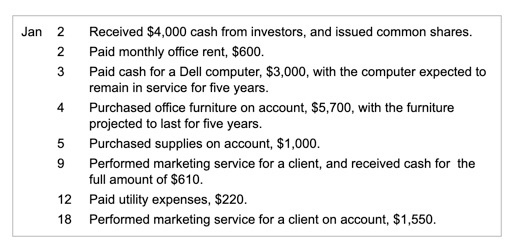

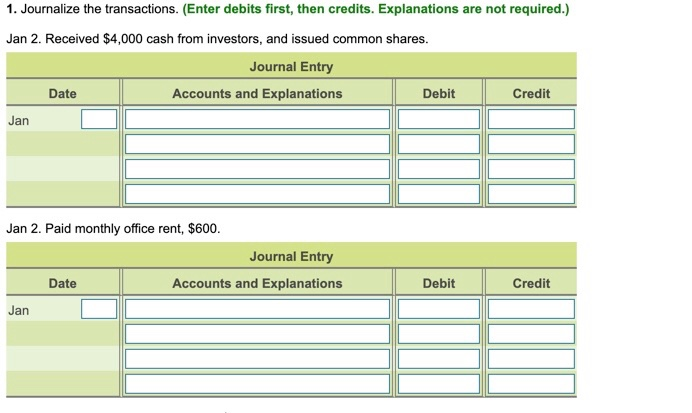

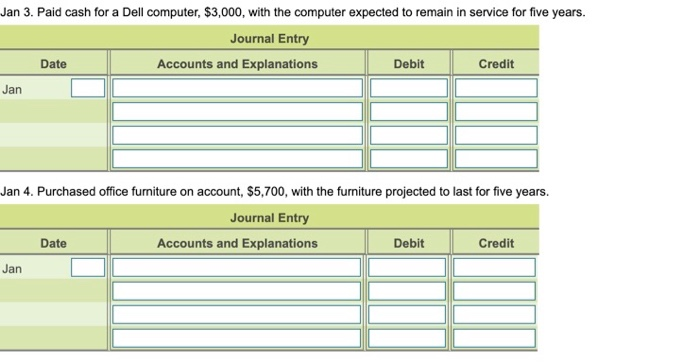

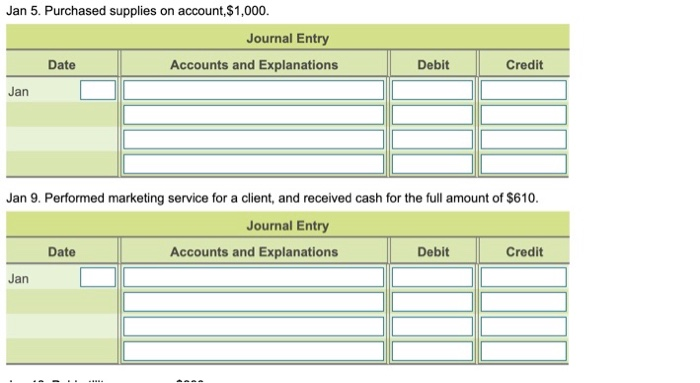

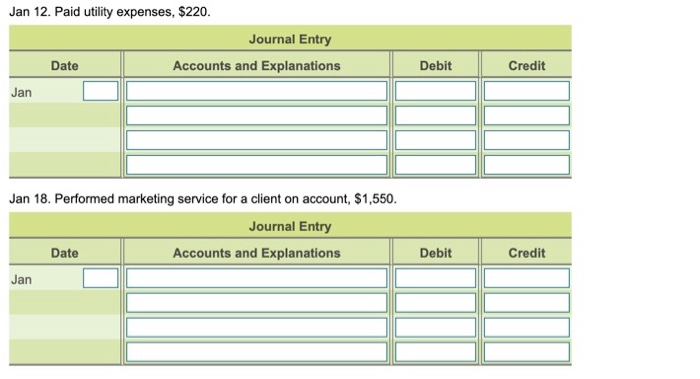

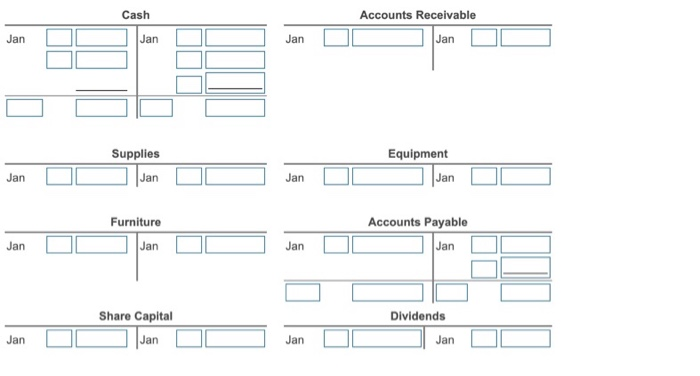

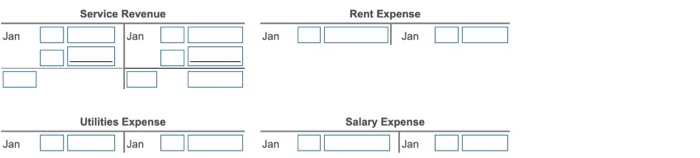

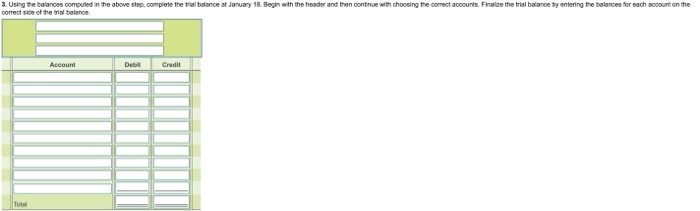

Jan 3 4 2 Received $4,000 cash from investors, and issued common shares. 2 Paid monthly office rent, $600. Paid cash for a Dell computer, $3,000, with the computer expected to remain in service for five years. Purchased office furniture on account, $5,700, with the furniture projected to last for five years. 5 Purchased supplies on account, $1,000. 9 Performed marketing service for a client, and received cash for the full amount of $610. 12 Paid utility expenses, $220. 18 Performed marketing service for a client on account, $1,550. 1. Journalize the transactions. (Enter debits first, then credits. Explanations are not required.) Jan 2. Received $4,000 cash from investors, and issued common shares. Journal Entry Date Accounts and Explanations Debit Credit Jan Jan 2. Paid monthly office rent, $600. Journal Entry Date Accounts and Explanations Jan Debit Credit Jan 3. Paid cash for a Dell computer, $3,000, with the computer expected to remain in service for five years. Journal Entry Accounts and Explanations Debit Credit Date Jan Jan 4. Purchased office furniture on account, $5,700, with the furniture projected to last for five years. Journal Entry Date Accounts and Explanations Debit Credit Jan Jan 5. Purchased supplies on account $1,000. Journal Entry Date Accounts and Explanations Jan Debit Credit Jan 9. Performed marketing service for a client, and received cash for the full amount of $610. Journal Entry Date Accounts and Explanations Debit Credit Jan Jan 12. Paid utility expenses, $220. Journal Entry Accounts and Explanations Jan Date Debit Credit Jan 18. Performed marketing service for a client on account, $1,550. Journal Entry Date Accounts and Explanations Jan Debit Credit Cash Accounts Receivable Jan Jan Jan Jan Supplies Jan Equipment Jan Jan Jan Furniture Accounts Payable Jan Jan Jan Jan Share Capital Dividends Jan Jan Jan Jan Service Revenue Jan Rent Expense Jan Jan Jan Utilities Expense Salary Expense Jan Jan Jan Jan 3. Using the balances computed in the above step, complete the trial balance at January 18. Begin with the header and then continue with choosing the correct accounts. Finalize the trial balance by entering the balances for each account on the correct side of the trial balance Account Debit Credit To