Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jan. 29 Cash:$16,695 P-F:11-27 A Joumalizing liability transactions (Leaming Objectives 1, 3) The following transactions of Plymouth Pharmacies occurred during 2023 and 2024: 2023 Jan.

Jan. 29 Cash:$16,695

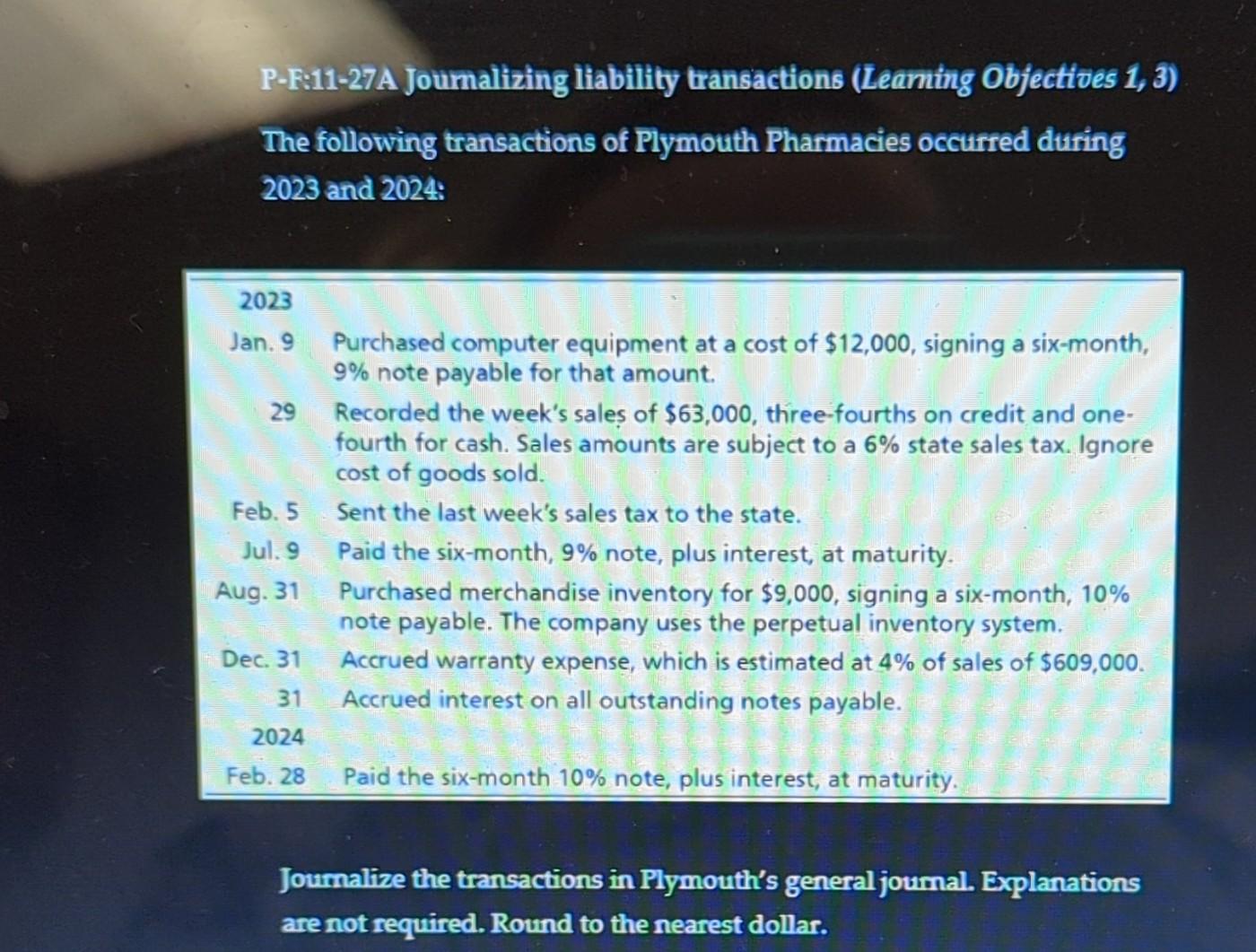

P-F:11-27 A Joumalizing liability transactions (Leaming Objectives 1, 3) The following transactions of Plymouth Pharmacies occurred during 2023 and 2024: 2023 Jan. 9 Purchased computer equipment at a cost of $12,000, signing a six-month, 9% note payable for that amount. 29 Recorded the week's sale of $63,000, three-fourths on credit and onefourth for cash. Sales amounts are subject to a 6% state sales tax. Ignore cost of goods sold. Feb. 5 Sent the last week's sales tax to the state. Jul. 9 Paid the six-month, 9% note, plus interest, at maturity. Aug. 31 Purchased merchandise inventory for $9,000, signing a six-month, 10% note payable. The company uses the perpetual inventory system. Dec. 31 Accrued warranty expense, which is estimated at 4% of sales of $609,000. 31 Accrued interest on all outstanding notes payable. 2024 Feb. 28 Paid the six-month 10% note, plus interest, at maturity. Joumalize the transactions in Plymouth's general joumal. Explanations are not required. Round to the nearest dollarStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started