Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jan. 3 Sell merchandise on account to B. Corpas $3,900, invoice no. 510, and to J. Revere $2,000, invoice no. 511. 5 Purchase merchandise from

| Jan. | 3 | Sell merchandise on account to B. Corpas $3,900, invoice no. 510, and to J. Revere $2,000, invoice no. 511. | ||

| 5 | Purchase merchandise from S. Gamel $5,000 and D. Posey $2,100, terms n/30. | |||

| 7 | Receive checks from S. Mahay $3,600 and B. Santos $2,000 after discount period has lapsed. | |||

| 8 | Pay freight on merchandise purchased $230. | |||

| 9 | Send checks to S. Meek for $10,000 less 2% cash discount, and to D. Saito for $9,000 less 1% cash discount. | |||

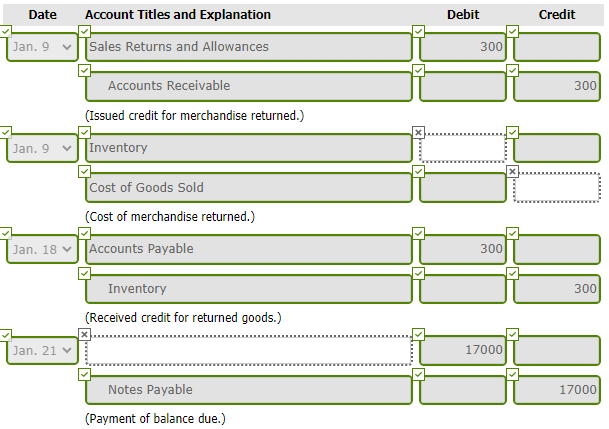

| 9 | Issue credit of $300 to J. Revere for merchandise returned. | |||

| 10 | Daily cash sales from January 1 to January 10 total $18,000. Make one journal entry for these sales. | |||

| 11 | Sell merchandise on account to R. Beltre $1,200, invoice no. 512, and to S. Mahay $900, invoice no. 513. | |||

| 12 | Pay rent of $1,600 for January. | |||

| 13 | Receive payment in full from B. Corpas and J. Revere less cash discounts. | |||

| 15 | Withdraw $800 cash by M. Carla Vista for personal use. | |||

| 15 | Post all entries to the subsidiary ledgers. | |||

| 16 | Purchase merchandise from D. Saito $16,000, terms 1/10, n/30; S. Meek $14,200, terms 2/10, n/30; and S. Gamel $1,400, terms n/30. | |||

| 17 | Pay $400 cash for office supplies. | |||

| 18 | Return $300 of merchandise to S. Meek and receive credit. | |||

| 20 | Daily cash sales from January 11 to January 20 total $22,600. Make one journal entry for these sales. | |||

| 21 | Issue $17,000 note, maturing in 90 days, to R. Moses in payment of balance due. | |||

| 21 | Receive payment in full from S. Mahay less cash discount. | |||

| 22 | Sell merchandise on account to B. Corpas $2,700, invoice no. 514, and to R. Beltre $2,100, invoice no. 515. | |||

| 22 | Post all entries to the subsidiary ledgers. | |||

| 23 | Send checks to D. Saito and S. Meek in full payment less cash discounts. | |||

| 25 | Sell merchandise on account to B. Santos $4,000, invoice no. 516, and to J. Revere $6,300, invoice no. 517. | |||

| 27 | Purchase merchandise from D. Saito $14,100, terms 1/10, n/30; D. Posey $3,200, terms n/30; and S. Gamel $5,600, terms n/30. | |||

| 27 | Post all entries to the subsidiary ledgers. | |||

| 28 | Pay $200 cash for office supplies. | |||

| 31 | Daily cash sales from January 21 to January 31 total $21,600. Make one journal entry for these sales. | |||

| 31 | Pay sales salaries $5,000 and office salaries $3,200. |

Record the January transactions in a two-column general journal. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.)

Date Account Titles and Explanation Debit Credit Jan. 9 Sales Returns and Allowances 300 Accounts Receivable 300 (Issued credit for merchandise returned.) Jan. 9 Inventory II Cost of Goods Sold (Cost of merchandise returned.) Jan. 18 v Accounts Payable 300 300 Inventory (Received credit for returned goods.) Jan. 21 REX ___ 17000 17000 Notes Payable (Payment of balance due.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started