Question

Jan entered into a house insurance contract with ABC Insurance. Many of the questions in the proposal, completed before the policy was issued, asked about

Jan entered into a house insurance contract with ABC Insurance. Many of the questions in the proposal, completed before the policy was issued, asked about the age, building materials and condition of the house. Jan answered all these questions accurately. One of the questions asked:

Is there any other information about the house that is relevant to the insurance in question?

Jan answered nil to this question.

Over the past few years Jan had been collecting fireworks with the intention of saving them for her 50th birthday party celebration. The fireworks are stored in the attic of her house. When Jan completed the proposal, she forgot about the fireworks and in any event she did not consider this was something the insurance company would need to know about.

Last week Jans house was completely destroyed by fire. A small kitchen fire accelerated quickly when it reached the attic and the fireworks exploded. Jan made a claim on her insurance policy. The insurance company has declined Jans claim and refuse to pay out on the policy. Advise Jan.

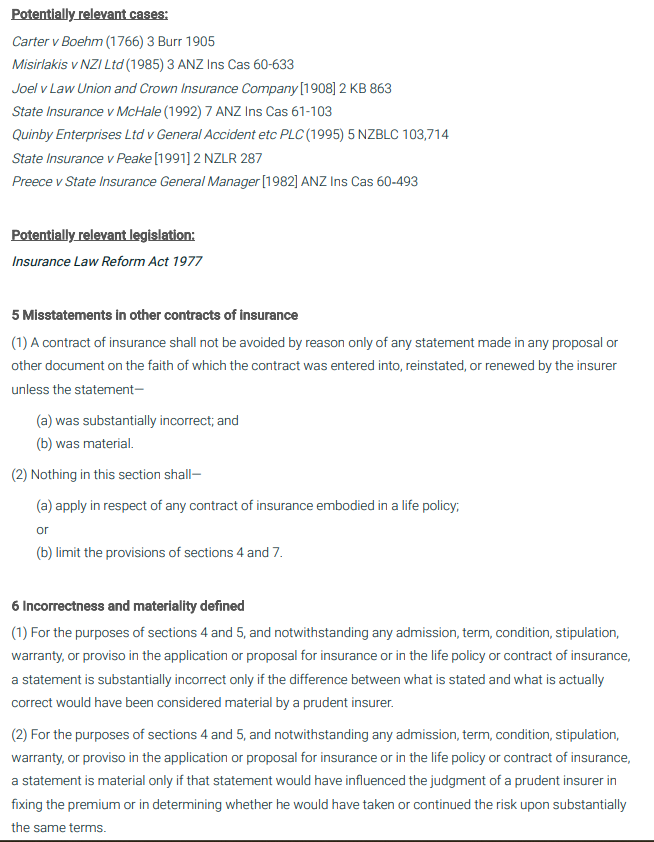

Potentially relevant cases: Carter v Boehm (1766) 3 Burr 1905 Misirlakis v NZI Ltd (1985) 3 ANZ Ins Cas 60-633 Joel v Law Union and Crown Insurance Company [1908] 2 KB 863 State Insurance v McHale (1992) 7 ANZ Ins Cas 61-103 Quinby Enterprises Ltd v General Accident etc PLC(1995) 5 NZBLC 103,714 State Insurance v Peake [1991] 2 NZLR 287 Preece v State Insurance General Manager [1982] ANZ Ins Cas 60-493 Potentially relevant legislation: Insurance Law Reform Act 1977 5 Misstatements in other contracts of insurance (1) A contract of insurance shall not be avoided by reason only of any statement made in any proposal or other document on the faith of which the contract was entered into, reinstated, or renewed by the insurer unless the statement- (a) was substantially incorrect; and (b) was material. (2) Nothing in this section shall- (a) apply in respect of any contract of insurance embodied in a life policy; or (b) limit the provisions of sections 4 and 7 . 6 Incorrectness and materiality defined (1) For the purposes of sections 4 and 5, and notwithstanding any admission, term, condition, stipulation, warranty, or proviso in the application or proposal for insurance or in the life policy or contract of insurance, a statement is substantially incorrect only if the difference between what is stated and what is actually correct would have been considered material by a prudent insurer. (2) For the purposes of sections 4 and 5, and notwithstanding any admission, term, condition, stipulation, warranty, or proviso in the application or proposal for insurance or in the life policy or contract of insurance, a statement is material only if that statement would have influenced the judgment of a prudent insurer in fixing the premium or in determining whether he would have taken or continued the risk upon substantially the same terms

Potentially relevant cases: Carter v Boehm (1766) 3 Burr 1905 Misirlakis v NZI Ltd (1985) 3 ANZ Ins Cas 60-633 Joel v Law Union and Crown Insurance Company [1908] 2 KB 863 State Insurance v McHale (1992) 7 ANZ Ins Cas 61-103 Quinby Enterprises Ltd v General Accident etc PLC(1995) 5 NZBLC 103,714 State Insurance v Peake [1991] 2 NZLR 287 Preece v State Insurance General Manager [1982] ANZ Ins Cas 60-493 Potentially relevant legislation: Insurance Law Reform Act 1977 5 Misstatements in other contracts of insurance (1) A contract of insurance shall not be avoided by reason only of any statement made in any proposal or other document on the faith of which the contract was entered into, reinstated, or renewed by the insurer unless the statement- (a) was substantially incorrect; and (b) was material. (2) Nothing in this section shall- (a) apply in respect of any contract of insurance embodied in a life policy; or (b) limit the provisions of sections 4 and 7 . 6 Incorrectness and materiality defined (1) For the purposes of sections 4 and 5, and notwithstanding any admission, term, condition, stipulation, warranty, or proviso in the application or proposal for insurance or in the life policy or contract of insurance, a statement is substantially incorrect only if the difference between what is stated and what is actually correct would have been considered material by a prudent insurer. (2) For the purposes of sections 4 and 5, and notwithstanding any admission, term, condition, stipulation, warranty, or proviso in the application or proposal for insurance or in the life policy or contract of insurance, a statement is material only if that statement would have influenced the judgment of a prudent insurer in fixing the premium or in determining whether he would have taken or continued the risk upon substantially the same terms Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started