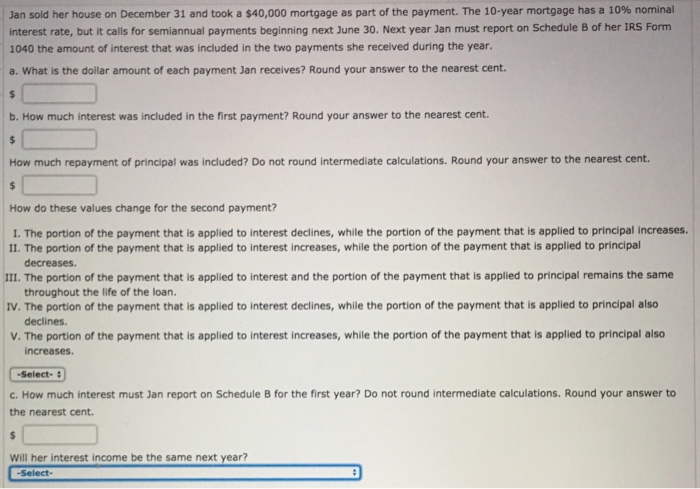

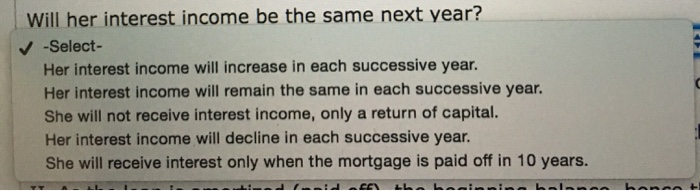

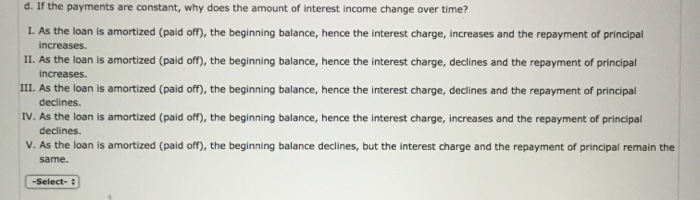

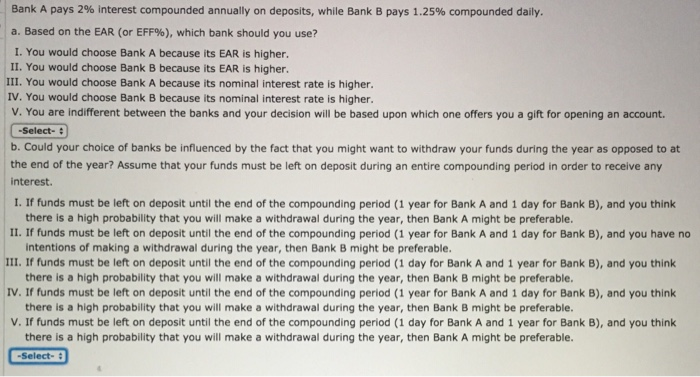

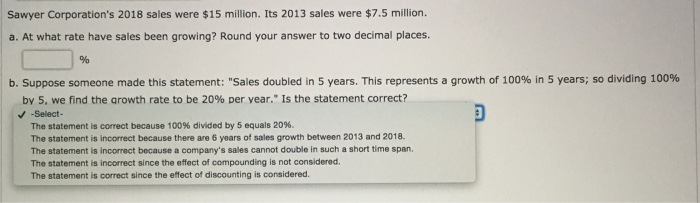

Jan sold her house on December 31 and took a $40,000 mortgage as part of the payment. The 10-year mortgage has a 10% nominal interest rate, but it calls for semiannual payments beginning next June 30. Next year Jan must report on Schedule B of her IRS Form 1040 the amount of interest that was included in the two payments she received during the year. a. What is the dollar amount of each payment Jan receives? Round your answer to the nearest cent $ b. How much interest was included in the first payment? Round your answer to the nearest cent. $ How much repayment of principal was included? Do not round intermediate calculations. Round your answer to the nearest cent. $ How do these values change for the second payment? I. The portion of the payment that is applied to interest declines, while the portion of the payment that is applied to principal increases. I1. The portion of the payment that is applied to interest increases, while the portion of the payment that is applied to principal decreases. III. The portion of the payment that is applied to interest and the portion of the payment that is applied to principal remains the same throughout the life of the loan. IV. The portion of the payment that is applied to interest declines, while the portion of the payment that is applied to principal also declines. v. The portion of the payment that is applied to interest increases, while the portion of the payment that is applied to principal also increases. Select- c. How much interest must Jan report on Schedule B for the first year? Do not round intermediate calculations. Round your answer to the nearest cent $ Will her interest income be the same next year? -Select Will her interest income be the same next year? -Select- Her interest income will increase in each successive year. Her interest income will remain the same in each successive year. She will not receive interest income, only a return of capital. Her interest income will decline in each successive year. She will receive interest only when the mortgage is paid off in 10 years. hance d. If the payments are constant, why does the amount of interest income change over time? I. As the loan is amortized (paid off), the beginning balance, hence the interest charge, increases and the repayment of principal increases. II. As the loan is amortized (paid off), the beginning balance, hence the interest charge, declines and the repayment of principal increases. II. As the loan is amortized (paid off), the beginning balance, hence the interest charge, declines and the repayment of principal declines. IV. As the loan is amortized (paid off), the beginning balance, hence the interest charge, increases and the repayment of principal declines. v. As the loan is amortized (paid off), the beginning balance declines, but the interest charge and the repayment of principal remain the same. -Select- Find the future values of the following ordinary annuities: a. FV of $500 paid each 6 months for 5 years at a nominal rate of 12% compounded semiannually. Do not round intermediate calculations. Round your answer to the nearest cent. $ b. FV of $250 paid each 3 months for 5 years at a nominal rate of 12 % compounded quarterly. Do not round intermediate calculations. Round your answer to the nearest cent c. These annuities receive the same amount of cash during the 5-year period and earn interest at the same nominal rate, yet the annuity in partb ends up larger than the one in part a. Why does this occur? -Select The nominal deposits intthe annuity in part (b) are greater than the nominal deposits into the annuity in part (a). The annuity in part (a) is compounded less frequently; therefore, more interest is earned on previously-earned interest The annuity in part ja) is compounded more frequently; therefore, more interest is earned on previously-earned interest. The annuity in part b) is compounded less frequently; therefore, more interest is earned on previously-earned interest The annuity in part (b) is compounded more frequently: therefore, more interest is earned on previously-earned interest. Check My Work (3 remaining) Bank A pays 2 % interest compounded annually on deposits, while Bank B pays 1.25 % compounded daily. a. Based on the EAR (or EFF%), which bank should you use? I. You would choose Bank A because its EAR is higher. II. You would choose Bank B because its EAR is higher. III. You would choose Bank A because its nominal interest rate is higher. IV. You would choose Bank B because its nominal interest rate is higher. v. You are indifferent between the banks and your decision will be based upon which one offers you a gift for opening Select- b. Could your choice of banks be influenced by the fact that you might want to withdraw your funds during the year as opposed to at the end of the year? Assume that your funds must be left on deposit during an entire compounding period in order to receive any an account. interest. 1. If funds must be left on deposit until the end of the compounding period (1 year for Bank A and 1 day for Bank B), and you think there is a high probability that you will make a withdrawal during the year, then Bank A might be preferable. II. If funds must be left on deposit until the end of the compounding period (1 year for Bank A and 1 day for Bank B), and you have no intentions of making a withdrawal during the year, then Bank B might be preferable. III. If funds must be left on deposit until the end of the compounding period (1 day for Bank A and 1 year for Bank B), and you think there is a high probability that you will make a withdrawal during the year, then Bank B might be preferable. IV. If funds must be left on deposit until the end of the compounding period (1 year for Bank A and 1 day for Bank B), and you think there is a high probability that you will make a withdrawal during the year, then Bank B might be preferable. v. If funds must be left on deposit until the end of the compounding period (1 day for Bank A and 1 year for Bank B), and you think there is a high probability that you will make a withdrawal during the year, then Bank A might be preferable. -Select- Sawyer Corporation's 2018 sales were $15 million. Its 2013 sales were $7.5 million a. At what rate have sales been growing? Round your answer to two decimal places b. Suppose someone made this statement: "Sales doubled in 5 years. This represents a growth of 100% in 5 years; so dividing 100% by 5, we find the arowth rate to be 20 % per vear." Is the statement correct? -Select- The statement is correct because 100 % divided by 5 equals 20 %. The statement is incorrect because there are 6 years of sales growth between 2013 and 2018. The statement is incorrect because a company's sales cannot double in such a short time span. The statement is incorrect since the effect of compounding is not considered The statement is correct since the effect of discounting is considered