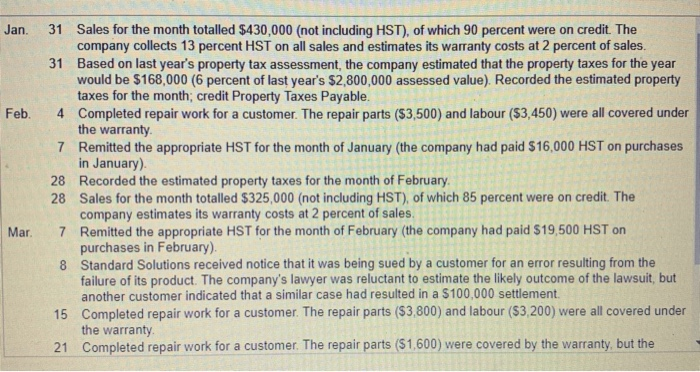

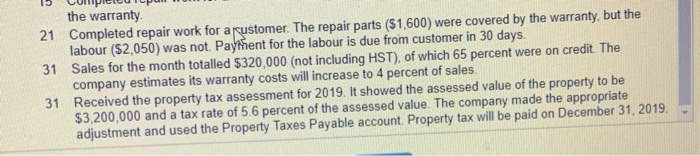

Jan. Feb. 31 Sales for the month totalled $430,000 (not including HST), of which 90 percent were on credit. The company collects 13 percent HST on all sales and estimates its warranty costs at 2 percent of sales. 31 Based on last year's property tax assessment, the company estimated that the property taxes for the year would be $168,000 (6 percent of last year's $2,800,000 assessed value). Recorded the estimated property taxes for the month, credit Property Taxes Payable. 4 Completed repair work for a customer. The repair parts ($3,500) and labour ($3,450) were all covered under the warranty 7 Remitted the appropriate HST for the month of January (the company had paid $16,000 HST on purchases in January) 28 Recorded the estimated property taxes for the month of February 28 Sales for the month totalled $325,000 (not including HST), of which 85 percent were on credit. The company estimates its warranty costs at 2 percent of sales 7 Remitted the appropriate HST for the month of February (the company had paid $19,500 HST on purchases in February) 8 Standard Solutions received notice that it was being sued by a customer for an error resulting from the failure of its product. The company's lawyer was reluctant to estimate the likely outcome of the lawsuit, but another customer indicated that a similar case had resulted in a $100,000 settlement. 15 Completed repair work for a customer. The repair parts ($3,800) and labour ($3,200) were all covered under the warranty 21 Completed repair work for a customer. The repair parts (S1,600) were covered by the warranty, but the Mar 15 the warranty 21 Completed repair work for a customer. The repair parts (51,600) we were covered by the warranty, but the labour ($2,050) was not. Paythent for the labour is due from customer in 30 days. 31 Sales for the month totalled $320,000 (not including HST), of which 65 percent were on credit. The company estimates its warranty costs will increase to 4 percent of sales. 31 Received the property tax assessment for 2019. It showed the assessed value of the property to be $3,200,000 and a tax rate of 5.6 percent of the assessed value. The company made the appropriate adjustment and used the Property Taxes Payable account. Property tax will be paid on December 31, 2019. Required 1. Journalize the above transactions. 2. Show the appropriate financial statement presentation for all liabilities. nor. --- Jan. Feb. 31 Sales for the month totalled $430,000 (not including HST), of which 90 percent were on credit. The company collects 13 percent HST on all sales and estimates its warranty costs at 2 percent of sales. 31 Based on last year's property tax assessment, the company estimated that the property taxes for the year would be $168,000 (6 percent of last year's $2,800,000 assessed value). Recorded the estimated property taxes for the month, credit Property Taxes Payable. 4 Completed repair work for a customer. The repair parts ($3,500) and labour ($3,450) were all covered under the warranty 7 Remitted the appropriate HST for the month of January (the company had paid $16,000 HST on purchases in January) 28 Recorded the estimated property taxes for the month of February 28 Sales for the month totalled $325,000 (not including HST), of which 85 percent were on credit. The company estimates its warranty costs at 2 percent of sales 7 Remitted the appropriate HST for the month of February (the company had paid $19,500 HST on purchases in February) 8 Standard Solutions received notice that it was being sued by a customer for an error resulting from the failure of its product. The company's lawyer was reluctant to estimate the likely outcome of the lawsuit, but another customer indicated that a similar case had resulted in a $100,000 settlement. 15 Completed repair work for a customer. The repair parts ($3,800) and labour ($3,200) were all covered under the warranty 21 Completed repair work for a customer. The repair parts (S1,600) were covered by the warranty, but the Mar 15 the warranty 21 Completed repair work for a customer. The repair parts (51,600) we were covered by the warranty, but the labour ($2,050) was not. Paythent for the labour is due from customer in 30 days. 31 Sales for the month totalled $320,000 (not including HST), of which 65 percent were on credit. The company estimates its warranty costs will increase to 4 percent of sales. 31 Received the property tax assessment for 2019. It showed the assessed value of the property to be $3,200,000 and a tax rate of 5.6 percent of the assessed value. The company made the appropriate adjustment and used the Property Taxes Payable account. Property tax will be paid on December 31, 2019. Required 1. Journalize the above transactions. 2. Show the appropriate financial statement presentation for all liabilities. nor