Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jan Shumard, president and general manager of Danbury Company, was concerned about the future of one of the company's largest divisions. The division's most recent

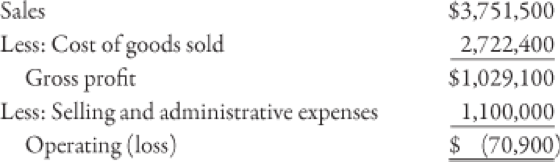

Jan Shumard, president and general manager of Danbury Company, was concerned about the future of one of the company's largest divisions. The division's most recent quarterly income statement follows:

Jan is giving serious consideration to shutting down the division because this is the ninth consecutive quarter that it has shown a loss. To help him in his decision, the following additional information has been gathered:

- The division produces one product at a selling price of $100 to outside parties. The division sells 50% of its output to another division within the company for $83 per unit (full manufacturing cost plus 25%). The internal price is set by company policy. If the division is shut down, the user division will buy the part externally for $100 per unit.

- The fixed overhead assigned per unit is $20.

- There is no alternative use for the facilities if shut down. The facilities and equipment will be sold and the proceeds invested to produce an annuity of $100,000 per year. Of the fixed selling and administrative expenses, 30% represent allocated expenses from corporate headquarters. Variable selling expenses are $5 per unit sold for units sold externally. These expenses are avoided for internal sales. No variable administrative expenses are incurred.

Required:

- Prepare an income statement that more accurately reflects the division's profit performance.

- Should the president shut down the division? What will be the effect on the company's profits if the division is closed?

Please make sure the answer is different from the book's key.

Sales $3,751,500 2,722,400 $1,029,100 1,100,000 $ (70,900) Less: Cost of goods sold Gross profit Less: Selling and administrative expenses Operating (lossStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started