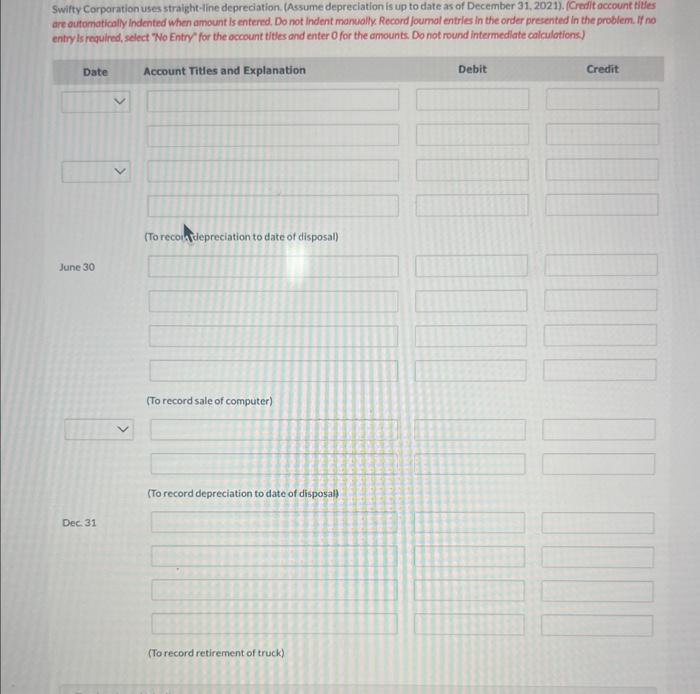

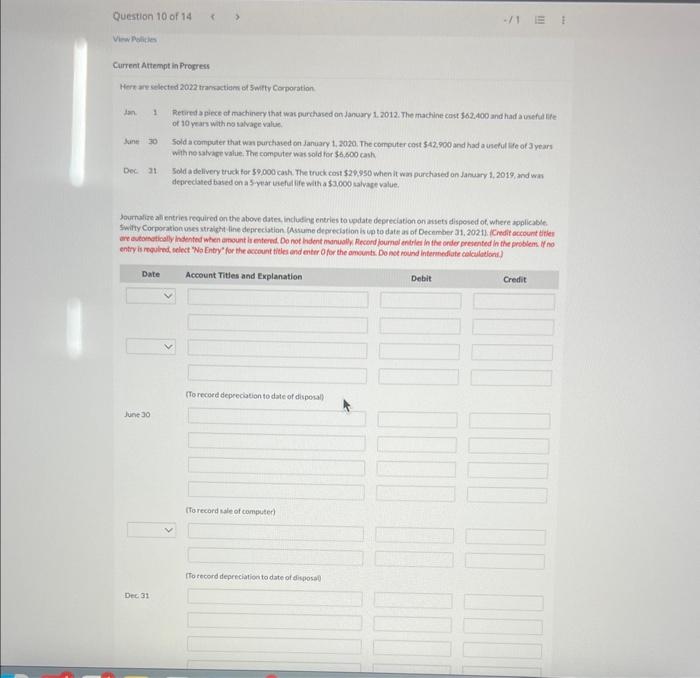

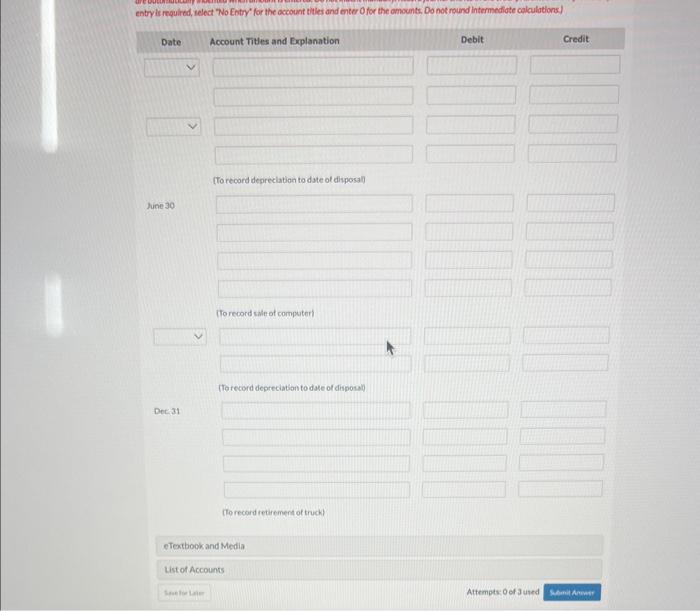

Jan. 1 Retired a piece of machinery that was purk ased on lanuary 1,2012 . The machine cost $62,400 and had a useful life of 10 years with no 5 mivage value. June 30 Sold a computer that was purchased on danuary 1, 2020. The computer cost $42.900 and had a useful life of 3 years with no salvage value. The computer was sold for $6,600 cash. Dec. 31 Sold a delivery truck for $9,000 cash. The truck cost $29,950 when it was purchased on January 1, 2019, and was depreciated based on a 5 -year useful life with a $3,000 salvage value. Journalize all entries required on the above dates, including entries to update depreciation on assets disposed of, where applicable. Swifty Corporation uses straight-line depreciation. (Assume depreciation is up to date as of December 31, 2021). (Credit account titles ore outomatically indented when omount is entered. Do not indent monually. Record journol entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Do not round intermediate calculations.) Swifty Corporation uses straight-line depredation. (Assume depreciation is up to date as of December 31, 2021). (Crefit occount nites Swifty Corporation uses straight-line depreciation. (Assume depreciation is up to date as of December 31, 2021).Crefitoctount Hiles Current Attempt in Procress Hert are selected 2022 tramactiam of Feity Comporation Inh. 1 Retired a piece of machinecy that was furchased on danuary 1. 2012. The machine cast 562 . 400 and had a unehat life of 10 yeara with nolvage value Sane 30 Sold a compoter that wou porhased on January 1, 2070. The computer cont 542.900 and had a uneful let of 3 years with ne salvine value. The computer warsold tor $6,600cash Dec It Sold a delivery tuck tor 59,000 cash. The truck cost 529,950 when it was purchased on January 1, 2019 , and wan depredated tased on a syear iaefulife witha $3,000 aalvage value. dournalize all entries reguired on the above dates, includine entries tougdate depreciation on aisets disposed of, where applicable. Swifty Corporation uses tralght -ine depreciation (hassume depreciation is cp to date as of December a1, 2021) (Credif account tiblen entry is moquled neinct "No Entry" for the account titles and enter O for the anounts. Do not round interinediate celealaeions.) entry is required, relect 'No Enty' for the account titles and enter O for the omounts, Do not round intermediote calculations:)