Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jan owns her own service business and also owns some blue-chip stock. She is starting to retire and she wants her son, Matt, to

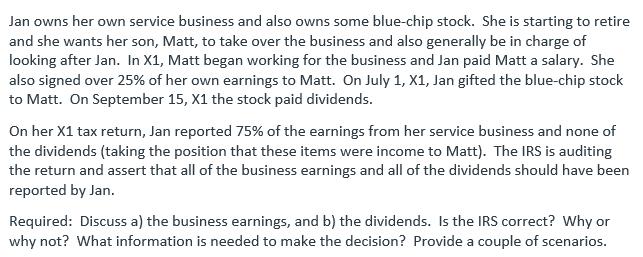

Jan owns her own service business and also owns some blue-chip stock. She is starting to retire and she wants her son, Matt, to take over the business and also generally be in charge of looking after Jan. In X1, Matt began working for the business and Jan paid Matt a salary. She also signed over 25% of her own earnings to Matt. On July 1, X1, Jan gifted the blue-chip stock to Matt. On September 15, X1 the stock paid dividends. On her X1 tax return, Jan reported 75% of the earnings from her service business and none of the dividends (taking the position that these items were income to Matt). The IRS is auditing the return and assert that all of the business earnings and all of the dividends should have been reported by Jan. Required: Discuss a) the business earnings, and b) the dividends. Is the IRS correct? Why or why not? What information is needed to make the decision? Provide a couple of scenarios.

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a The business earnings The IRS is correct that the business earnings should be reported by Jan The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started